Messari’s recent report on the state of the XRP Ledger in Q1 2023 reveals some key insights. During this timeframe, there was a significant surge in the level of engagement observed on the XRP Ledger.

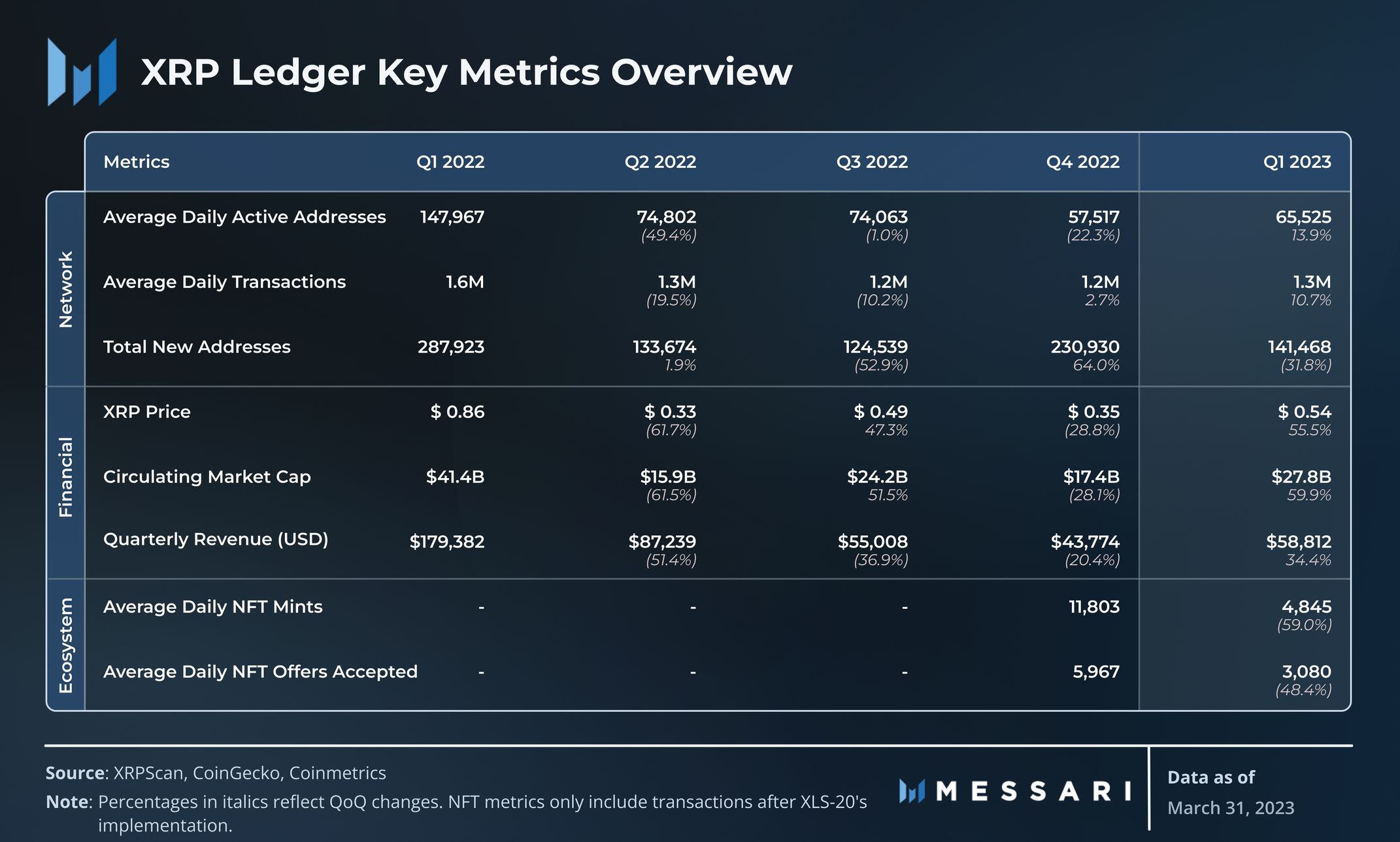

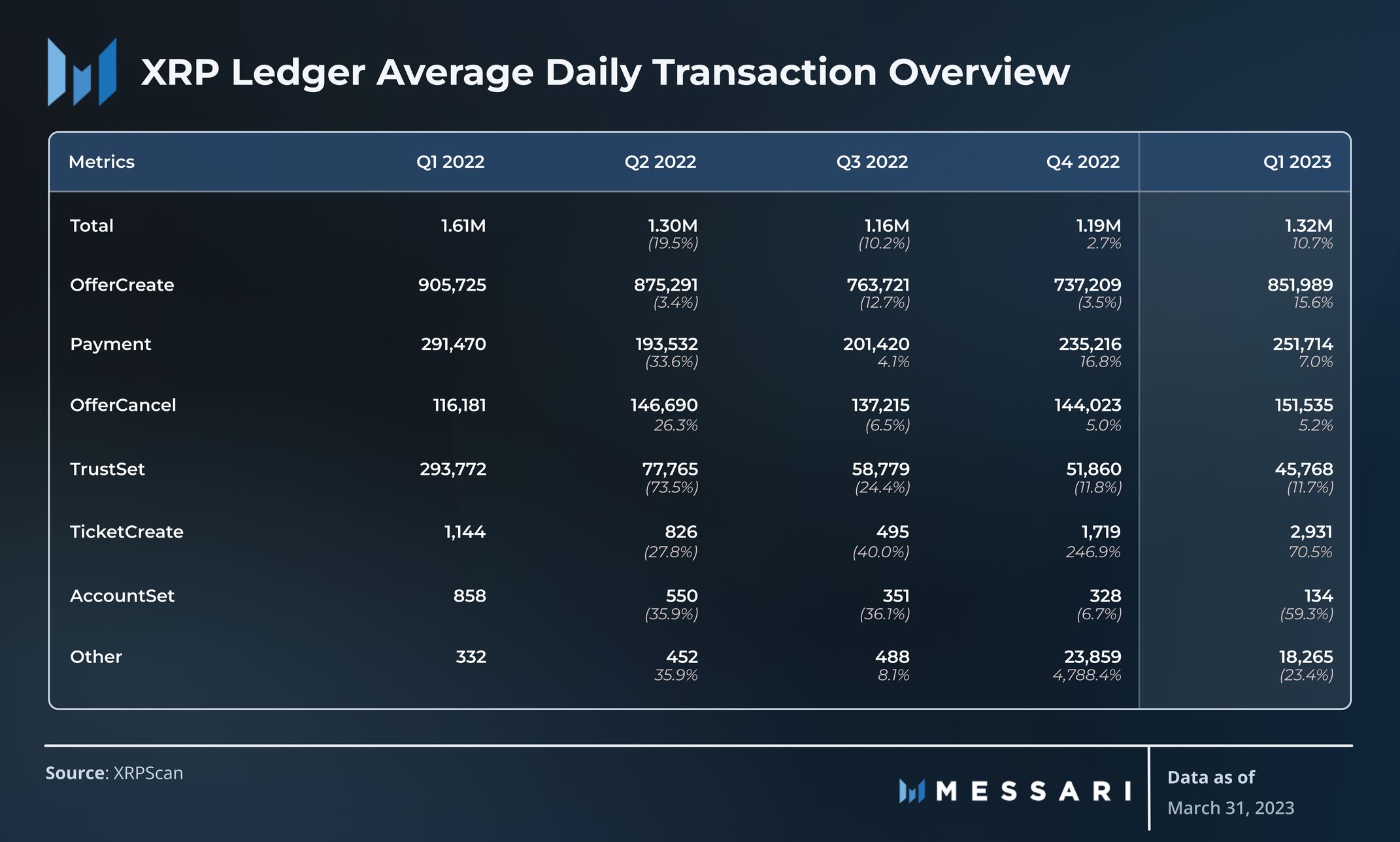

Daily active addresses and daily transactions experienced a noteworthy uptick, registering a growth of 13.9% and 10.7%, respectively, compared to the previous quarter.

XRP’s price surged by 56% during Q1, surpassing the overall crypto market cap, climbing from $0.35 to $0.54. This surge was attributed to positive news emerging from the ongoing legal case between Ripple and the SEC.

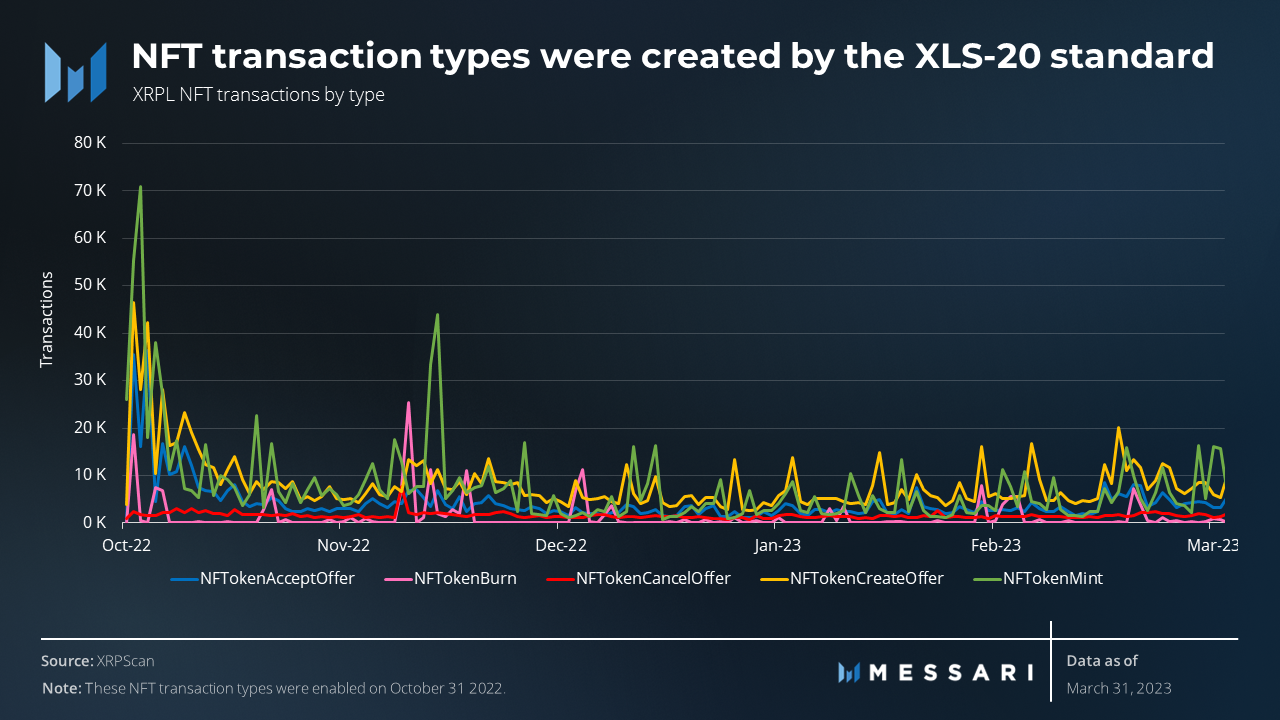

One noteworthy development during this period was the introduction of the XLS-20 Standard, which mapped NFT transactions. Five new transaction types were created, and five additional types were proposed.

Despite the decline in NFT activity compared to the previous quarter, participants still accepted 436,000 NFT mints and 277,000 NFT offers.

Two sidechains, Coreum (CORE) and Flare Network (FLR) achieved mainnet status on the XRP Ledger. Coreum focuses on interoperability and scalability, catering to enterprise-grade applications, while Flare Network is an EVM-based sidechain emphasizing decentralized data.

Developers within the XRP Ledger ecosystem remain focused on NFTs, the metaverse, and smart contracts. Projects such as Futureverse’s Root Network, Hooks, and the EVM sidechain are developing, promising to bring a new dimension to the ecosystem.

Overview Of XRP Ledger Features And Tokenomics

XRP Ledger offers long-standing, swift, eco-friendly, global payment options for 10+ years. It offers native Issued Currencies, a decentralized exchange (DEX), escrow functionality, and token management. Despite not supporting smart contracts, the XRPL can perform similar functions to other networks through its native capabilities.

The native coin on the XRPL, XRP, has a market valuation of over $28 billion and is now the sixth-largest cryptocurrency. The XRPL can handle an average of 15 transactions per second, potentially supporting up to 1,500. Transaction costs on the XRPL are deterministic, with most types costing 10 drops, equivalent to a fraction of a cent.

The XRPL aims to provide a digital payment infrastructure for individuals and established financial entities, including central banks. Ripple, XRPL Foundation, XRPL Labs, XRPL Commons, and developers worldwide support the ecosystem.

In Q1, network activity metrics increased overall, such as daily active addresses and daily transactions. Active addresses increased with a 17.1% rise in receiving addresses while sending addresses dropped by 7.2% QoQ.

The XRP Ledger witnessed a continuous rise in the total number of addresses despite deleting 141,000 accounts. The XRPL’s ability to delete accounts and reclaim escrowed XRP, incentivizing the deletion process, contributes to it.

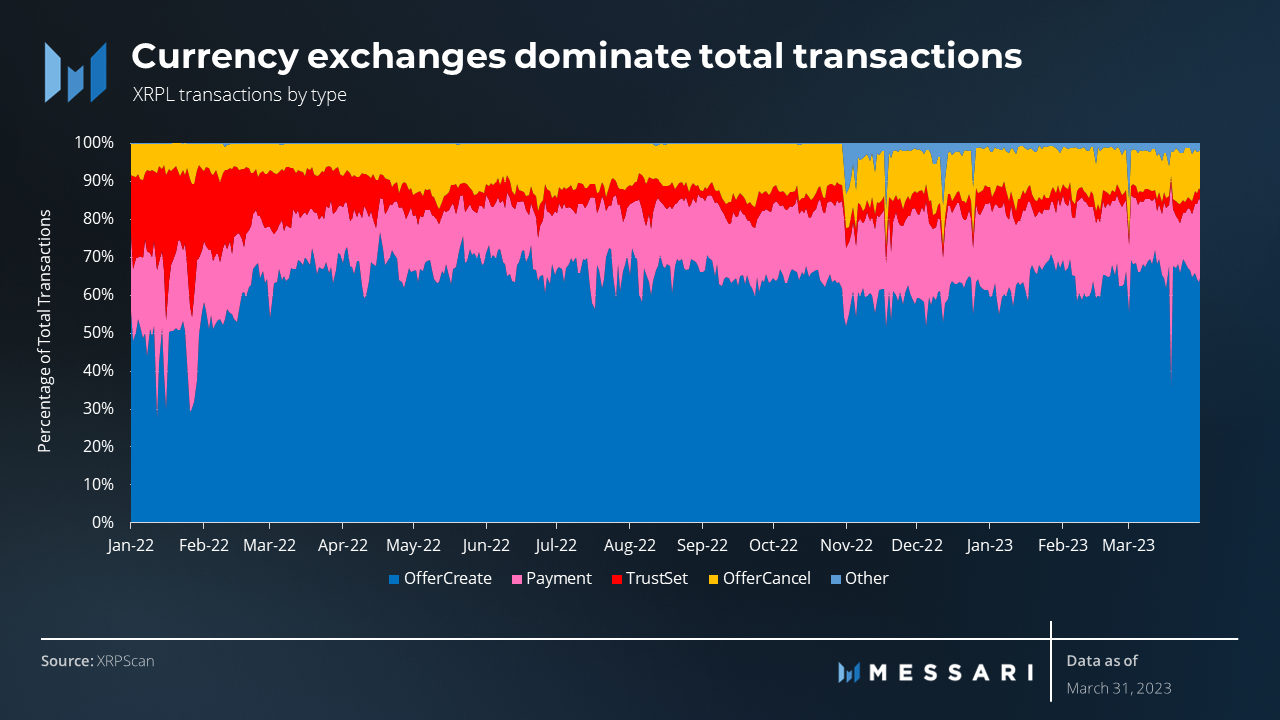

The dominance of transaction types varied, with OfferCreate holding the highest dominance at 65%, followed by Payment, OfferCancel, and TrustSet with dominances of 19%, 11%, and 3%, respectively. Notably, The OfferCreate transaction type primarily drove the increase in total daily transactions.

XRP’s financial overview showcased a significant increase in its circulating market cap, rising by 59.9% from $17.4 billion to $27.8 billion.

The XRPL burns transaction fees, exerting deflationary pressure on the total supply of XRP. Although Ripple vests 1 billion monthly. It returns any unspent XRP to escrow, and only a small portion of the token has been burned.