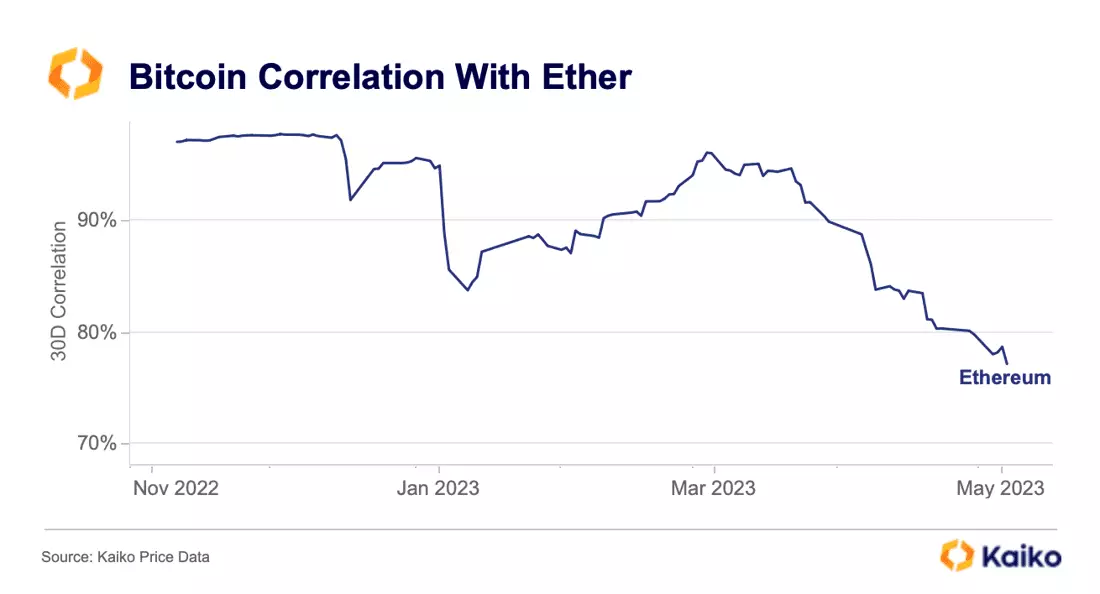

Bitcoin and ETH, the two leading crypto assets, have experienced a weakening correlation since mid-March. The correlation dropped from 96% to 77%, reaching its lowest level since November 2021.

The decline coincides with ETH’s decrease of nearly 14% and BTC’s 11% drop since the Shapella upgrade. This divergence suggests that distinct factors increasingly influence both cryptocurrencies.

The Kaiko report reveals that market makers continue to reduce liquidity, resulting in BTC and ETH erasing most of their gains. The resurgence of the Dollar has played a role in this development.

Additionally, the Ethereum network encountered technical issues, Bakkt delisted 25 tokens due to regulatory pressure, and Binance.US reportedly aims to reduce CZ’s dominant stake in the exchange.

Major market makers, Jane Street, and Jump Crypto, recently announced their plans to wind down some of their crypto exposure, mainly in the U.S., due to regulatory uncertainty. This move is expected to have significant implications for liquidity in the industry. It has already lost several prominent players in the past year.

Regarding Liquidity on U.S. Exchanges

Surprisingly, market depth for BTC has remained relatively unchanged despite the announcement, indicating that Jump and Jane Street have likely already adjusted their exposure.

Regarding liquidity on U.S. exchanges, they have not been as affected as anticipated by the reduction in market depth. U.S. exchanges have experienced a similar decrease in BTC liquidity, around 50%, since the beginning of the year.

Jump Crypto, known for providing altcoin liquidity, has contributed to the decline in altcoin liquidity, which has fallen more sharply than that of BTC and ETH over the past month.

The decline in liquidity has led to increased intraday volatility for Bitcoin. The intraday volatility, measured by BTC price changes every ten minutes, has risen this year as liquidity hit a one-year low.

Large market orders now have a greater impact on the market, amplifying market movements. On average, BTC’s price moved by $10 every 10 minutes in December 2022. It compared to an average of $34 from March 1 to May 11.

The Turkish election’s contentious nature has caused a spike in crypto activity in Turkey, driven by currency volatility. The Turkish Lira reached a new all-time high against the U.S. Dollar. Stablecoins, particularly Tether (USDT), have become popular assets for trading as investors seek to avoid wealth depreciation.

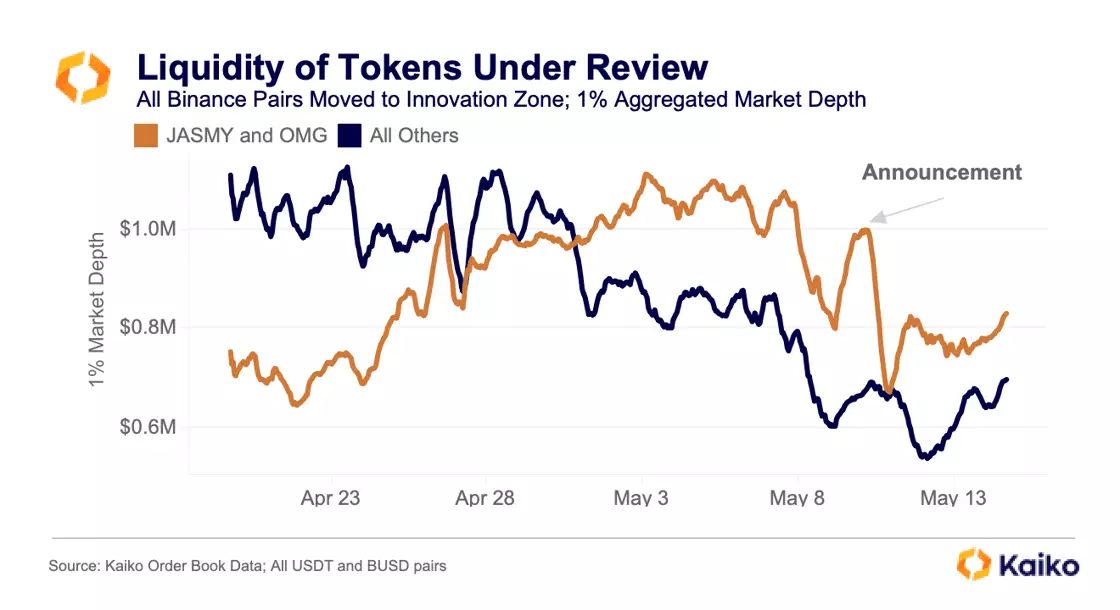

Binance’s “Innovation Zone” Affects Liquidity of Bitcoin Tokens

Binance’s recent move of 18 tokens to its “Innovation Zone” has impacted liquidity. Tokens like OMG Network (OMG) and JasmyCoin (JASMY) experienced a drop in liquidity. While TUSD-USDT is no longer the most liquid pair in crypto.

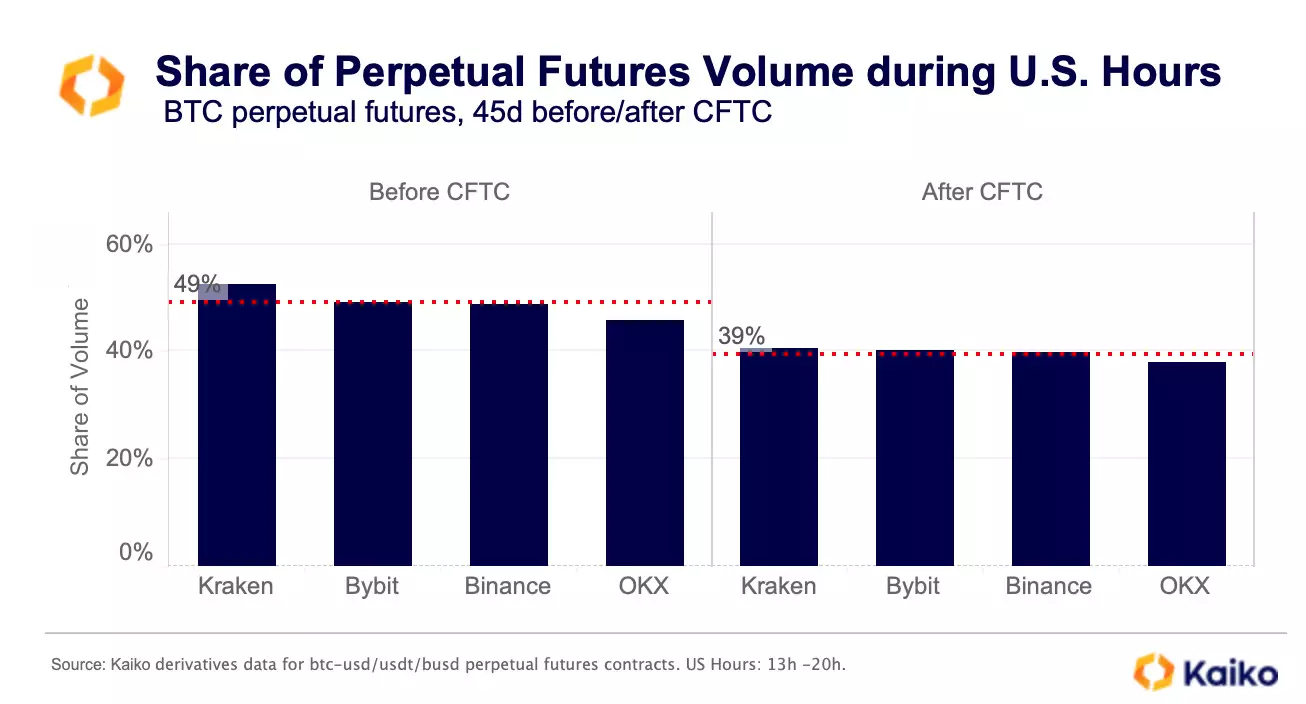

Binance’s volume during U.S. trading hours has declined following the CFTC’s action against the exchange. The average share of BTC perpetual futures traded during U.S. business hours dropped significantly from 49% to 39% post-CFTC. Similar volume decreases were observed on Kraken and Bybit during U.S. hours.

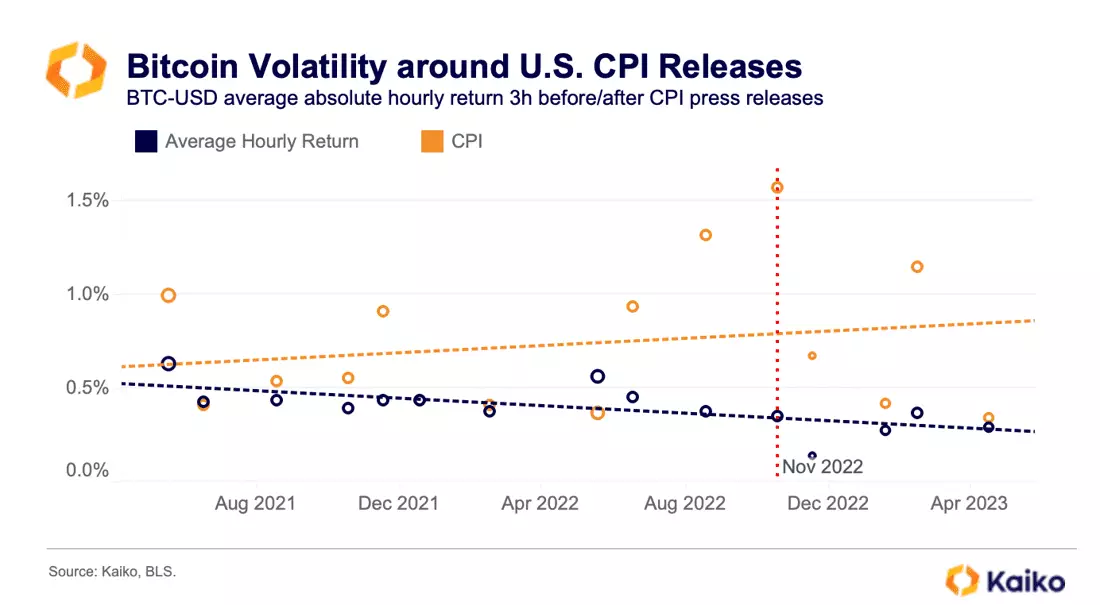

BTC’s volatility around U.S. CPI releases has decreased but remains above average for the month. Predictability in inflation and economists’ accurate predictions allow the U.S. Fed to adopt a more cautious monetary policy.

Crypto mining stocks have outperformed BTC and other blockchain-related stocks due to the introduction of ordinals. It increased demand for block space and fees earned by miners. Stocks like Riot Platforms and Marathon Digital have seen significant returns, ranging from 88% to 215%.

Related Reading | Crypto Payments for Fentanyl Precursors: Elliptic’s Findings