United States-based spot Bitcoin (BTC) exchange-traded funds (ETF) recorded $563.7 million in total net outflows on March 1 — the largest since the funds began trading on January 11 — according to data from Farside Investors. These outflows coincide with a 10.32% BTC price decrease over the past week.

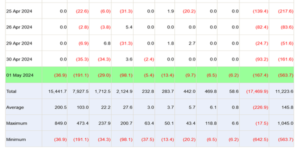

Fidelity’s Wise Origin Bitcoin Fund (FBTC) saw the largest net outflows among the ETFs, with more than $191 million moving out of the fund. Meanwhile, nine other BTC ETFs witnessed a combined $526.8 million in outflows. The Hashdex Bitcoin ETF (DEFI) was the only fund that didn’t record any flows, as per Farside Investors data.

The Grayscale’s Bitcoin Trust (GBTC) took the second spot with outflows of $167.4 million. Ark Invest’s ARKB saw $98.1 million in daily net outflows, marking the third-largest outflows of the day, followed by BlackRock IBIT’s $36.9 million and Bitwise BITB’s $29 million. Investors have withdrawn approximately $1.2 billion from the ETFs since April 24. As of Wednesday, the cumulative net inflow for the 11 ETFs reached $11.2 billion.

The hype surrounding spot BTC ETFs has diminished. In April, net monthly outflows amounted to $343.5 million, marking the end of their three-month inflow streak. Grayscale’s GBTC experienced the highest outflows in April, with approximately $2.5 billion leaving the ETF.

Bitcoin ETFs Still Operating Smoothly: Analysts

In a March 2 post on X, James Seyffart, an ETF analyst at Bloomberg, emphasized that the BTC ETFs are still “operating smoothly” overall, and inflows and outflows are part of the ETF lifecycle.

Should add — these ETFs are operating smoothly across the board. Inflows and outflows are part of the norm in the life of an ETF.

— James Seyffart (@JSeyff) May 2, 2024

Echoing this sentiment, Nate Geraci, president of investment advisor The ETF Store, emphasized that such fluctuations are normal for ETFs. He compared it to outflows from traditional assets like gold ETFs, noting that the metal’s prices have surged by 16% year-to-date despite significant outflows. This year, the iShares Gold ETF and SPDR Gold ETFs have witnessed outflows of $1 billion and $3 billion, respectively.

Further, he added:

“So, iShares Bitcoin ETF has first day of outflows ($37mil). This is what ETFs do. Inflows don’t go up in straight line.”