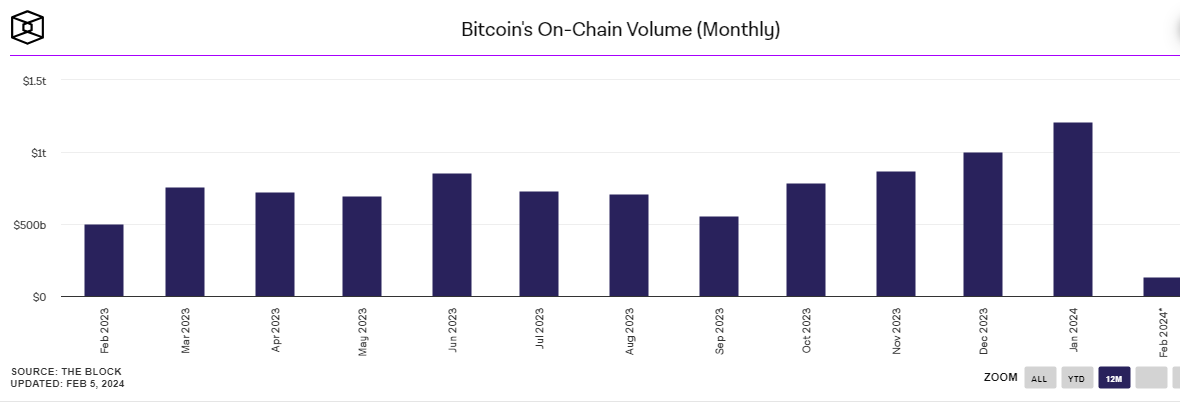

Bitcoin’s on-chain volume hit $1.21 trillion in January 2024, surpassing any month since September 2022. The volume tripled September 2023’s $400 billion total, according to data from The Block.

Bitcoin’s transaction volume has risen consecutively for the fourth month since January, rebounding from a low of $550 billion in September 2023. The January 2024 total value moved on-chain surpasses any amount since September 2022, during which Bitcoin was trading at around $20,000.

Bitcoin’s failure to exceed $1 trillion volume in any 2023 month except December points to traders awaiting spot Bitcoin ETF approval. With those ETFs finally approved, volume now matches expectations. Long-term Bitcoin holders seem unwilling to sell at this time. Instead, Glassnode analysts say they “appear to ride the market waves calmly.”

Bitcoin Resurgence: A Glimpse into 2024

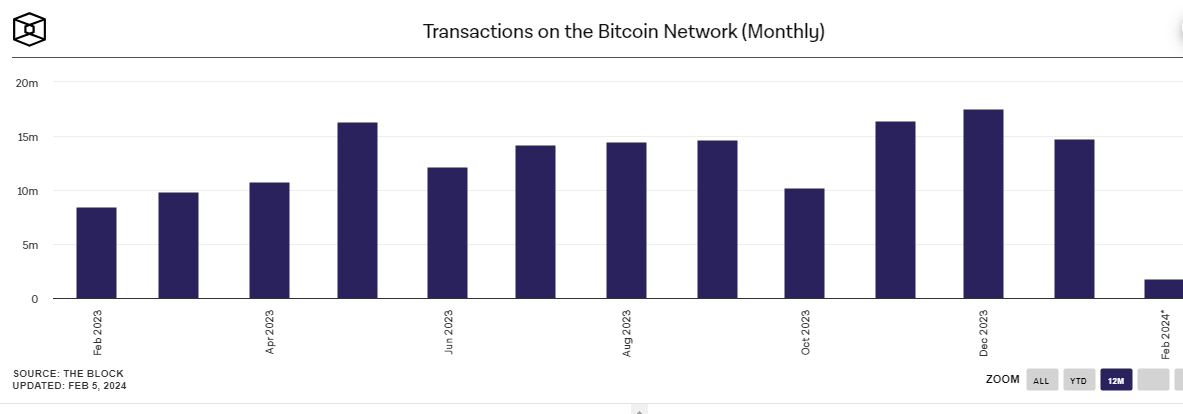

Monthly Bitcoin network transactions fell between December 2023 and January 2024. The Block’s data confirms this drop. Overall, the rise in on-chain volume signals growing Bitcoin adoption and more users transact as faith strengthens in crypto’s future.

However, trading volume continues to lag behind the highs seen in 2022. Lingering caution stems from the declines witnessed in 2023. Nevertheless, upward trends in both volume and price indicate a growing positive sentiment. Moreover, ongoing regulatory clarity is expected to enhance market activity even more. The prolonged anticipation for approval of a Bitcoin ETF deterred numerous institutional investors, but its final approval has eliminated this obstacle.

Bitcoin could hit new record highs in 2024 if things stay positive, but there will still be volatility. The active trading in January shows crypto is making a strong comeback. So, BTC can likely overcome any challenges as it enters 2024 with fresh momentum. Experts think Bitcoin’s advancing technical capabilities demonstrate it has robust foundations. Bitcoin’s fixed supply is notable as prices keep increasing. Major banks starting to offer crypto services indicates BTC is becoming more mainstream and drawing new investors.

Because of the world’s extreme unpredictability, Bitcoin’s fundamental narratives about being a safe haven and digital gold will probably continue to sustain its price despite the constant threats. BTC has survived previous collapses and returned even stronger despite persistent skepticism from detractors. This cycle may eventually reward those who persevere by replicating past patterns. Better times are ahead, as seen by the January trade activity, which suggests BTC may return in 2024.

Related Reading | Bitcoin Enthusiasts Celebrate as Google Embraces a Bitcoin ETF