Decoding Bitcoin’s 2024 Halving: Your Essential Guide

Introduction

One of the pivotal events that may predict the direction Bitcoin will take is the upcoming halving event scheduled for 2024. It talks about crucial matters such as coming halving time, the possible impact of halving the value of Bitcoin, and its consequent reduced total supply. In simple terms, halving should mean “what will be for Bitcoin in 2021”.

This concise guide delves into essential questions: What’s the date of the upcoming Bitcoin halving? What is its connotation? Is it good or bad for us? Could Bitcoin’s halving explain the price rise? Moreover, is the result of having a reduced supply of bitcoins? Examine these essential issues to understand what is in store for Bitcoin.

The Impact of Halving on BTC

Decoding the $44,023 Bitcoin Ticker and Mining Process

Unlocking the secrets behind Bitcoin’s value involves exploring the intricate mining world. Bitcoin, represented by the BTC ticker currently at $44,023, operates on a decentralized principle. Anyone can delve into digital mining, deploying powerful computers to crack complex mathematical problems or encrypted hashes through the proof-of-work (PoW) process. This process not only verifies transactions but also adds them to the blockchain. Successful miners, in turn, are rewarded with a predetermined amount of Bitcoin.

Understanding the 50% Reduction: Bitcoin Block Reward Halving

The game-changing Bitcoin block reward halving event reduces the block subsidy reward received by miners by half. Satoshi Nakamoto introduced this measure to control the inflation rate of Bitcoin. By diminishing mining rewards, the incentive to mine diminishes, amplifying Bitcoin scarcity and elevating the stock-to-flow ratio. This deliberate scarcity enhances the precious nature of BTC, fostering its retention and potential appreciation over time, especially if the demand for Bitcoin continues to surge.

Bitcoin’s Halving Events: A Decade of Reward Reductions

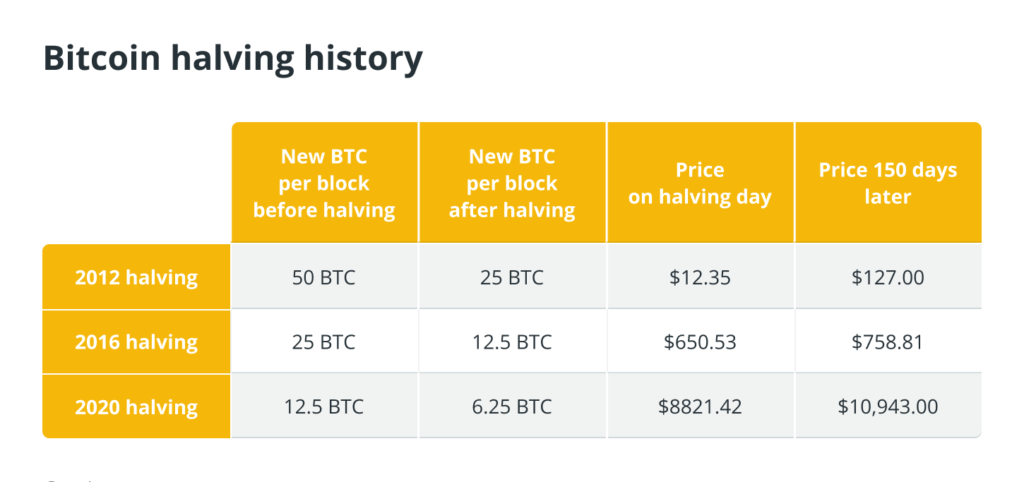

In 2009, the launch of the Bitcoin network introduced a mining reward of 50 BTC per block, as meticulously embedded by its creator, Satoshi Nakamoto. This automatic reduction in miner rewards, activated every 210,000 blocks, has been a defining element of Bitcoin’s monetary policy.

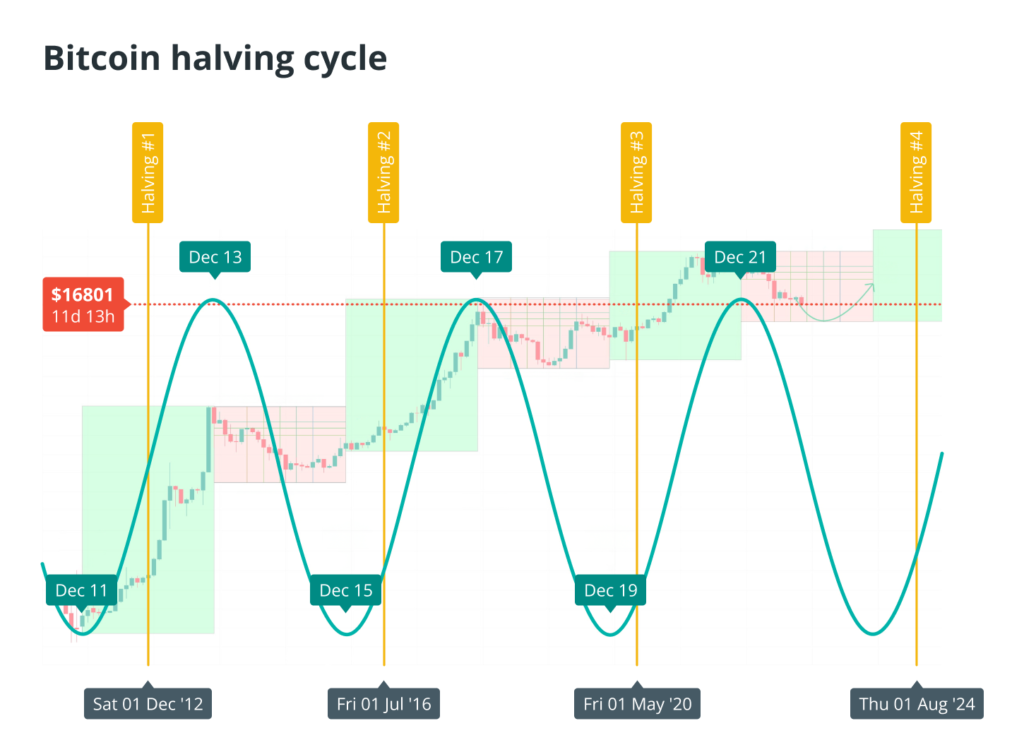

Since the inaugural event 2012, Bitcoin has witnessed three halving episodes (2012, 2016, and 2020), each marking a four-year interval. The fourth halving is anticipated in 2024 at block 840,000, with the fifth poised for 2028—an intriguing evolution in cryptocurrency.

Navigating the Bitcoin Halving

It is very difficult to determine exactly when or when the next halving will occur in the Bitcoin blockchain since a period of only 210 thousand blocks is considered during this process. However, since it usually takes at least ten (10) minutes to confirm/add a new block into Bitcoin’s network, its halving schedule occurs approximately every four years.

Catalyst for Innovation and Economic Resilience

The cycle is crucial for strengthening innovations, ensuring that Bitcoin differs from regular cash. BTC’s entry into the market occurs on a fixed basis; as for the next halving event scheduled for 2024, it will be significant. The rewards are reduced from 6.25 to 3.125 BTC; hence, miners must increase their operation efficiency to adapt.

To sustain profitability, miners are compelled to innovate, potentially driving advancements in mining hardware. This may lead to the development of mining rigs characterized by increased energy efficiency and heightened processing power, marking a technological stride in the evolution of Bitcoin mining.

Notably, Bitcoin’s capped supply policy, restricting the total supply to 21 million BTC, starkly contrasts fiat currencies that lack such limitations.

Bitcoin’s Halving and Price Projections

Cryptocurrency markets have always faced scarcity whenever bitcoins halved historically, leading to price surges and bull runs. According to social media expert BitQuant, the probability of reaching an all-time high price near this year’s halving event at around US$250,000, a ninefold increase, is not implausible. Record prices have always followed halving events, and this projection is in line with such a trend.

After the crypto winter of 2022 and the economic crisis 2023, the 2023 timeline for Bitcoin’s halving has gained significance. The deflationist supply of BTC functions similarly to the scarcity of gold. Because there is a risk of inflation with normal currencies, it also draws investors who want to protect their cash.

Transparent Stability and Gold-Like Resonance

Contrary to the discretionary decisions central banks make in traditional money, there is a predetermined, open, and planned halving for Bitcoins. The fact that this regularity offers security to the investors is extremely important, particularly during unpredictable periods of time. Bitcoin’s strict monetary policy carried out through halving, is very attractive to those who are cautious of central bank action or policy changes.

To gold fans, Bitcoins are valuable assets with properties that act as a hedge against inflation and investment during recession periods like gold does. When BTC is being halved like gold mining, it may have a function of “digital gold” and act somewhat like gold when electronic currencies are used widely. Gold investors pay much attention to Bitcoin halving events because they underline a similar deflationary character of these assets.

Bitcoin Halving: Impact on Price and Scarcity

The halving cycle’s influence on Bitcoin’s price is significant. As the halving diminishes the mining incentive for Bitcoin, it introduces scarcity, prompting the crucial inquiry: Will Bitcoin’s halving contribute to an increase in BTC’s price?

Examining historical data from previous halving events provides valuable perspectives, as they have consistently exhibited a comparable trend. This trend primarily stems from reduced mining rewards and inflation due to the diminished introduction of new Bitcoin.

Accumulation Period

Before each halving event, Bitcoin users commonly gather BTC, leading to a period of price stagnation or a mild uptrend. This trend has consistently occurred before the first, second, third, and most recent halving events, lasting between 13 and 22 months.

Bullish Period Following Halving

Historically, halving events have initiated bull markets lasting 10–15 months, with a consistent price rise leading to new all-time highs. There was a single instance in 2016 when Bitcoin experienced a momentary pullback, but it swiftly recovered and resumed the typical trajectory of a bullish phase.

Bear Market Phase

Each of the preceding bull markets concluded with a pullback or a price correction period, typically lasting around 600 days, although the most recent one lasted only about a year.

Impact of Bitcoin Halving on Miner Profitability

Bitcoin mining, known for its high resource and energy consumption, requires 1,449 kilowatts per hour for a single transaction, equivalent to 55 days of a typical American household’s energy use. The upcoming Bitcoin halving, reducing mining rewards, adds financial strain to miners grappling with high operational costs.

Moreover, mining profitability, measured in dollars per terahash (TH) per second, declined from $3.39 per TH/s at Bitcoin’s 2017 peak to $0.104 per TH/s by mid-2022. The halving exacerbates this, making profitability dependent on favorable market conditions, particularly during a bull run.

Pros and Cons of Bitcoin Halving

Pros of Bitcoin Halving

Halving really impacts the cryptocurrency industry in a very positive aspect. Following are the most significant positives involving an impact on the rate at which fresh BTC is issued, and the subsequent scarcity that impacts on driving up the value of that cryptocurrency. Scarcity can thus give rise to long term appreciation, and there are more investors that are ready to create new positions around this cryptocurrency as they look for some kind of shelter.

Cons of Bitcoin Halving

Bitcoin’s halving presents challenges. It boosts short-term volatility due to uncertainty. Miners face reduced profitability, earning half for confirming blocks with similar costs. This incentive reduction may decrease miner participation, risking Bitcoin network security and increasing the threat of a 51% attack.

Conclusion

The 2024 halving promises significant changes to the Bitcoin ecosystem. A 50% block reward drop induces scarcity, pushing miners to seek innovation for economic resilience. Forecasts align with trend values, reflecting a similar situation. Bitcoin’s transparent stability attracts investors seeking a dependable wealth store, contrasting established monetary systems.

In addition, short-term volatility continues to plague challenges from the future of halving events, while there are potential network security implications and lower miner profitability. With changing halving events of Bitcoin in future, handling these dynamics requires a meticulous look at the pros and cons.