In recent days, Bitcoin, the foremost digital currency globally, has encountered a period of limited price fluctuations. The bulls hang on to the crucial resistance level near $30,000 while the bears work nonstop to take it back.

Over the previous week, there were two instances where BTC made efforts to surpass the resistance level of $30,000. First at $29,995.84 on April 26 and second at $29,952.03 on April 30. Both endeavors did not succeed, leading to a swift recovery by the bears.

However, according to the data from CoinMarketCap, BTC is currently trading at $28,366.94, with a 4% decline in the past 24 hours.

2022 had been tough for asset prices due to inflation and tightening liquidity. Cryptocurrencies are particularly affected due to high leverage and collateral coming due. Bitcoin has fallen below its previous cycle highs, causing unrealized losses for investors.

Bitcoin’s 2022 drawdown is comparable in scale and duration to previous bear cycles in 2015, 2018, and 2019. Historical lows ranged from -75% to -84% from the ATH, taking 260 to 410 days to recover.

The Mayer Multiple (MM) shows that the 2021-22 cycle has a lower MM value than the previous cycle’s low, with only 2% of trading days recording a closing MM value below 0.5.

The bear market 2022 has seen the largest monthly decline in Realized Cap in history and large capital outflows. It makes it one of Bitcoin’s most significant bear markets.

Bitcoin Current State: Glassnode

In a recent tweet, Glassnode’s co-founder shared his thoughts on the future of Bitcoin (BTC). He stated that the $28k mark is a crucial battleground, with bears currently holding the expensive wrong position.

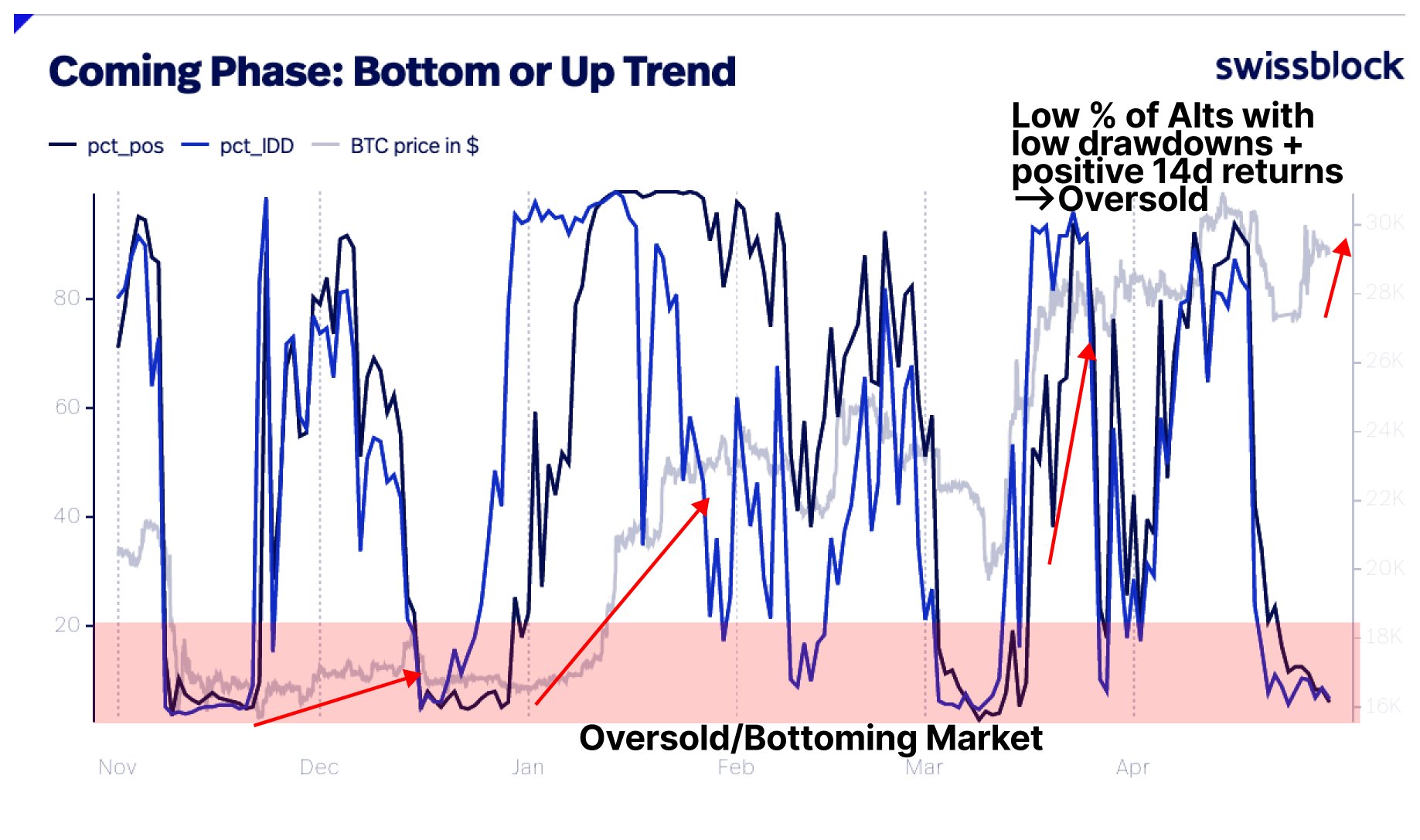

However, the market looks oversold, indicating that a bottom or uptrend could be on the horizon. The co-founder predicts that Bitcoin’s move to $30k is imminent.

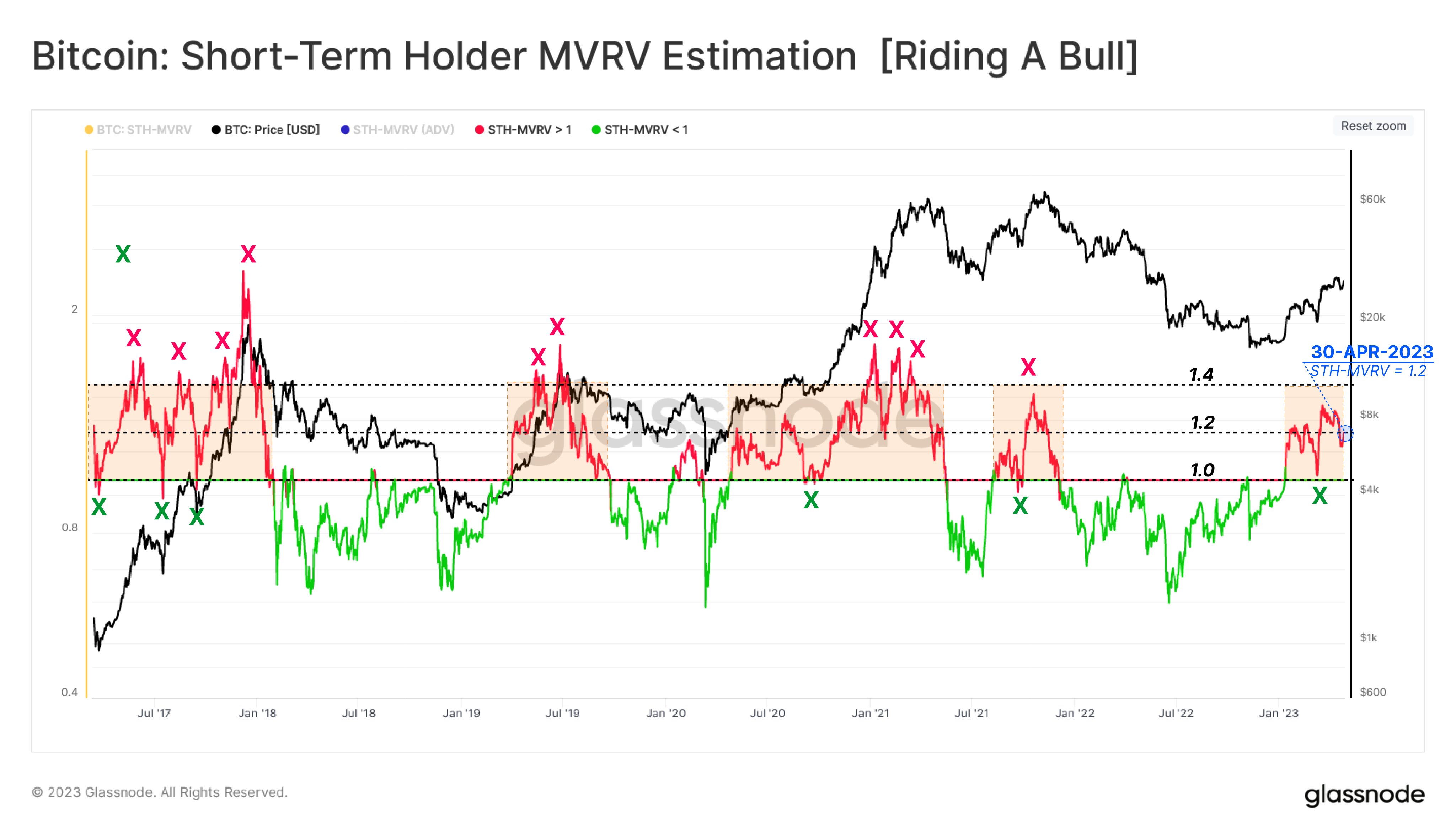

Supporting this prediction, a tweet from a senior researcher at Glassnode, notes that recent resistance was found at the $30k level. This level corresponds with the STH-MVRV hitting 1.33, meaning new investors currently enjoy an average profit of 33%.

Should the market experience a deeper correction, a $24.4k would bring the STH-MVRV back to a break-even value of 1.0. This has historically been a point of support in up-trending markets.

However, given the previous months’ huge price fluctuations, these observations come at a time when Bitcoin is experiencing a period of extremely high volatility. Due to the potential impact on the larger market, observers closely monitor the cryptocurrency.