In the aftermath of the much-anticipated spot Bitcoin ETF launch, the market has failed to sustain a bullish momentum, triggering a bearish wave that has left investors on edge. The Bitcoin price, which initially experienced a minor upswing, is now grappling with significant pullbacks, raising questions about the cryptocurrency’s immediate future.

Bitcoin Price Trend: From $38,500 to $42,000

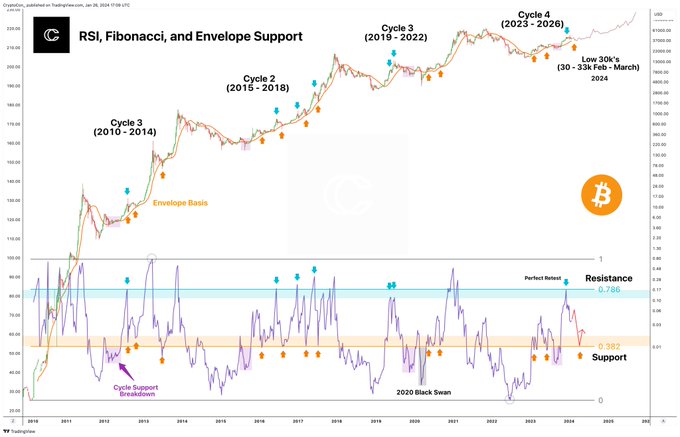

Crypto analyst CryptoCon has shared insights on social media platform X, indicating that Bitcoin is currently making a modest rebound from its recent dip to $38,500, now hovering around the $42,000 mark. Despite this slight recovery, some observers hesitate to declare that the market has hit its bottom, and analysts advise caution against it.

Market experts further analyze the situation and indicate that the weekly Relative Strength Index (RSI) is poised to descend into the orange .382 support zone. This suggests potential further declines, with prices possibly dipping into the low 30k range. Critics argue that the current 20% decline is not a definitive indicator of a market bottom, emphasizing the need to consider historical patterns.

On the other hand, proponents of a market bottom point to 12 instances where similar 20% declines occurred in 2023. However, skeptics counter this argument, highlighting the fact that the current rise of almost 100% surpasses the 60% moves that preceded previous 20% drops in the same year. This substantial increase marks the most significant single rise in the current market cycle.

While acknowledging that historical data has accurately identified periods of overheating, experts remain cautious about prematurely declaring the current market undervalued. They emphasize that the market may not have reached its bottom yet, and further fluctuations may be on the horizon.

As of the latest data, the price of Bitcoin stands at $42,063, accompanied by a 24-hour trading volume of $31.99 billion and a market capitalization of $824.84 billion. Over the past 24 hours, the price of BTC has seen a 5.30% increase.

Related Reading | BlackRock’s Ethereum ETF Approval Postponed by SEC