Introduction

Staking cryptocurrency is an increasingly popular method for earning passive income in the crypto space. This guide will walk you through the essentials of staking, helping you understand how it works, its benefits, and how to get started.

What is Staking?

Staking involves participating in a proof-of-stake (PoS) network by locking up a certain amount of cryptocurrency to support the network’s operations, such as validating transactions. In return, stakers earn rewards, typically in the form of additional tokens.

Benefits of Staking

- Passive Income: Earn regular rewards without needing to trade actively.

- Network Support: Contribute to the security and efficiency of the blockchain.

- Lower Energy Use: PoS is more energy-efficient compared to proof-of-work (PoW) systems like Bitcoin.

Staking is a viable way to earn passive income while contributing to the crypto ecosystem. By understanding the basics and choosing the right approach, you can effectively participate in staking and reap its benefits.

How to Stake Cryptocurrency

- Choose a PoS Coin: Popular options include Ethereum 2.0 (ETH), Cardano (ADA), Polkadot (DOT), and Solana (SOL).

- Select a Staking Method:

- Exchanges: Platforms like Binance, Coinbase, and Kraken offer staking services.

- Wallets: Use dedicated wallets such as Trust Wallet or Ledger Live.

- Staking Pools: Join a pool to combine resources with other stakers.

- Set Up Your Wallet: Ensure your crypto is stored in a wallet that supports staking.

- Stake Your Coins: Follow the platform’s instructions to lock your tokens and start earning rewards.

Risks and Considerations

- Lock-up Periods: Some staking methods require locking your assets for a specified period.

- Market Volatility: The value of staked tokens can fluctuate.

- Platform Security: Choose reputable platforms to mitigate risks of hacks or fraud.

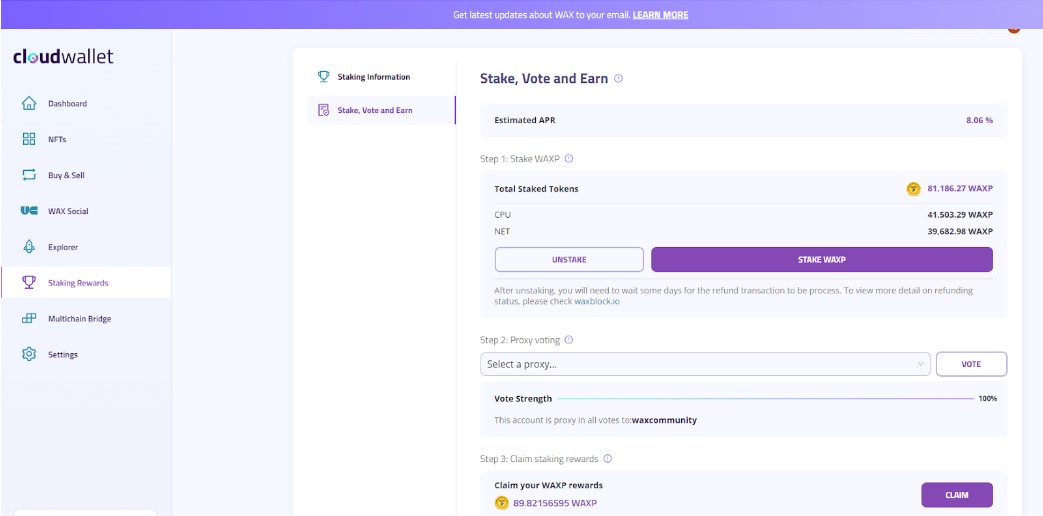

An example: Staking WAXP – Our Guide

Overview of WAXP

WAX (Worldwide Asset eXchange) is a blockchain platform specializing in virtual items and collectibles trading. Known for its environmental sustainability, WAX uses a delegated proof-of-stake (DPoS) consensus mechanism, significantly reducing energy consumption compared to traditional proof-of-work systems. WAXP tokens are the native cryptocurrency of the WAX blockchain, enabling transactions, governance, and staking.

WAX also features dedicated NFT marketplaces, hosting official collections such as Funko NFTs, which can be exchanged for physical collectibles.

How to Stake WAXP

- Set Up a WAX Wallet:

- Create a WAX Cloud Wallet to securely store your WAXP tokens.

- Acquire WAXP Tokens:

- Purchase WAXP on exchanges like Binance or Huobi.

- Stake Your WAXP:

- Visit Staking Rewards to access the staking calculator and explore staking options.

- Use your WAX Cloud Wallet interface to stake your tokens and begin earning rewards.

The current APR of WAXP is around 8%.

How the WAX staking platform looks: