Bitcoin (BTC) has continued its uptrend, reaching over $35,000 on Monday after a brief dip due to legal issues with FTX founder Sam Bankman-Fried. The Fear & Greed Index, which assesses overall market sentiment, currently stands at 74, showing a state of “greed.”

✅ BTC aims for its third consecutive green week, striving to close above $35k. pic.twitter.com/M0l4Wn3LBY

— MonFi Finance (@MonFifinance) November 6, 2023

Another reason might be that the United States added only 150,000 jobs in October, below the expected 180,000 and less than the 297,000 jobs added in September. Additionally, the unemployment rate rose to 3.9 percent, exceeding the expected 3.8 percent.

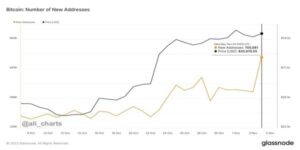

The growing optimism is not confined to its price alone. Crypto analyst Ali Martinez reported that Bitcoin’s network activity added over 700,000 new addresses on November 4.

Positive Sentiment And Bitcoin Surge

In the crypto world, it is still difficult to agree on the exact reasons behind Bitcoin’s current price surge. Market players are debating various possible reasons. Some believe US regulators will soon approve spot Bitcoin ETFs, making investing in BTC as easy as trading stocks through a brokerage account. Specifically, Blackrock’s DTCC listing and Grayscale’s victory against the SEC have impacted BTC’s price.

Additionally, the buzz surrounding Bitcoin’s “halving” event has added to the excitement. This event reduces miners’ rewards and tightens the currency’s supply, reinforcing that BTC is a finite and valuable asset.

The ongoing political events regarding crypto have impacted the price of BTC. Recently, the CEO of Hong Kong’s Securities and Futures Commission, Julia Leung, proposed allowing spot crypto ETFs for retail investors. The move represents a potential reversal of previous restrictions on retail investors’ access to such investments.

BREAKING 🚨 CHINA #BITCOIN

Hong Kong to allow regular investors buy #Bitcoin and crypto ETF pic.twitter.com/TXOr16H7dc

— BITCOINLFG® (@bitcoinlfgo) November 6, 2023

The Crypto Fear and Greed Index hits 74 out of 100, which shows that individuals have a more positive outlook on the market. While some think the recent price increase might not last, experts believe there are signs of continued interest supporting the ongoing upward trend.

Bitcoin Fear and Greed Index is 74 ~ Greed

Current price: $35,190 pic.twitter.com/pCx0if3Ske— Bitcoin Fear and Greed Index (@BitcoinFear) November 6, 2023

Record-High Bitcoin Wallets Holding $1,000

Notably, the number of blockchain addresses that hold at least $1,000 worth of BTC has reached an all-time high, now standing at 8 million. These addresses represent a significant increase in potential purchasing power. As Bitcoin continues to rise in value, this presents a positive long-term indicator for the crypto.

https://twitter.com/thanhtruc2022/status/1721497701374992411?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1721497701374992411%7Ctwgr%5Ef3a00aecd927cafbbfce4280fd44e00296e584d5%7Ctwcon%5Es1_&ref_url=https%3A%2F%2Fcryptonews.com%2Fnews%2Fbitcoin-price-prediction-as-35000-resistance-is-surpassed-when-is-the-next-leg-up.htm

BTC Price Prediction

Currently, Bitcoin is hovering around $34,919, manifesting minor oscillations over the last day. BTC faces an immediate resistance level at $35,352, and if it breaks, it could pave the way for more favorable targets at $36,834 and eventually $37,722. In contrast, support levels are currently strengthening the market at around $34,112, with further potential stops at $33,425 and $32,432 if demand arises. Meanwhile, the Relative Strength Index (RSI) is at 50.01, indicating a balanced market with no clear signs of overbought or oversold.

The chart shows an upward channel, indicating a bullish trend. However, the market seeks confirmation by a sustained price movement within or above this channel. In short, the market sentiment for BTC could be neutrally bullish. The short-term projection shows that the $35,352 resistance may be difficult to cross, but it depends on strong support and positive market signals.

“Target Remains $36,500-$37,000”

In a recent post, a well-known crypto trader and analyst, Michael van de Poppe, shared a BTC chart showing a clear upward trend. The analyst called it a “classic grind upwards” for Bitcoin. He believes that BTC is targeting the $36,500-$37,000 levels and that it will continue to move towards them. Classical liquidity is low, “but the trend is clearly upward,” Poppe added.

The classic grind upwards is taking place for #Bitcoin.

Probably we'll continue towards new highs (target remains $36,500-37,000).

Classic liquidity drops take place, but the trend is clearly upwards. pic.twitter.com/xYG8gkEfWs

— Michaël van de Poppe (@CryptoMichNL) November 6, 2023

Another popular crypto analyst, Credible Crypto, points out that Bitcoin is strong above $34,600 and cannot easily fall below that level. Bitcoin’s stability can be attributed to the optimistic investors who continued to stay in the crypto market and even created excitement.