Glassnode, a blockchain data analysis firm, has released a report detailing what has happened to the 1.55 million Ethereum that was withdrawn following the Shanghai/Capella hard fork upgrade on the Ethereum network.

The report contradicts the popular belief that Ethereum becoming liquid would have a negative effect on the market, as prices actually rose to $2,110 in the week after the upgrade before declining to $1,920.

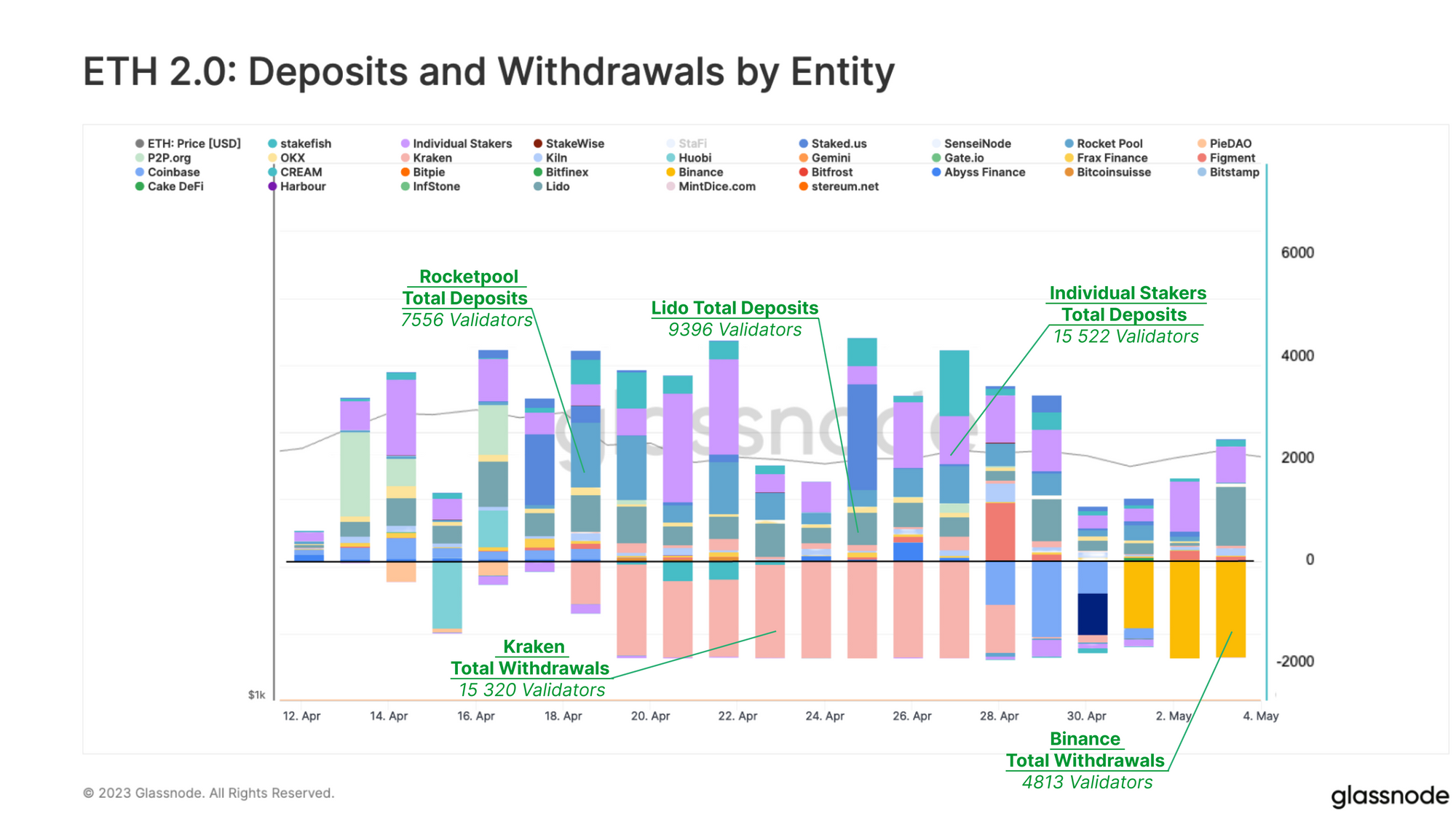

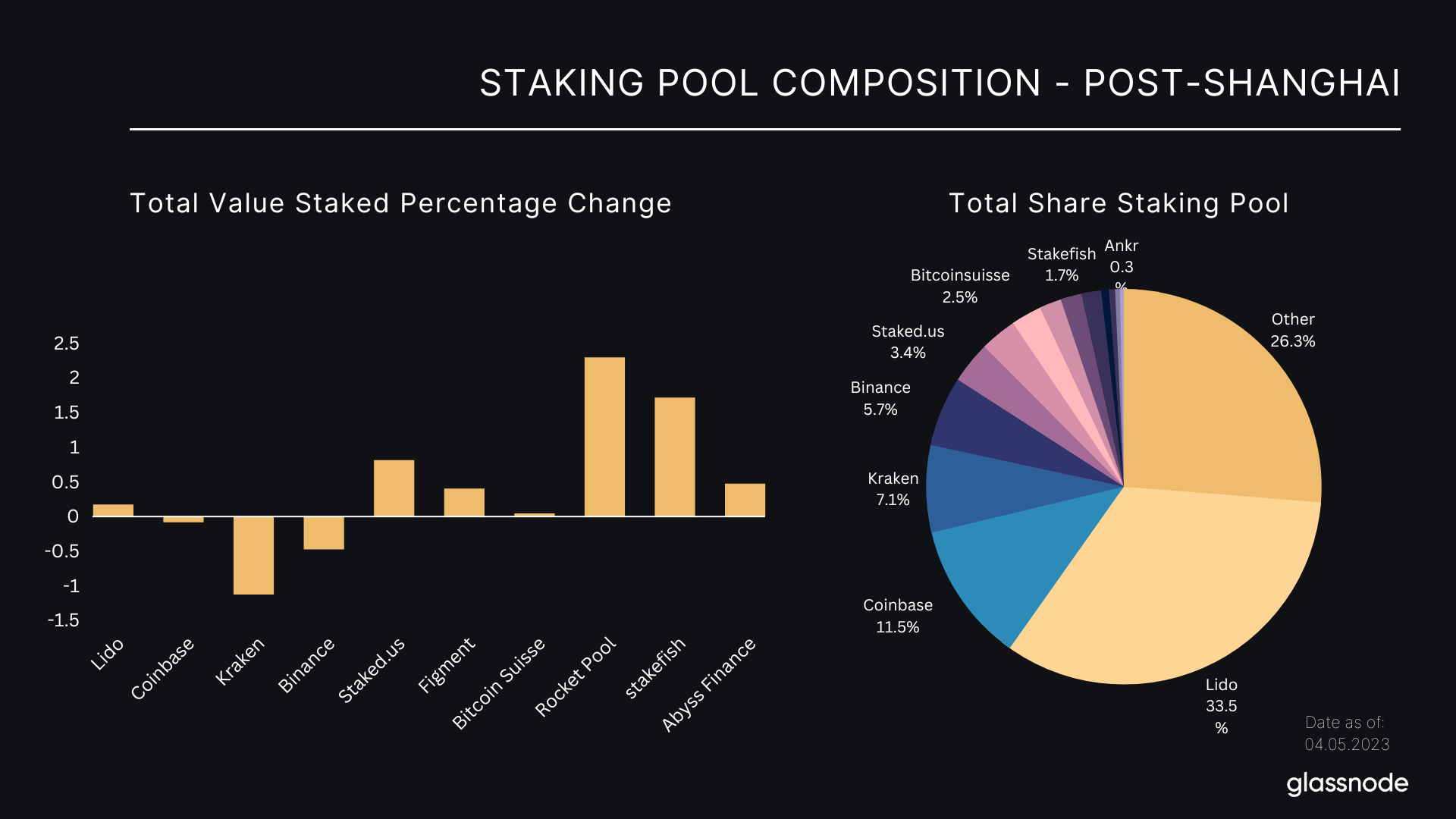

The report examined the balance of withdrawals, deposits, and entities initiating them. The estimate projected the sale of around 170,000 ETH. But this figure was too conservative, as the exchange Kraken alone withdrew 125,088 ETH amidst pressure from the SEC to close its US-based staking service.

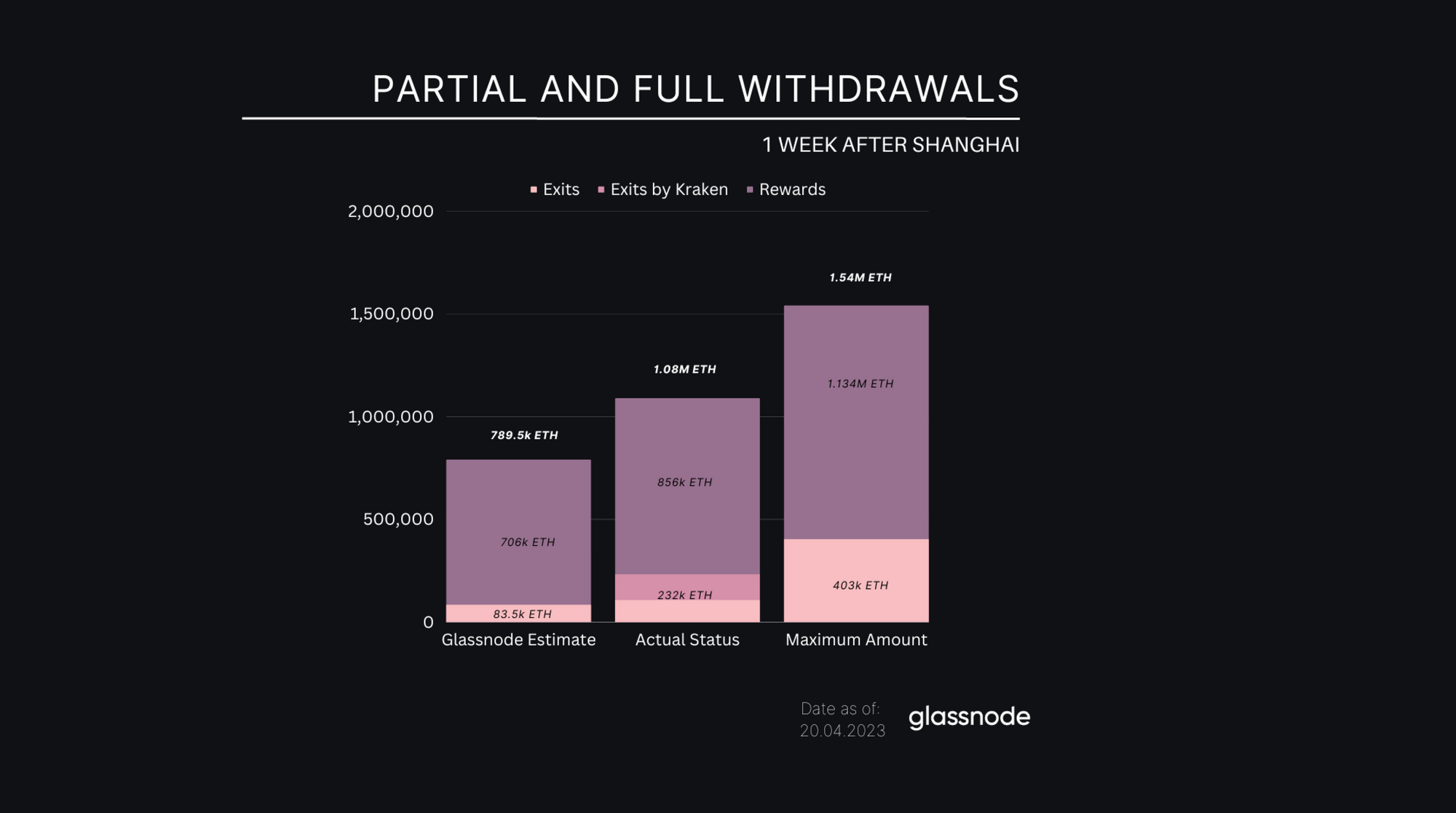

During the first week after the upgrade, users withdrew a total of 856,000 ETH rewards and 232,000 ETH. While partial withdrawals account for 80% of the total amount released.

The report also stated that there was no appreciable increase in exchange inflow volume during this time. It indicates that the sell-side pressure was not as significant as some expected.

The report also noted that the upgrade introduced two types of withdrawals: partial and full withdrawals. Partial withdrawals automatically transfer rewards to the owner’s Ethereum mainnet account every 4.5 days.

Whereas full withdrawals require the staker to sign an exit message and enter an exit queue manually. The same automatic skimming process withdraws the unstaked ETH after waiting around a day, which takes up to 4.5 days.

Ethereum Staking Rewards Withdrawn, Churn Limit Reached

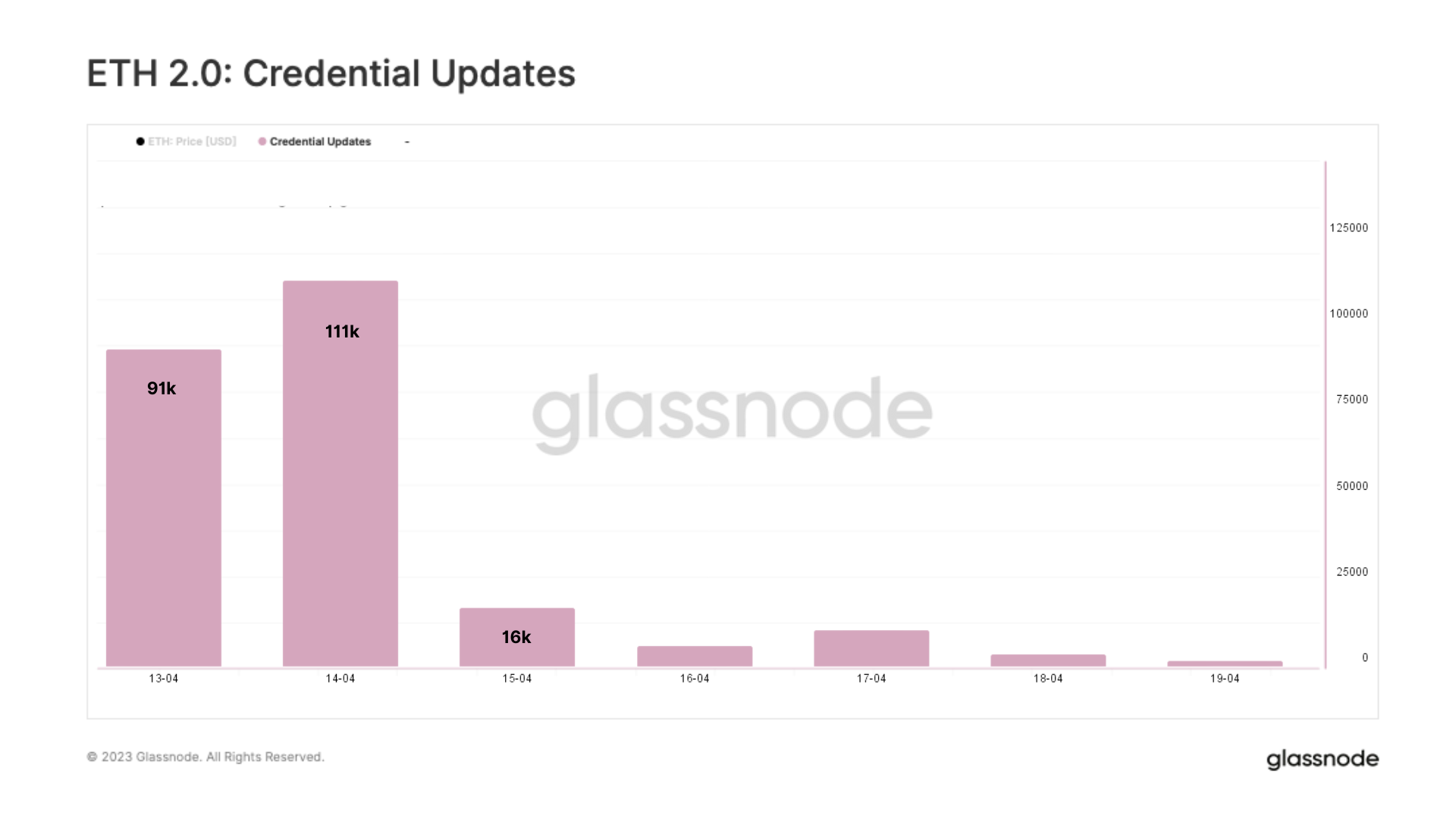

The report states that individuals had withdrawn 84% of the accumulated staking rewards up to date, while the remaining 16% was due to missing credential updates. After the upgrade, the demand for exits reached its maximum level, and individuals withdrew their stake, which was capped at 57,600 Ethereum due to the Churn Limit.

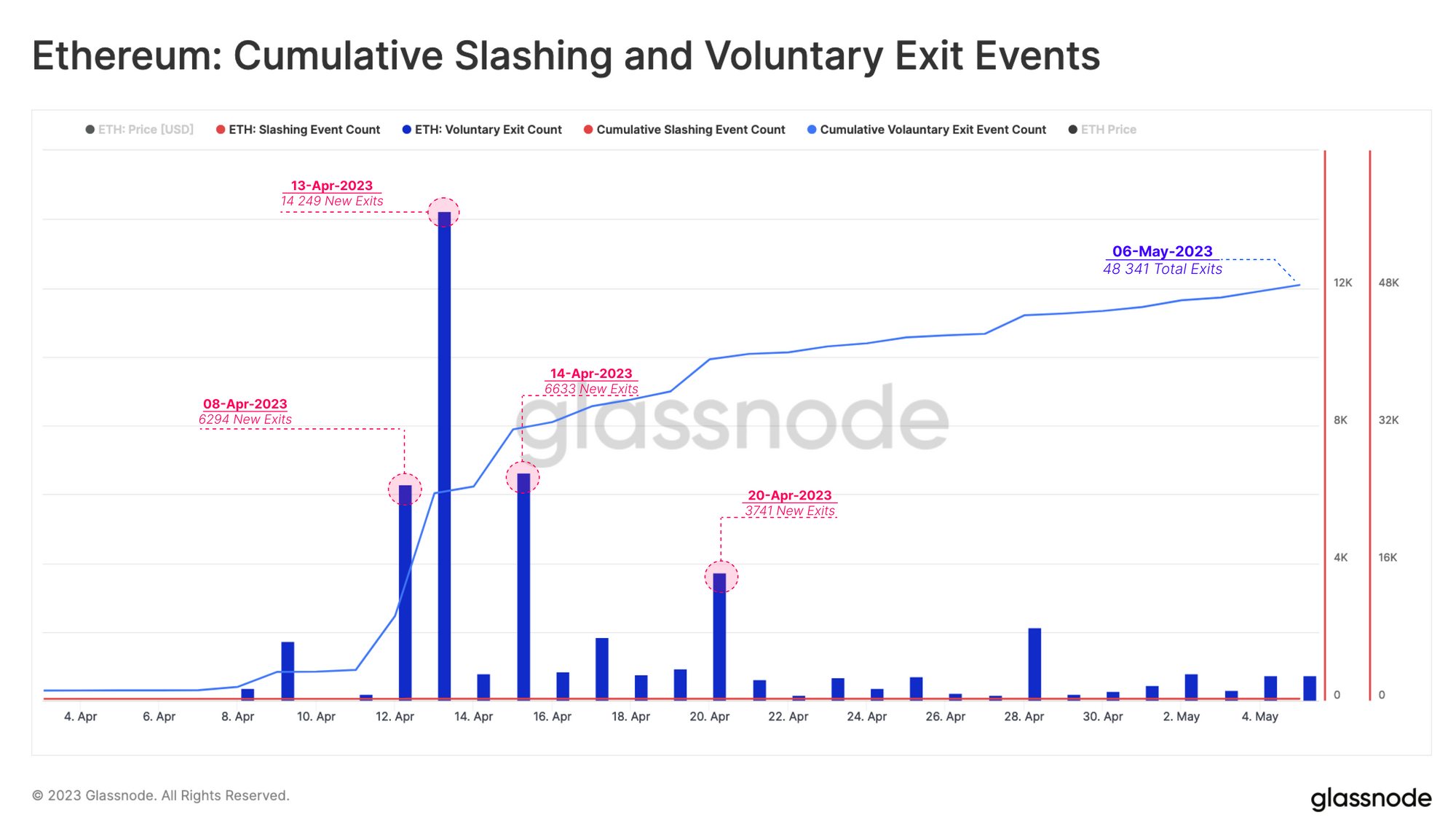

Currently, 48,341 validators are left, totaling 1.55M ETH ($2.93B). The day after the Shanghai/Capella upgrade, 14,249 validators left, the largest daily count. Exit events decreased quickly and leveled off to 300-700 daily. 11 validators were slashed after the update due to human error by a node operator of Lido, a liquid staking provider.

The report indicates that withdrawing staked ETH funds for Proof-of-Stake did not greatly affect the Ethereum market. The Ethereum market appears to have remained largely stable despite withdrawing these funds

The report confirmed the accuracy of its expectations. The Shanghai sell-side pressure did not cause a significant increase in daily trade volumes. Nevertheless, the Glassnode report’s conclusion provides insight into the technical mechanisms of Proof-of-Stake. Additionally, it also provides the history of development in the staking industry.

According to the report:

Overall, the results of the analysis suggest that the mechanics of Proof-of-Stake for both incoming and exiting validators have played out as intended, with Ethereum’s consensus mechanism remaining stable throughout the process. This is likely to de-risk longstanding engineering challenges, with net positive effects for both the security of the network, and the economy built upon it.