Morgan Stanley, one of the largest investment banks in the United States, is exploring the possibility of expanding its bitcoin exchange-traded fund (ETF) offerings by allowing its approximately 15,000 brokers to recommend these products to customers. According to a report from AdvisorHub, this potential move comes as the firm aims to tap into the growing demand for cryptocurrency investments.

Currently, Morgan Stanley offers Bitcoin ETFs on an unsolicited basis, meaning customers must approach their advisors independently to express interest in investing. Enabling advisors to recommend these products actively could broaden the firm’s customer base, although it would also expose itself to additional liability.

Brokerage Firms Simplify Bitcoin ETF Access for Clients

According to knowledgeable sources, Morgan Stanley is presently working on the so-called pre-work behind the design. This involves setting parameters for invited bids based on, among other things, client risk and limiting allocations and trading frequency.

Previously, major brokerage firms like Merrill Lynch, Wells Fargo, and Morgan Stanley have been running unsolicited spot Bitcoin ETFs. In other words, a customer had to call their financial adviser to make any transaction. The ability of brokers to offer spot Bitcoin ETFs would streamline matters for clients interested in investing in digital currencies.

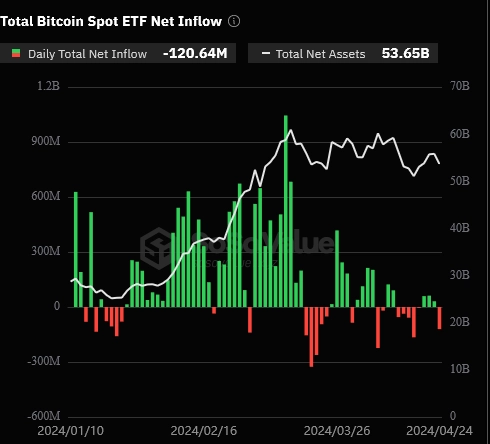

These moves suggest a growing popularity of spot Bitcoin ETFs launched only in January. Since their approval, these ETFs have attracted significant inflows, with U.S.-traded spot bitcoin ETFs from major financial institutions amassing a cumulative net inflow of $12.29 billion and over $53.6 billion in assets under management as of Wednesday, according to SoSoValue data.

Morgan Stanley Embraces Bitcoin ETF Amid Investment Shift

Morgan Stanley’s anticipated Spot Bitcoin ETF investment will demonstrate that cryptocurrencies are becoming more widely accepted and integrated into traditional financial systems. As a major brokerage firm, Morgan Stanley’s support would legitimize digital currencies, drawing more investors to the asset class.

Morgan Stanley’s consideration of allowing its advisers to recommend spot bitcoin exchange-traded funds represents a significant step forward. It shows how perspectives on investing in digital currency have changed over time. Such a move might make it easier for individuals who want exposure to this burgeoning universe of virtual assets.

Furthermore, they wouldn’t have to go through too much trouble or inconvenience themselves with it. This could be seen as an indication of the interest shown towards these types of investments. Despite initial skepticism, it proves their worth for adoption by mainstream finance players, including Morgan Stanley.

Related Reading | US Prosecutors Seek 36 Months’ Jail for Binance Founder Zhao