6 Best Crypto Lending Platforms In 2023

Every crypto investor holding significant amounts in their wallet should consider earning interest on their cryptocurrencies by putting them on crypto lending sites. These platforms serve as intermediaries connecting lenders and borrowers. In this article, we’ll cover the most reliable crypto lending platforms, delving into their lending rates, fees, features, pros, and cons.

What Is A Crypto Lending Platform?

A crypto lending platform offers a mechanism for borrowing and lending. Users can take digital loans or generate income by investing or lending their crypto assets. Most crypto lending platforms possess their capital resources to facilitate borrowers. They also use customers’ assets to complete a circle. Investors who lend their funds receive interest rates based on the loan amount and investment duration. Conversely, borrowers are subject to interest rates based on the amount borrowed and the duration of their loans.

6 Best Crypto Lending Platforms

Nexo – Overall Best Crypto Lending Platform

Nexo is widely considered a leading choice among crypto lending platforms. It is a user-friendly platform that offers a wide selection of cryptocurrencies to lend or borrow, a cost-effective exchange, a credit card, and more. Nexo offers industry-leading wallet insurance and has never experienced liquidity problems. It manages assets of approximately 4 million clients and operas in 200 jurisdictions. The platform supports 35 different coins and tokens, including Ethereum, Litecoin, Bitcoin, Dash, and Ripple.

Borrowers can secure loans starting from 0% APR, while lenders can potentially earn interest rates of up to 16%. This interest is paid out daily in the form of NEXO tokens. The lock-in period varies depending on the chosen asset. You can select the lock-in period and receive bonus interest, typically around 1% for 1 month or 4% for 6 months. The minimum deposit (crypto/fiat) varies depending on the asset.

Moreover, it is regulated by several authorities, including the Financial Services Authority in Seychelles, the Financial Crimes Investigation Service in Switzerland, and SO-FIT in Switzerland, among others. Nexo customers’ assets are held in custody by Bakkt, Ledger, Fireblocks, and BitGo. The platform stores all digital assets in a mixture of cold and hot wallets, thereby reducing vulnerability to potential hacks.

Pros

- Regulated and licensed platform

- Over 30+ assets available to lend or borrow

- Up to 16% APR on cryptocurrencies

- Borrow assets starting with 0% APR

- Daily payouts

- No hidden fees for withdrawing, holding, and adding funds

- Insurance coverage in the case of third-party hacks, theft, or loss of private keys

Cons

- Interest earning is unavailable for US residents

- Currently facing legal issues regarding the SEC

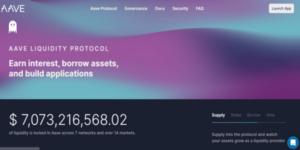

Aave – Top Choice For Advanced Investors

Aave is one of the few crypto lending firms operating fully as a borrowing and lending platform. It currently has over $4.5 billion in Total Value Lock (TVL). Aave is a decentralized liquidity protocol created on the Ethereum network. It utilizes smart contracts to automate borrowing and lending.

Determining the exact APY can be challenging due to the incentivization protocol. However, it typically varies between 0.1% and 18% for certain assets such as BUSDT and USDT. However, Ethereum, Avalanche, Arbitrum, Polygon, and Optimism APY vary, usually between 0% and 3%. The interest is paid out weekly. For borrowers, the APR can be as low as 1.3% (BUSD), 0.5% (AAVE), and 0.1% (MKR). In addition to providing regular crypto loans, Aave also offers uncollateralized flash loans.

Pros

- No KYC during onboarding

- Best for Ethereum-based coins

- No KYC during onboarding

- Offers uncollateralized flash loans

- Up to 18% APR on BUSDT and USDT

Cons

- Interface is not user-friendly

CoinRabbit – Simplest Crypt Lending Platform

It is a London-based crypto lending platform popular for offering various coins. You can get quick loans from CoinRabbit without the hassle of lengthy KYC verifications or document submissions. You can secure a loan of at least $100 by using your collateral. Moreover, there are no additional fees for customers, and borrowers can choose from 70 different coins.

For lending, the platform allows users to earn interest on five stablecoins: USDC, BUSD, USDT(BSC), USDT(TRX), and USDT(ETH). You can earn a flat 8% APY interest rate on all these stablecoins. CoinRabbit pays profits daily. Users can withdraw their profits or funds whenever they want, with no waiting restrictions or periods. Lending with CoinRabbit is easy. You can start by depositing a $100t and verifying your account using a phone number.

Pros

- Beginner-friendly

- Earn 8% APY on stablecoins

- Get instant loans

- No KYC verification is required

- Daily payouts

- Excellent security system

Cons

- More attuned to borrowers

- Only 5 assets to invest

YouHodler – Beginner-friendly Lending Site With Over 50 Coins

As the name suggests, YouHodler is designed for cryptocurrency holders who want to lend or invest their digital assets to earn interest. The platform was founded in 2018 and is based in Cyprus and Limassol. YouHodler claims lenders can earn up to 11.28% APY, depending on the crypto asset they lend. It supports over 50 cryptocurrencies, such as Bitcoin and Ethereum. The platform also supports stable assets to reduce risk during your investment.

You can earn 10.3% on USDC, 4.7% on BTC, 10.7% on USDT, and 5.5% on ETH. Interest rates can fluctuate with market conditions but generally stay around these values. You must deposit at least $100 to earn interest. Furthermore, YouHodler makes weekly payouts.

Pros

- Beginner-friendly platform

- Flexible lending options

- Over 50 assets are available

- Instant loans available

- No lock-in periods

- Earn up to 10.7% APY on USDT

Cons

- Not available in the USA

Crypto.com – Most Trusted Crypto Lending Platform With Up To 12% APY Earnings

It is one of the most popular and versatile crypto exchanges. The exchange supports 250+ coins. You can earn interest on 40+ of them, including popular cryptocurrencies and stablecoins. Interest rates for stablecoins are relatively high compared to popular assets like Ethereum or Bitcoin. This platform offers the highest interest rate of around 12.5% APY for Polygon and Polkadot. However, the interest rate for ETH and BTC is 4%, while for stable assets like USDT and USDC, you can earn up to 6.5% APY with ease.

The rates you receive may vary based on your staked CRO (Crypto.com’s native token) amount. They can also differ depending on whether you choose a flexible term or lock it in for 1- or 3-month periods. Besides investing, the platform offers trading, selling, and purchasing of assets, crypto wallets, and even a Visa debit card.

Pros

- Lend over 40 cryptocurrencies to earn interest

- Earn up to 12.5% APY

- Buy and sell 250+ coins with ease

- Beginner-friendly app

- Highly trusted and reputable platform

- Customizable lock-in period

- Low minimum deposit amounts (depending on coins)

Cons

- Flexible lock-in provides low APY

Aqru – Platform With High-security Features

Aqru is a Bulgarian cryptocurrency platform that is also registered in Wales and England. The platform enables users to exchange crypto coins, invest, and lend in cryptocurrency. It employs robust security measures, including multi-layered deposit insurance, to safeguard your funds from potential hackers. You can earn a maximum of 10% APY interest, and it’s paid out daily. However, most crypto assets offer lower APYs, typically around 2% to 3%.

Pros

- Daily interest rates

- No lock-in period on many assets

- No fees on withdrawals or deposits

- Up to 10% interest

- Good online reputation

- Fast transaction speeds

Cons

- Occasional withdrawal problems

- APY could be low on many assets

Final Thoughts

We know that cryptocurrency has a bright future, and more people are learning about blockchain’s potential in finance. If you have crypto assets, don’t let them sit idle; consider lending them through the platforms in this review to make good use of them. You can earn higher returns and grow your funds than traditional bank savings accounts.