Germany’s financial regulator, BaFin, has officially banned the public sale of Ethena GmbH’s USDe token. The move comes after the agency identified multiple violations of the EU’s MiCA (Markets in Crypto-Assets Regulation) framework. This enforcement reflects a broader crackdown on digital assets operating without full regulatory compliance.

As a result, Ethena is no longer allowed to distribute the USDe token in Germany or across the European Union. According to BaFin, the token closely resembles an unregistered security, which breaches MiCA’s core rules.

BaFin Accuses Ethena of Selling Unlicensed Securities

In its statement, BaFin claimed that Ethena GmbH offered USDe and a related token, sUSDe, without the required legal documentation. The regulator suspects that Ethena OpCo Ltd. has been selling sUSDe tokens as securities, which is illegal without a prospectus.

BaFin explained the connection between the tokens, stating that investors can swap USDe for sUSDe. This exchangeability raises red flags. It implies an investment structure similar to traditional securities but without legal oversight.

BaFin also criticized the company’s internal operations. It described them as seriously lacking in organizational structure and transparency.

Key Actions Taken by BaFin

In response, BaFin introduced several immediate measures:

- It ordered Ethena to freeze all reserve assets backing USDe.

- The firm must shut down its public-facing website and onboarding platform.

- Ethena can no longer accept new users within the EU.

- A court-appointed representative will monitor Ethena’s compliance.

Interestingly, the regulator clarified that secondary trading of USDe tokens remains unaffected. Investors can still trade them on third-party exchanges.

Ethena Responds and Moves Operations to BVI

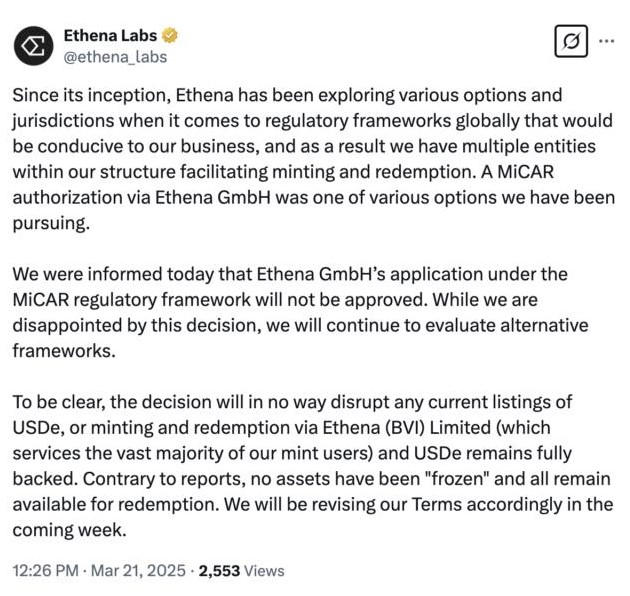

Following BaFin’s announcement, Ethena Labs released a statement on X (formerly Twitter). The company reassured users that USDe remains fully backed and redeemable. Redemptions will now go through Ethena BVI Limited, a non-German affiliate.

This shift suggests a tactical pivot by Ethena. By continuing operations from the British Virgin Islands, the company may avoid EU jurisdiction while maintaining token utility.

MiCA Application Denied After Review

Ethena submitted a MiCA compliance request on July 29, 2024. The company hoped to be grandfathered into the new regulatory framework. However, BaFin rejected the application on March 21, 2025.

The regulator cited a lack of transparency, missing disclosures, and a poorly structured business model. According to BaFin, these shortcomings made the firm ineligible for MiCA approval.

BaFin also revealed that 5.4 billion USDe tokens are in circulation. Many were created outside Germany and before MiCA came into effect. This raises concerns about regulatory loopholes and cross-border investor exposure.

Institutional Investors Still Back Ethena

Despite the setback, Ethena continues to draw attention from institutional players. In February 2024, the firm raised over $100 million to launch a new token, iUSDe, designed for large-scale investors.

Additionally, Ethena partnered with World Liberty Financial. This DeFi protocol was launched in December 2024 by former U.S. President Donald Trump. As part of the deal, the organization acquired 500,000 ENA tokens — Ethena’s governance asset.

On February 26, 2024, the MEXC crypto exchange invested $20 million into USDe. The goal was to boost stablecoin adoption and increase confidence in synthetic digital dollars.

What This Ban Means for Crypto in Europe

BaFin’s ruling sets a precedent for how the EU will treat unlicensed stablecoin offerings. With MiCA now fully active, regulators are taking strong steps to enforce transparency and investor protection.

The consequences are significant:

- MiCA could become a global model for crypto regulation.

- Issuers may relocate to less regulated markets, like the BVI.

- Institutions will likely demand full regulatory clarity before partnering with crypto firms.

BaFin’s message is clear. Innovation in digital assets must come with strict responsibility and legal structure.