In the last two days, Glassnode, a blockchain intelligence firm, released several interesting statistics on the state of Bitcoin.

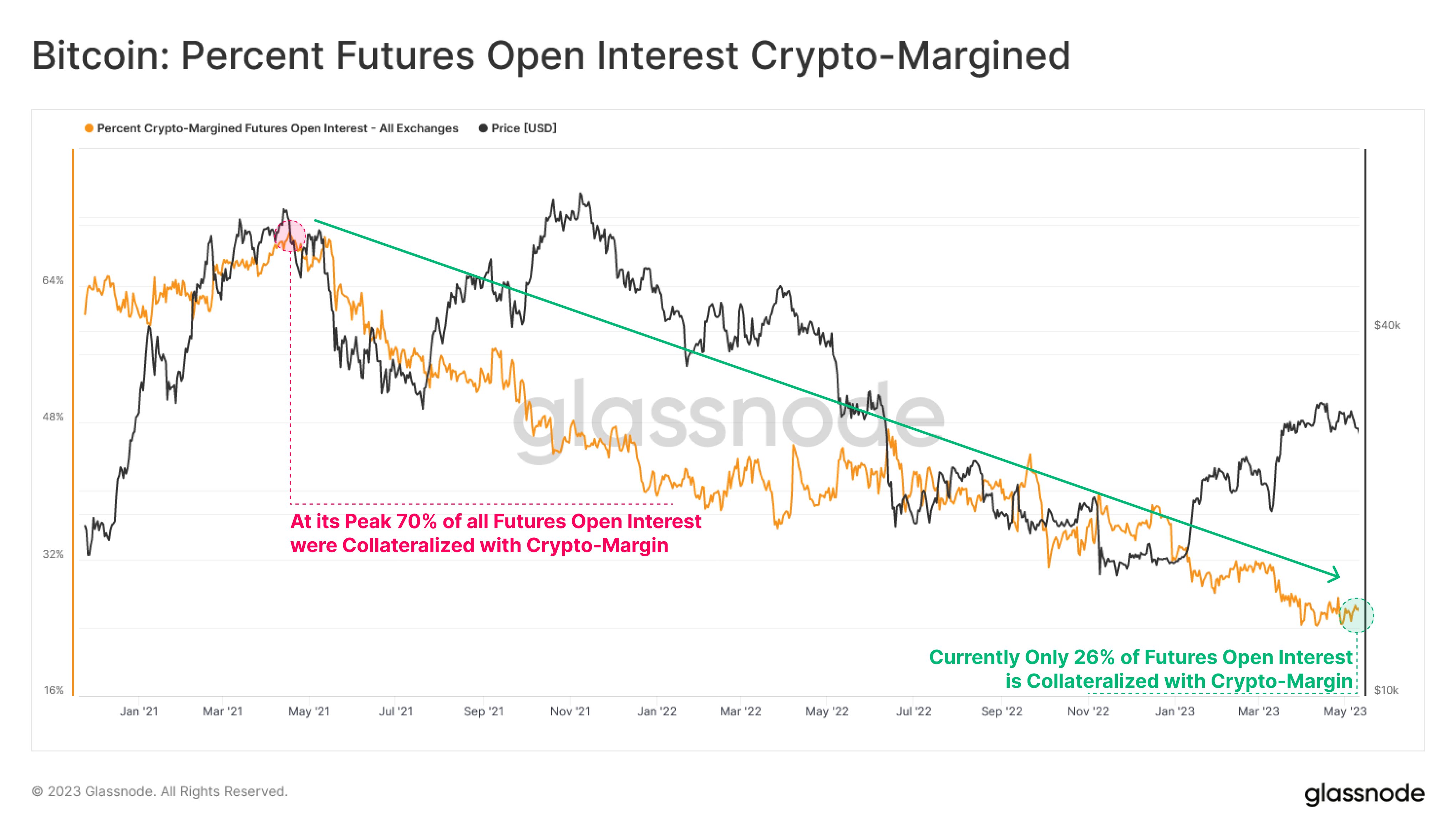

According to Glassnode statistics, the percentage of Futures Open Interest with Crypto-margined collateral remains at historic lows. This collateral, which includes cryptocurrencies like Bitcoin and Ethereum, is inherently more volatile and can amplify deleveraging events. However, the derivative collateral structure has greatly improved over the last two years, indicating a healthier market.

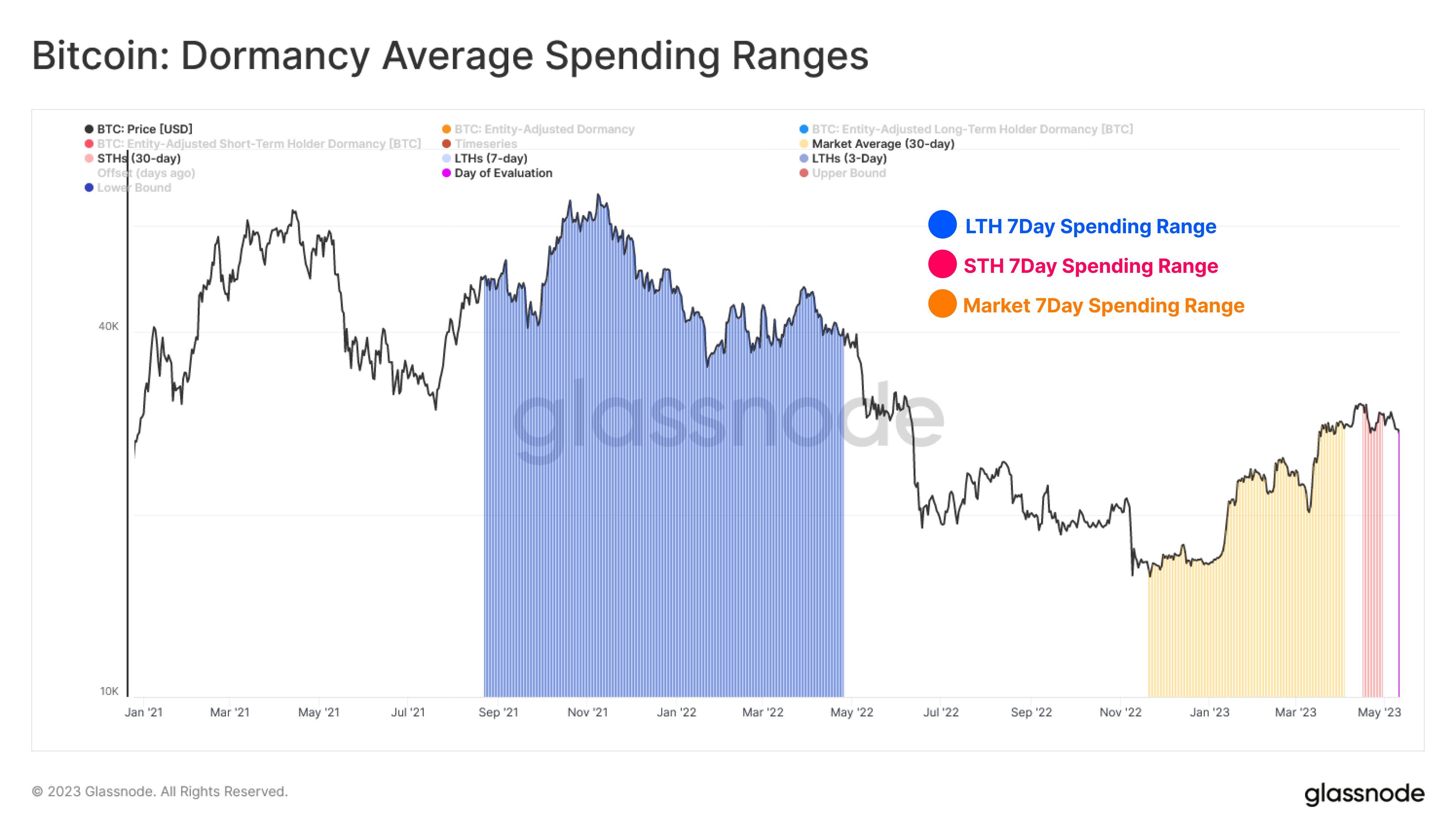

Bitcoin Dormancy Spending Ranges: LTH, STH, & Market

The Bitcoin Dormancy Spending Ranges also revealed some interesting insights into the market. The LTH 7Day Spending Range was between $67.6k and $35k, while the STH 7Day Spending Range was between $30.4k and $27.3k. The Market 7Day Spending Range was between $15.8k and $28.5k, highlighting the fluctuation of spending patterns in the market.

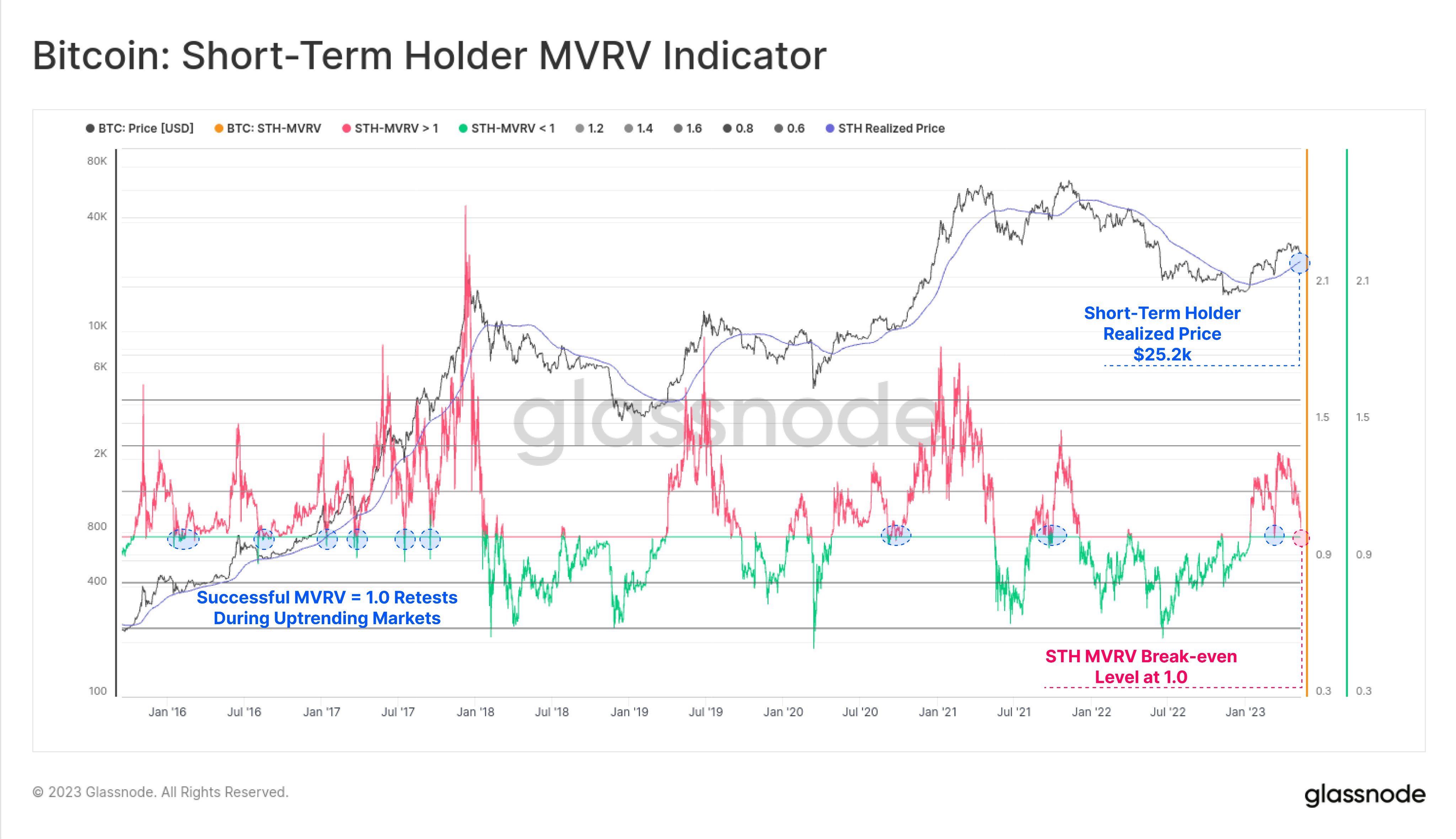

Bitcoin Short-Term Holder Cost Basis: Will it reach $25.2k?

The cost basis for Bitcoin Short-Term Holders is hovering around $25.2k, representing break-even for recent buyers. A successful retest of MVRV = 1.0 was achieved in the March correction, which is typical of up-trending markets. It remains to be seen if Bitcoin will reach $25.2k and find support this round.

SOPR is another powerful tool to deploy during market corrections. Shows that top local buyers often panic and spend coins, with increasing volumes, near correction lows. It pushes SOPR below 1, indicating realized losses.

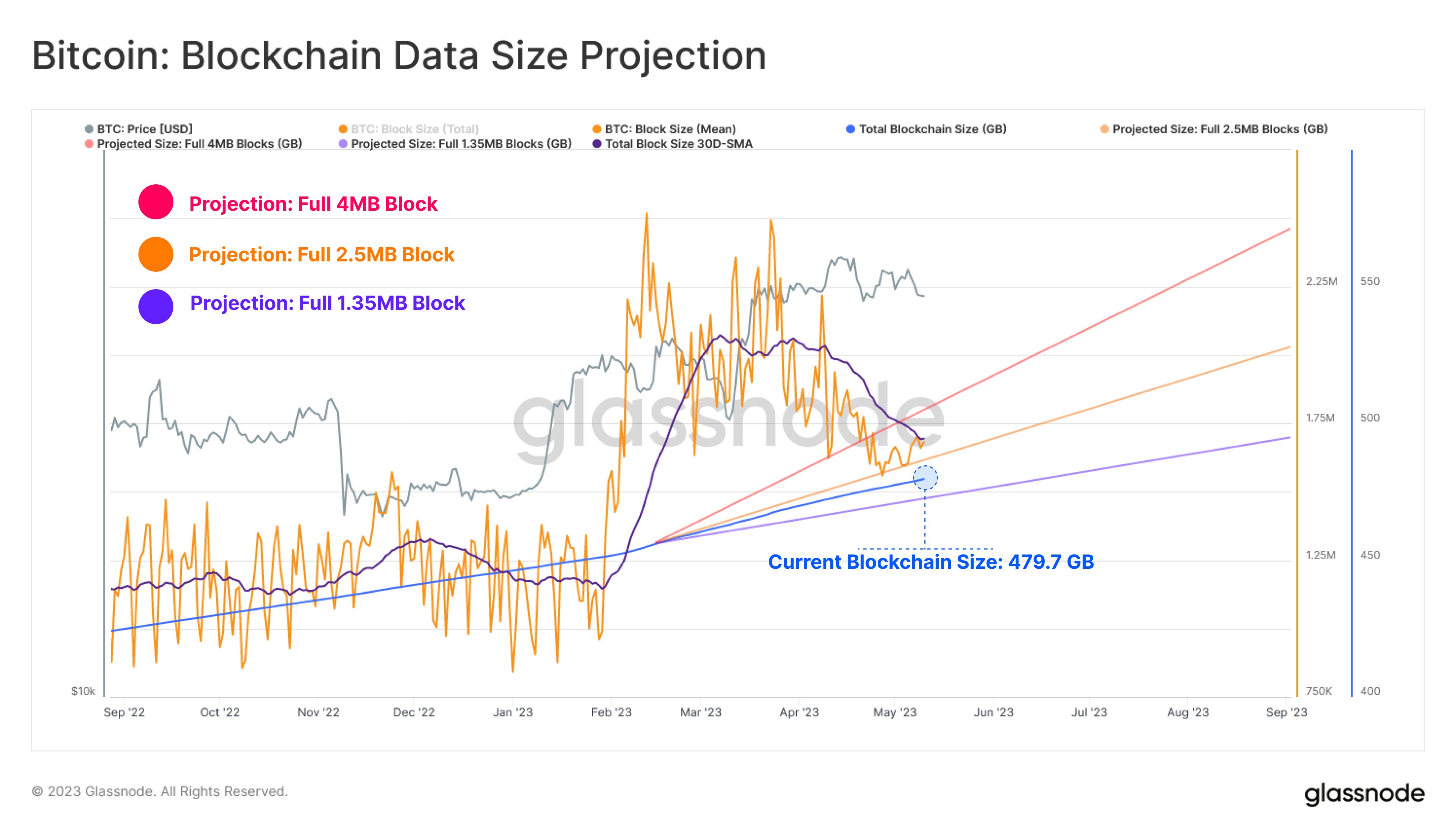

Bitcoin Blockchain Size Increases By 24GB

In other news, the explosion in Bitcoin Inscription popularity has led to an increase in the size of the Blockchain by 24GB to a total of 479.7GB as of May 11th. However, the current Blockchain size is within the projections of consistent 2.5MB and 1.35MB blocks.

The size of the Blockchain would be 504.9GB with a full 4MB block, 486.6GB with a full 2.5MB block, and 472.5GB with a full 1.35MB block, according to theoretical projections.

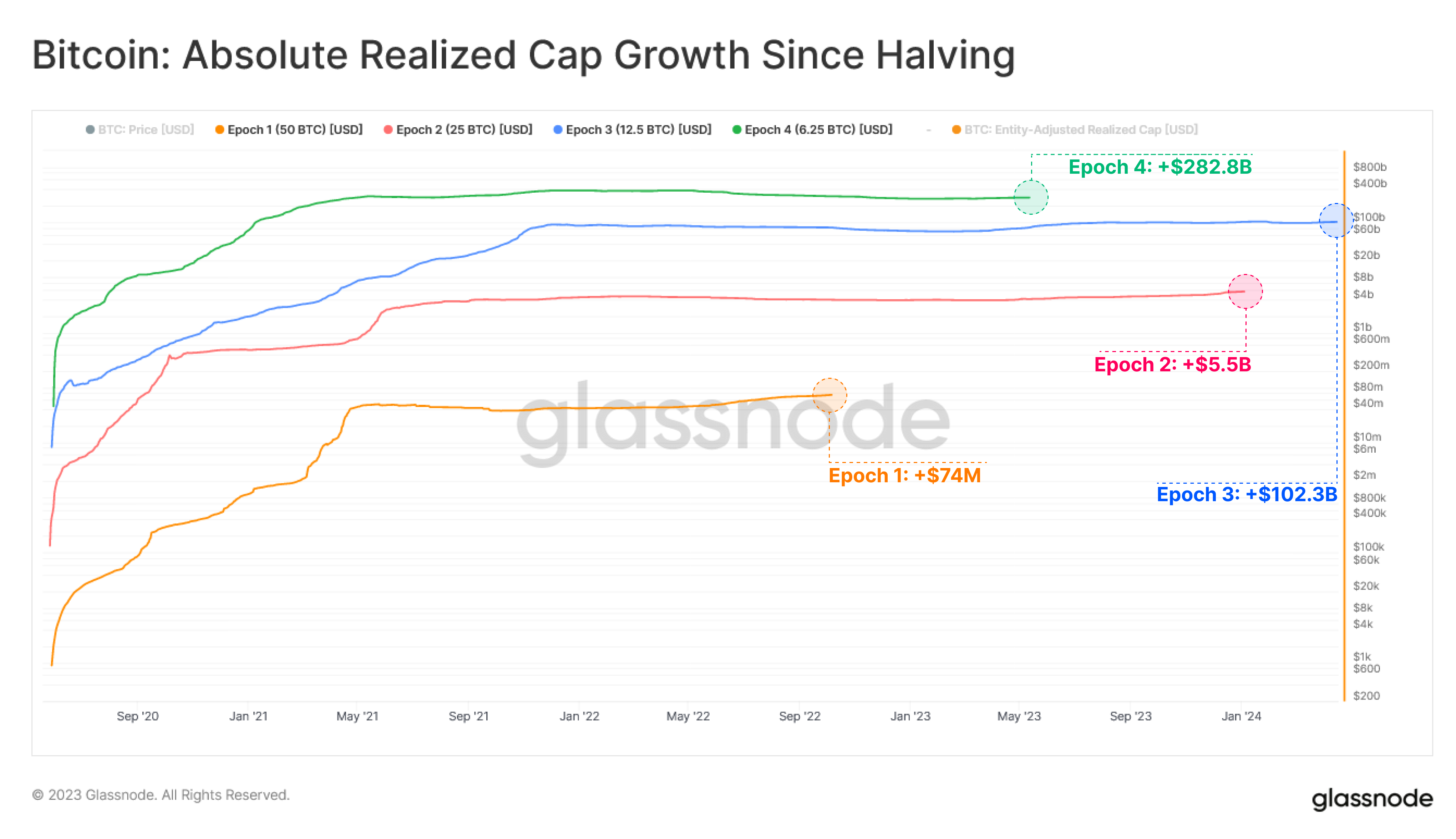

Realized Cap Cyclical Growth: Diminishing Returns

Additionally, the cyclical growth for the Bitcoin Realized Cap had been increasing cycle upon cycle, with the current Epoch recording a capital inflow of $282.8B.

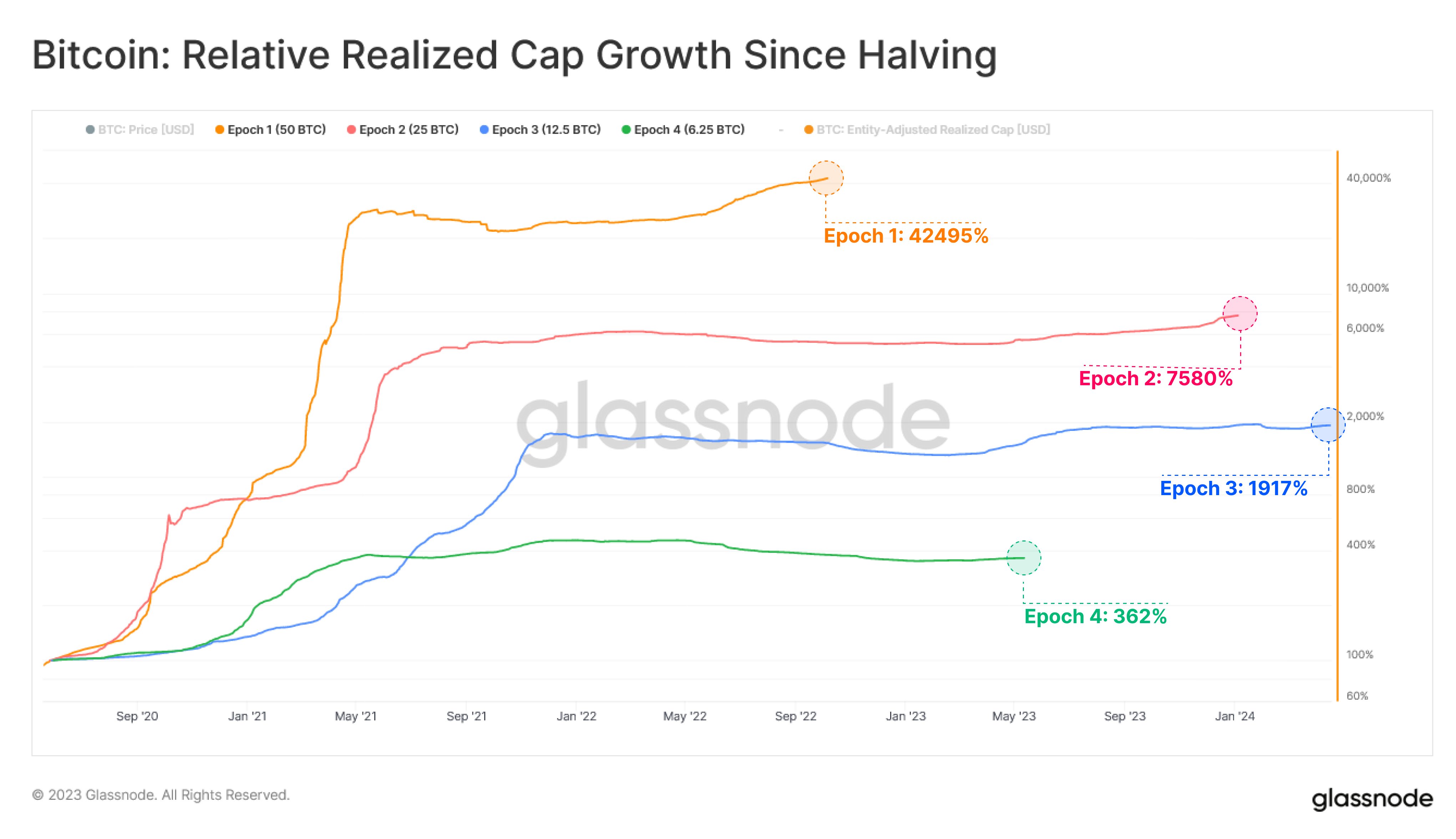

However, relative growth has been diminishing across Epochs, with the current cycle recording a 362% expansion in size compared to Epoch 1’s growth of 42,495%, Epoch 2’s growth of 7,580%, and Epoch 3’s growth of 1,917%.

Nevertheless, Glassnode’s latest statistics indicate a healthy market with an improving derivative collateral structure, fluctuating spending patterns, and an expanding Bitcoin Realized Cap. It’s uncertain how the market will react to upcoming events. If Bitcoin will maintain its positive performance in the following months.