Coinshare, a leading cryptocurrency research firm, has released a comprehensive report on the ownership and adoption of Ethereum, the second-largest cryptocurrency by market capitalization. The report provides key insights into the global ownership of Ethereum and sheds light on the motivations behind its usage.

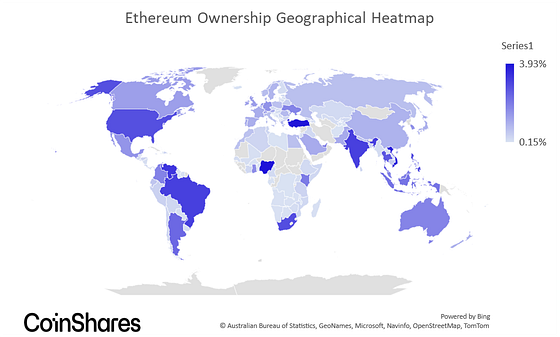

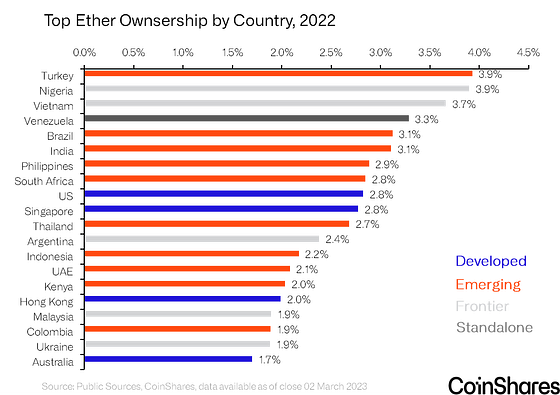

One of the report’s key findings is that Ethereum ownership is not confined to Western countries. Independent studies consistently show that the proportion of the population owning ether is higher in emerging and frontier markets. This suggests that Ethereum is gaining popularity worldwide, with a significant user base in these markets.

Ethereum: Popular Among Younger Generations

According to Coinshare’s estimates, more than a hundred million people are likely to own ether. The ownership of Ethereum has been growing rapidly over time, and this trend is expected to continue. Most of the ether owners are under the age of 45, indicating strong interest from younger generations.

The report emphasizes that most people use ether as a speculative investment instrument. Ethereum’s potential for code execution, decentralized finance collateralization, and store of value are considered key drivers of its demand. The investment case for Ethereum rests on its ability to outstrip the supply created by staking.

To understand the current ownership and adoption of Ethereum, Coinshare conducted a literature review of all publicly available research on cryptocurrency ownership. While specific studies on ether ownership are limited, the researchers analyzed broader studies on crypto ownership and made some assumptions to estimate Ethereum ownership.

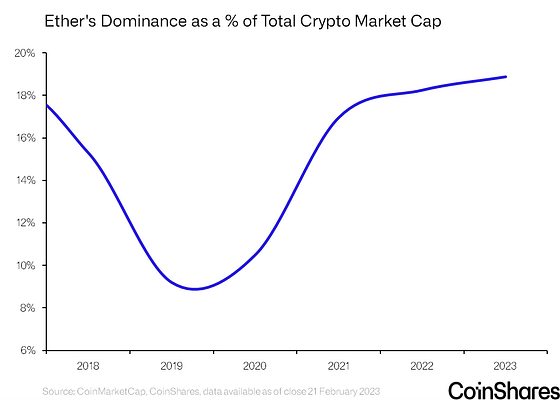

Coinshare used the market cap dominance of ether relative to the broader cryptocurrency market as a proxy for its proportional ownership relationship. People owning multiple cryptocurrencies consider this approach conservative. The researchers found that the ownership figures tend to be higher than the dominance figures.

Demographics And Motivations Behind Ethereum Ownership

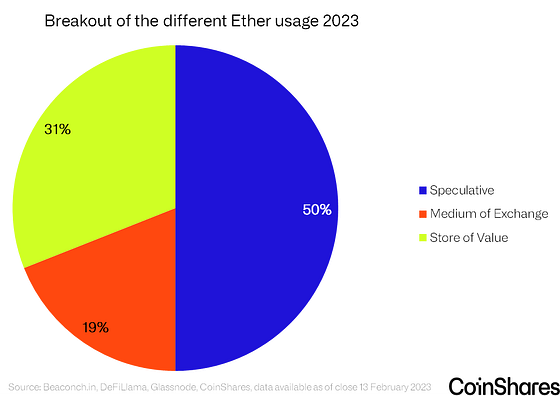

The study also examined the demographic and motivation data related to Ethereum ownership. However, the analysis had to rely on broader generalizations due to the fragmented nature of the available data. The researchers categorized the motivations behind Ethereum ownership into the medium of exchange, speculative, and store of value use cases.

The report acknowledges the limitations and sources of error in the review. The data’s scarcity and fractured nature and methodologies’ variations pose challenges in accurately estimating ownership numbers. However, the researchers found confidence in the consistency of the different studies, suggesting that the results are reasonably close to reality.

Solid Growth In Global Ethereum Users

Coinshare’s latest report on global ownership of ether reveals a solid growth in users worldwide. The estimate for 2022 suggests there are 115 million global ether users, with a compound annual growth rate of 30% since 2018. However, the data’s uncertainty prevents precise accuracy.

Despite the fragmented nature of the data, at least a hundred million people likely own ether. Market cycles appear to influence the adoption curve, with rapid booms during bull markets followed by cooling off in bear markets.

Interestingly, Emerging and frontier markets concentrate on the ownership of ether, with developed countries holding only a small percentage. This trend corresponds to the greater demand for financial services in these regions, where access to traditional banking is limited.

Ethereum’s appeal lies in providing financial services to the global population with internet access and smartphones. Western audiences, accustomed to well-functioning financial systems, may overlook Ethereum’s benefits. However, under authoritarian regimes or with unstable currencies, Ethereum’s advantages become more apparent.

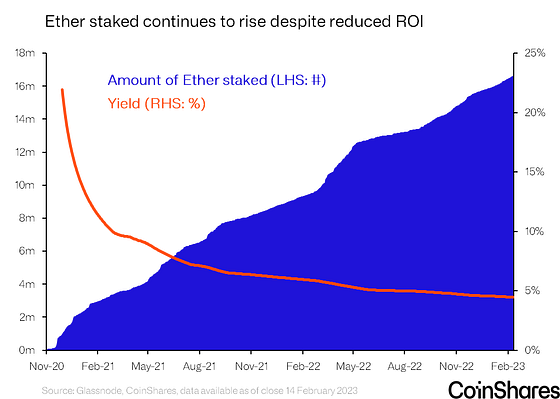

Ether’s Shift Towards Store Of Value & Staking

People increasingly view ether as a store of value rather than as a medium of exchange or a speculative instrument. Ethereum’s ecosystem data suggests a shift towards longer-term holding and staking. The amount of ether used as collateral within DeFi applications has also risen.

While ether’s relative usage as a medium of exchange is declining compared to the store of value, its absolute usage continues to grow. New use cases like DeFi and NFTs have contributed to ether’s rising demand and price.

Nevertheless, Coinshare’s report highlights the widespread ownership and growing adoption of Ethereum globally. The global ownership of ether is expanding, particularly in emerging markets with limited access to traditional financial services. Ether is increasingly seen as a store of value, and its absolute usage as a medium of exchange is still growing due to the emergence of new applications.