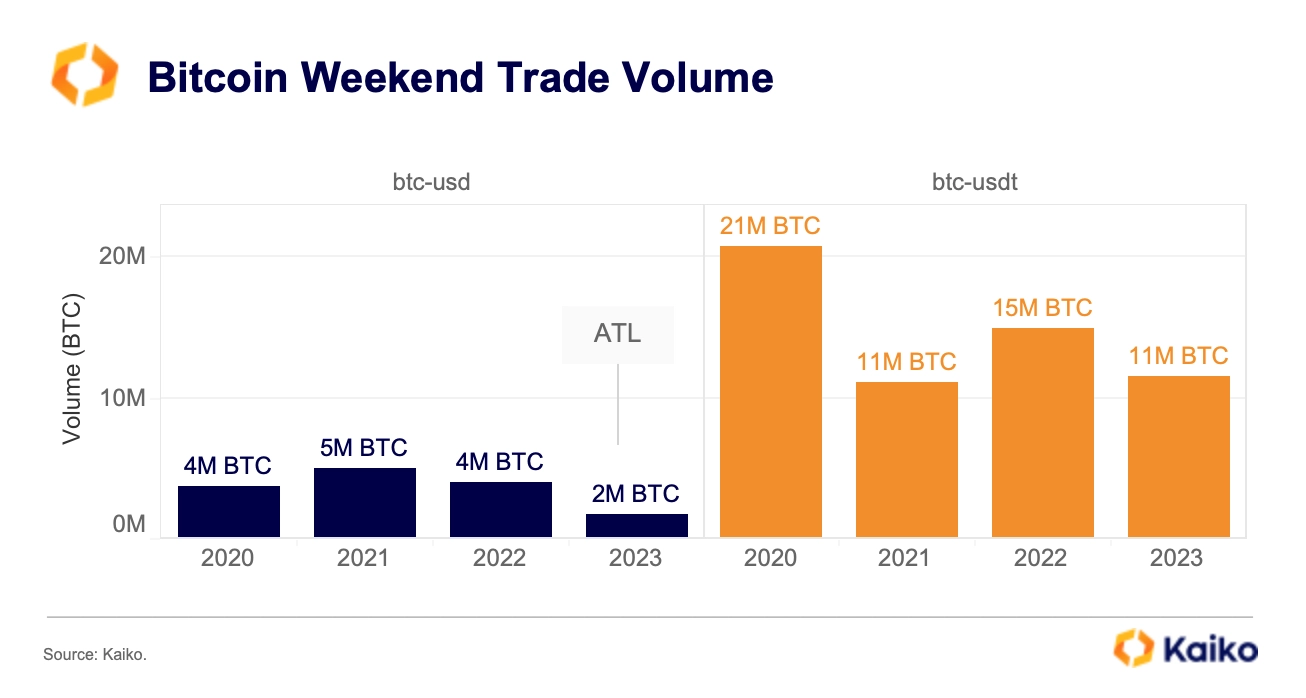

A recent report from Kaiko revealed that they had seen low weekend Bitcoin transactions in 2024. The report highlights that this week’s trade represents just 13% of the whole volume of Bitcoin, with a maximum of 1/4th from 2018 to 2021. This correlates with increasing institutional investors in the spiking Bitcoin market.

Drop in Volume of Bitcoin Trading

Kaiko attributes this decline to several factors, primarily the mismatch between the 24/7 trading nature of cryptocurrencies and the operating hours of traditional financial institutions. With more institutional investors entering the market, the need for liquidity during weekends has become increasingly challenging.

“This reduction suggests worsening liquidity circumstances on weekends, which can be ascribed to greater institutional involvement and deteriorating market infrastructure,” Kaiko said in their statement. According to the company, this problem has been worsened by the closing of many US banks that supported cryptocurrencies, affecting both US-based and offshore exchanges.

Nonetheless, these top offshore exchanges, such as Binance, HTX, OKX, Bybit, and Upbit, have continued with weekend tradeshows that have more than average. Conversely, American exchanges such as Coinbase, Kraken, and Bitstamp have made lesser trades. The percentage of activity on these off-shore platforms of 15% was slightly higher than the 11% on US stock exchanges.

The Bitcoin Trading Volume and the ETF Process

Kaiko’s analysis also showed in Coinbase less liquidity than in Binance on weekends. They revealed an increase in trading expenses at Coinbase’s network recorded in the second quarter of last year. In contrast, trading costs at Binance’s network were recorded to decrease in the same period.

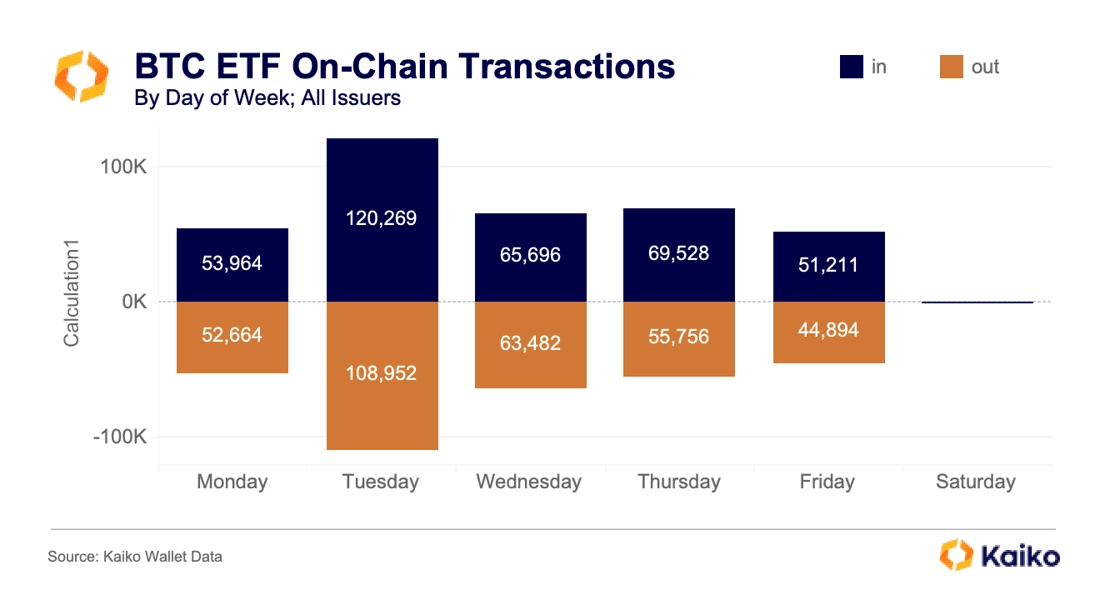

Interestingly, since the US saw the launch of spot Bitcoin exchange-traded funds (ETFs), Bitcoin liquidity has rebounded strongly. Kaiko did point out that there were still not many weekend transfers between exchanges and ETF providers. They issued a warning, saying that if ETF issuers keep accumulating Bitcoin holdings, this difference may get worse.

Furthermore, Kaiko’s study emphasizes how institutional participation affects the number of Bitcoin trades over the weekend. It will be essential for exchanges to handle liquidity issues on the weekends to maintain smooth trading operations. As the market develops, this is crucial to satisfy the needs of an expanding investor base.

Related Reading | Ethereum Resurfacing: Bulls Eye $4K as Analysts Predict Soaring Heights