Introduction

ICO is a way to raise funds when fresh ventures or firms issue new crypto or tokens as a trade for investors’ financial support. The token typically comes at a reduced cost during the ICO and is expected to be appreciated as the venture advances. ICOs usually lack regulation and are generally targeted towards crypto enthusiasts.

STO stands for a financing approach that releases tokens underpinned by a financial commodity or safety, like shares or bonds. STOs obey the laws governing securities, offering higher safeguards for investors than ICOs. Frequently, STOs are promoted to customary investors who are well-acquainted with securities laws and investment strategies.

What is an ICO?

Initial coin offering is a common method used within the blockchain and crypto world to raise money. Investopedia sheds some light on it; potential investors can join in an initial coin offering, and in return, they get a new cryptocurrency token given out by the business. This token could be handy in connection with the commodity or service that the business provides, or it might symbolize an ownership part in the entity or assignment.

Any business can forge a crypto token and opt to make it available “for sale.” Initially, they decide on the framework of the token’s worth (constant supply and fixed price, fluctuating supply and fixed price, or steady supply and variable price). These complicated terms mean the currency’s price may fluctuate, or the token’s supply cannot alter, augmenting or reducing its comprehensive worth. However, this mostly occurs with minimal supervision.

David Colin, CFP®, AIF®, and Senior VP of Investments at Diamond Wealth Partners of Raymond James, says figuring out ICOs is tricky. He comments, “Understanding who and what to trust, and knowing what you’re getting is difficult.”

ICOs need fewer rules to follow in different areas, including the US, than in an IPO. Several places like Australia, New Zealand, Hong Kong, and the UAE have already put out rules about ICOs.

What is STO?

A Security Token Offering (STO) is a fundraising method used by blockchain ventures or any business with a digital good or service. Its credibility is reinforced by local laws or appropriate financial standards in the area of the startup’s origin. Such regulation provides a safety net to investors, ensuring their investments are protected.

In the cryptocurrency realm, companies provide STO blockchains. To clarify, the company offers the STO as a digital token. The concept of an STO is straightforward: turn a part of your assets or products into tokens and make them available for public purchase. This way, people can gain ownership of the company.

How is STO different from ICO?

Security Token Offering (STO) and Initial Coin Offering (ICO) are ways companies and startups gather funds for their projects or businesses. But, these two methods have some big contrasts:

Security vs. Utility

The major distinction between STO and ICO is that STO is a security token offering. An initial coin offering (ICO) is another term for an ICO. Security tokens are an investment contract granting investors ownership of the underlying asset or firm, whereas utility tokens provide consumers access to a product or service.

Regulatory Compliance

Since regulators consider STOs securities, they impose more rules on them, requiring adherence to security laws, unlike ICOs. Like submitting paperwork to the Securities and Exchange Commission (SEC) in America, there are regulatory obligations for STOs that ICOs don’t have to follow.

Investor Protection

STOs are safer for investors than ICOs crypto because they’re clearer and more regulated. STOs often share in-depth data about the investment and stick to tough reporting rules. On the other hand, ICOs tend to be shady and have skimpy regulation.

Investment Potential

STOs present superior investment options over ICO tokens. This is due to their provision of extended ownership rights and participation in possible company profits. In contrast, ICOs typically involve more risk and do not supply investment benefits.

How Do ICOs and STOs Work?

ICOs (Initial Coin Offerings) and STOs (Security Token Offerings) are cryptocurrency fundraising strategies.

ICO

An initial coin offering (ICO) is a method of raising funds. People sell digital tokens to others for cryptocurrencies like Bitcoin or Ethereum. These tokens mean you own a part of a new project or business. You can trade them on places where cryptocurrencies are exchanged. ICOs often get money for new projects or ventures that use blockchain or cryptocurrency.

Starting an ICO means making a blueprint that narrates the project’s targets, tech, and the application of funds. Folks can then buy these online coins using Bitcoin or Ethereum. We then use the collected money to build the project.

STO

A Security Token Offering (STO) is like an Initial Coin Offering (ICO). But there’s a big difference. Tokens sold in an STO are seen as securities. What does that mean? It means that the government has rules that these tokens need to follow. Usually, STOs are used by businesses that have been around for a while. The tokens? They’re like owning a piece of the company, like stocks or shares.

Starting an STO is trickier than starting an ICO. It needs obeying securities rules in the area where the offering takes place. The firm issuing the tokens must give in-depth financial data. It must include inspected financial reports and details about the firm’s management team.

ICO and STO: Pros and Cons

ICO Pros and Cons

Pros:

- Both buyers and sellers face no entrance barriers.

- Beneficial network impacts.

- The system utilizes a straightforward and automated process to deliver tokens.

- Whichever the teams see fit, they can manage the cash.

- A well-executed digital campaign is frequently required for a successful ICO.

- Investors gain from significant profitability and early adopter perks if a coin’s price climbs and the team delivers.

- Some ICOs permit anonymous participation.

Cons:

- The cryptocurrency market is volatile and manipulated.

- Insufficient liquidity.

- Uncertainty over whether the product will be completed and delivered as indicated in the white paper.

- Scams and pump-and-dump tactics are frequent in the world of ICOs.

- Regulations may be a source of contention for both enterprises and investors.

- The unregulated environment has several dangers.

STO Pros and Cons

Pros:

- Something else derives the value of underlying assets purchased by investors.

- Regulators completely regulate offerings to safeguard the safety of investors.

- Projects that pursue STOs are often more developed and trustworthy than those that seek ICOs.

- STOs are rapidly expanding, whereas the ICO market is contracting.

- It is a continuing trend.

- Security tokens are anticipated to be exchanged through regulated broker-dealers.

- Security tokens are the next major advancement in traditional finance.

- There will be less speculation and market manipulation.

Cons:

- Obtaining regulatory approval involves significant time, effort, and money.

- Only accredited investors may have access to buying and selling STO tokens on managed markets.

- It may need large sums of money.

- So yes, the SEC has not approved a Reg A+ STO, and institutional investors may only participate.

Blockchain Crowdfunding Harmony: Bridging the Regulatory Divide

STOs are on the SEC’s registry, using special rules like Reg A+. Because of this, they resemble shares in many ways. For instance, tokens obtained through STOs give buyers some say in the company or group that offers them.

Signing up with the SEC is how STOs aim to give better safety to investors. Why? It keeps off fake people, letting only real and dedicated projects in. The sign-up is like the IPOs’ sign-up process. Not just good news for investors, it probably calms government worries too.

Financial professionals strongly believe in STOs, predicting a market worth surpassing $10 trillion by 2020. Meanwhile, ICOs have, so far, gathered around $4 billion. In 2017, ICOs were the preferred choice for crowdfunding, but this year, it looks like STOs will gain major popularity. By offering secure investment prospects, STOs might be the needed answer for crowdfunding in the cryptocurrency area.

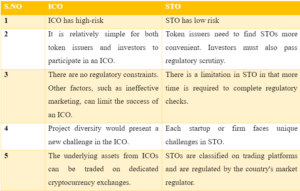

Comparison between ICO vs. STO

Conclusion

In our current system of dispersed financial operations, securities token offerings and initial coin offerings are two popular funding methods. Bar their distinct underlying assets, they share similarities with Initial Public Offerings (IPOs). Managed markets buy and sell STO tokens, while specific virtual money trading platforms exchange ICO tokens.