Uniswap, one of the top decentralized crypto exchanges (DEX), announced that it would be “fighting” an enforcement notice issued by the United States Securities and Exchange Commission (SEC) in a move that shook the DeFi industry. Upon receiving a Wells notice from the SEC, Uniswap CEO Hayden Adams said,

“I’m not surprised. Just annoyed, disappointed, and ready to fight.”

When a Wells notice is issued, the SEC usually takes enforcement action on individuals and companies. It’s important to note that this is not the first time an entity related to crypto has been under such scrutiny; even Coinbase received a Wells notice before it began its ongoing legal fight.

Crypto Backs Uniswap for DeFi Defense

Uniwap’s Chief Legal Officer Marvin Ammori responded to this notification by stating that the Uniswap Protocol, web app, and wallet were not securities exchanges or brokers according to their legal definitions. He referred to SEC v. Coinbase, where a judge had ruled against the commission. He emphasized that crypto wallets were still not considered brokers even if those tokens were considered securities.

4/ The Uniswap Protocol, web app, and wallet don't meet the legal definitions of securities exchange or broker

Just weeks ago, the judge in SEC v. Coinbase dismissed the claim that crypto wallets were brokers – *even if* the tokens at issue were securities.

— Marvin Ammori (@ammori) April 10, 2024

Numerous industry players support Uniswap’s battle to protect DeFi territories. In particular, Paul Grewal, the legal head at Coinbase, poured cold water on the SEC’s step towards Uniswap. Paul referred to the recent Coinbase Wallet dismissal from the SEC case to illustrate how the SEC cannot say that Uniswap is a broker.

Sometimes you have to laugh or else you'll cry. Question: how can you square the @SECGov's claim that @Uniswap acts as a broker with the Court's ruling against the @SECGov just a handful of days ago? Answer: you can't. https://t.co/K42aKw5YZc pic.twitter.com/OcegMnDWVu

— paulgrewal.eth (@iampaulgrewal) April 10, 2024

Nevertheless, Uniwanp’s COO, Mary Lader, stated, “Uniswap represents progress within the financial system—whether the SEC admits it or not.” Polygon CEO Marc Boiron also praised Uniswap’s determination: ‘I think that Uniswap Labs will take on the SEC, and I want to say how much respect I have for this team who are ready to take on this.’

Uniswap is a leading DEX that started on Ethereum but has expanded into several other chains, including the BNB Chain. According to DefiLlama data, Uniswap’s locked value total (TVL) stood at $6.2 billion, which indicates users’ trust and belief in this protocol. However, some users were scared away by regulatory notice.

UNI Plummets by Over 15% as Bearish Positions Rise

According to CoinMarketCap Data, UNI was down 16% and dropped from $11 to below $10 within hours after the notice. It traded at $9.14 as of the time of writing.

The intelligence data platform Santiment showed that the overall weighted sentiment turned negative (blue line). This indicates that social networks were bearish on the token. Besides, active addresses spiked (yellow) alongside supply on exchanges (red), indicating more users moved UNI holdings to exchanges for sell-offs.

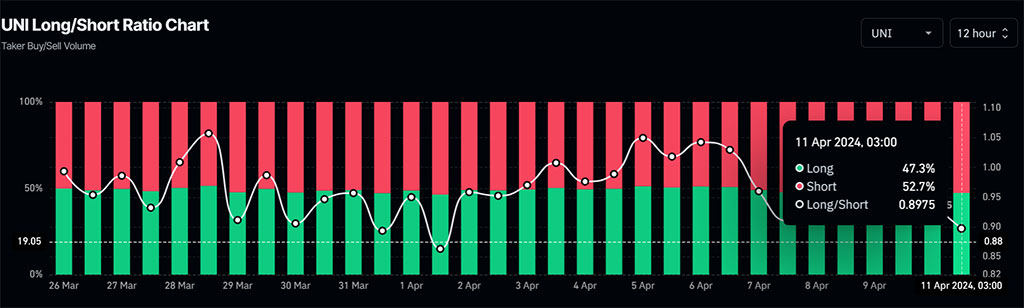

Furthermore, CoinGlass reported a spike in bearish bets against UNI in the derivatives market, with shorting activity dominating at 52% in the 12-hour timeframe. The crypto community watches closely as Uniswap prepares for a legal battle with the SEC. They recognize this confrontation’s implications for the broader DeFi ecosystem and the regulatory landscape governing cryptocurrencies.

Related Reading | SEC Postpones Bitwise and Grayscale Bitcoin ETF Decision