Gold and Bitcoin are leading the way in the financial markets in 2023, surprising analysts who expected other assets to outperform. Jurrien Timmer, the Director of Global Macro at Fidelity, has tweeted an analysis. It was conducted to understand what drives the rally in these two assets.

Was this on your bingo card? Look what's at the top of the leaderboard so far in 2023: Gold and Bitcoin. 🧵 pic.twitter.com/ihJojbMJhu

— Jurrien Timmer (@TimmerFidelity) May 12, 2023

Timmer believes that a potential era of financial repression could drive the surge in gold and Bitcoin. With rising debt costs, policymakers may be forced to adopt below-market rates, leading to a weaker dollar and suppressed real rates.

These factors are two of the main drivers of gold’s price increase. As gold’s high-octane cousin, Bitcoin also gains benefits from this trend. Historically, when debt burdens become excessive, the debt needs to be devalued or outgrown by rising nominal GDP. The 1940s were a useful history lesson in this regard.

Timmer believes that below-market rates may once again become the lowest-hanging fruit for policymakers on both sides of the aisle looking to preserve their spending power.

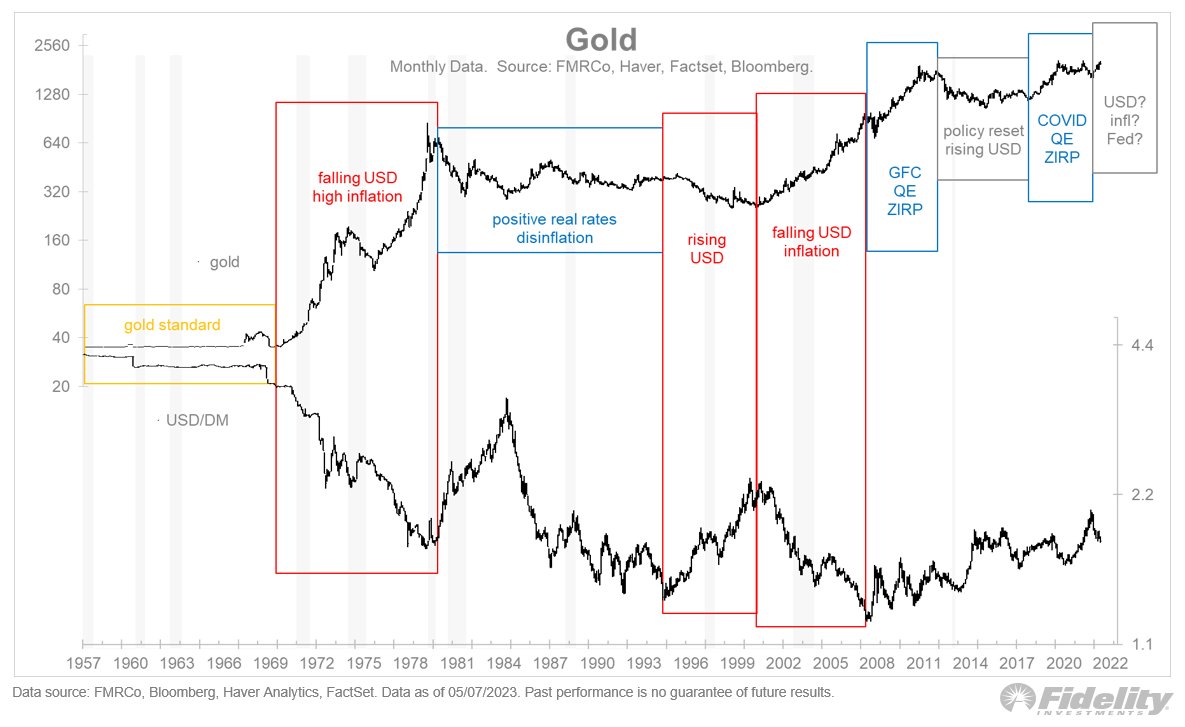

The analysis also shows that gold and Bitcoin have followed similar patterns in the past. Gold came of age during the 1970s, a turbulent era of high inflation and dollar devaluation.

It lost its shine during the era of disinflation and positive real rates that followed. Still, it regained its appeal during the Global Financial Crisis and the subsequent negative real rates and Quantitative Easing (QE) era.

Bitcoin As An Aspirational High-Powered Inflation Hedge

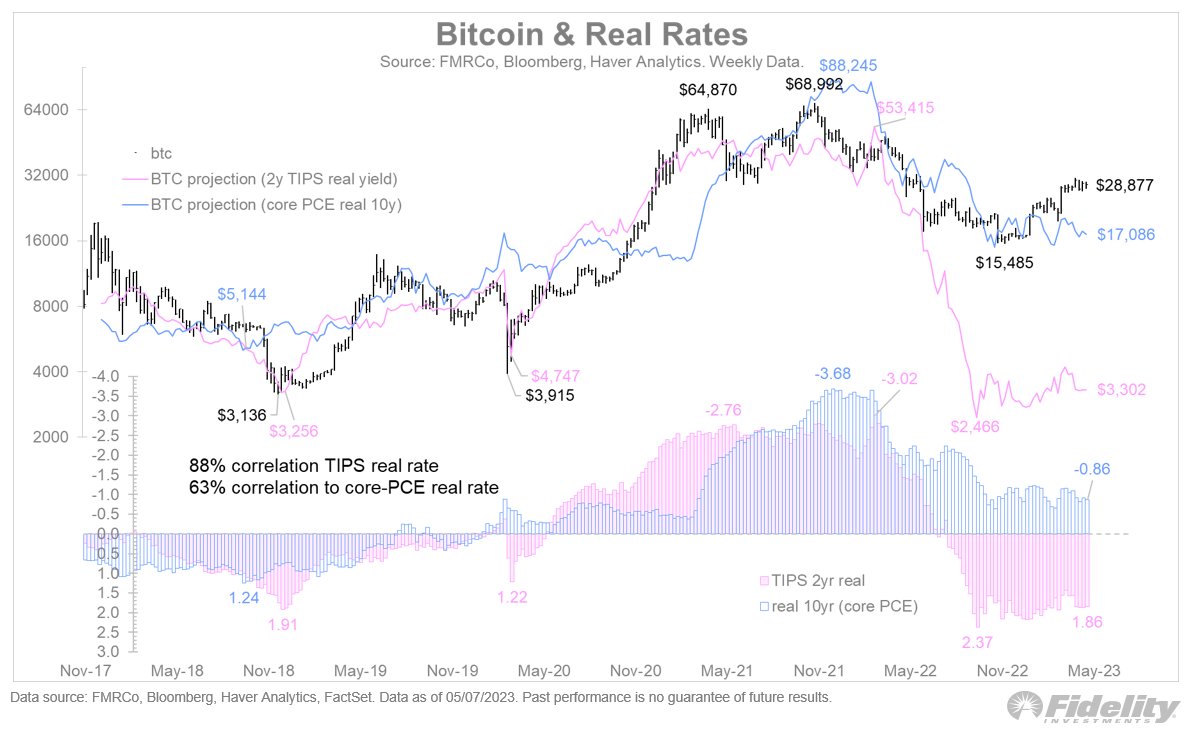

Bitcoin’s correlation to real rates is more recent. But Timmer sees an 88% inverse correlation to the 2-year real TIPS yield and a 63% inverse correlation to the PCE-derived real rate. The statement suggests that people also view Bitcoin as an inflation hedge. They see its exponential regression as a logical choice for a high-powered hedge.

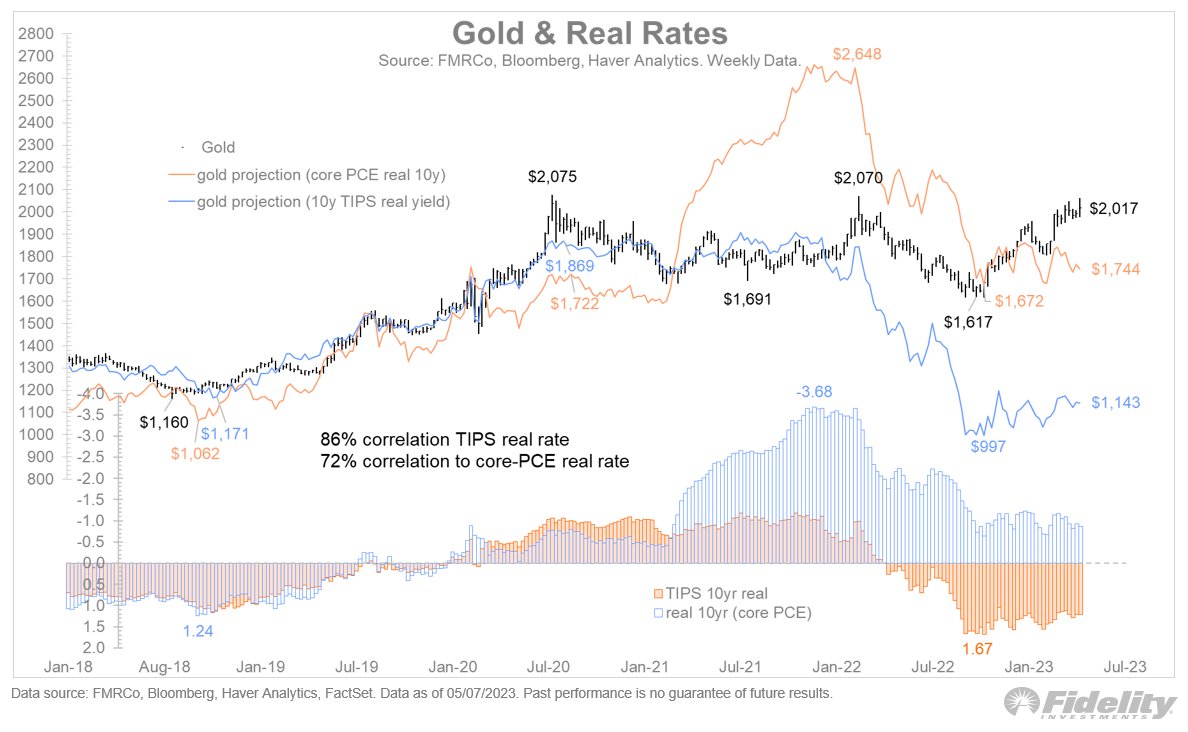

Despite the potential justifications for the rally, Timmer believes that both gold and Bitcoin are currently ahead of themselves in terms of price. He argues that while the direction of the rally is justified, the magnitude is not. The real rate model shows that both assets are ahead of themselves based on either TIPS or core-PCE measures.

Timmer, however, concluded by saying:

Note that the regression for gold is linear, but for Bitcoin it’s exponential. This makes sense to me, given that Bitcoin is an aspirational high-powered inflation hedge. But as is the case for gold, while Bitcoin’s rally is directionally justified, at $30k it looks to have gotten a bit ahead of itself.

Nevertheless, rising debt costs could be driving the current rally in gold and Bitcoin due to a potential era of financial repression. Both assets have historical justifications for their price increases, but their current prices may be ahead of themselves.