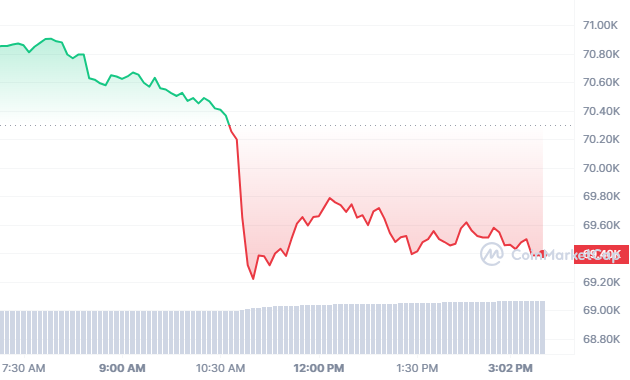

Bitcoin is consolidating near an all-time high and historically precedes explosive moves. The current pattern suggests the potential for significant upward momentum. Bitcoin’s price today is $69,395.14, with a 24-hour trading volume of $25.34B and a market cap of $2.65T. The BTC price increased 1.25% in the last 24 hours and surged by almost 6% over the last week.

Many crypto analysts are positive about future movements in Bitcoin seeing more upward pushes. Among these analysts, crypto analyst Ash Crypto expressed optimism about where BTC prices might go. Bitcoin is trading just below $74k, its recent all-time high.

Unlike 2020, when Bitcoin experienced a similar event and surged by 200% within three months of surpassing its previous peak, Ash Crypto expects a similar outcome. He claims that we are currently in an accumulation phase and predicts that there is possibly a rise of about $74k with an outside possibility of reaching $100k.

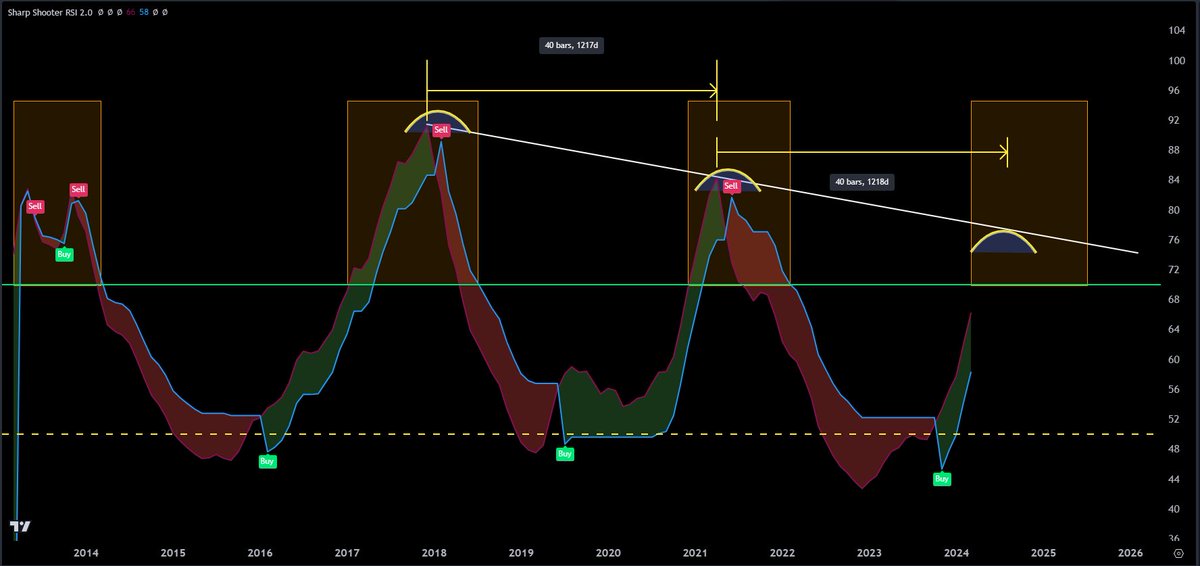

Analyzing the monthly Relative Strength Index (RSI) chart for Bitcoin, Jesse Olson suggests that there can still be a strong upward trend for 3-5 more months up to April, May, June, July, or August. Although Olson admits two waves could occur simultaneously, he highlights how important it is to get through the first wave.

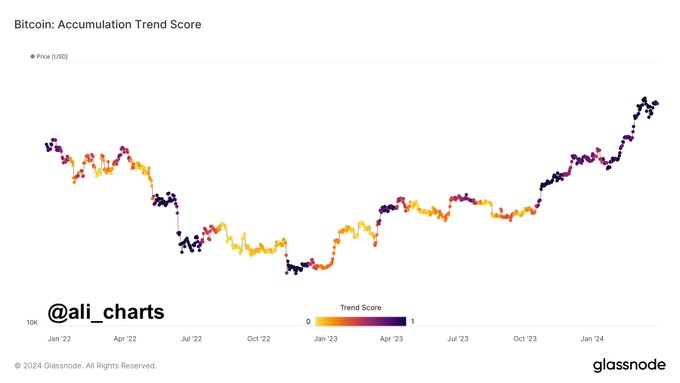

Additionally, Ali Martinez, a well-known crypto analyst, emphasizes Bitcoin’s long-term accumulation power during its consolidation stage close to the historical highs. This indicates continued buying interest among investors and the potential for prices to go up further.

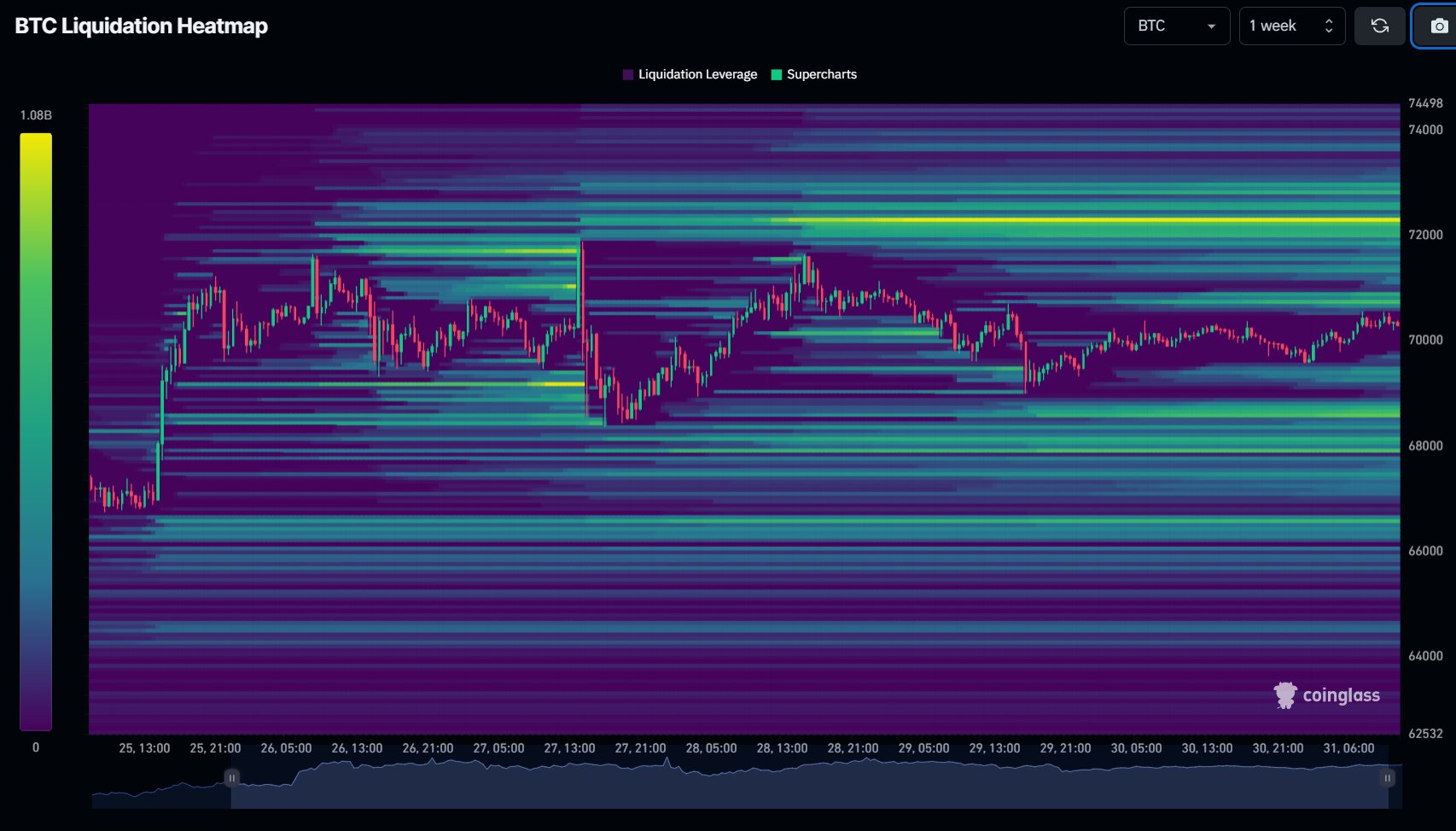

Navigating Bitcoin (BTC) Liquidation Strategy

Bitcoin holds around $70,000 for about one week, so the market is poised for a dynamic shift soon. Imagine a situation where bears face their judgment day; bull reigns, and bears lose all their positions.

Meantime, shorts get squeezed by the relentless upward pressure. Dedicated long-term hodlers survive as winners through this battlefield, getting their faithfulness compensated amid the turmoil.

Such resilience and optimism reverberate throughout the cryptocurrency community. Analysts like Crypto Rover indicate that Bitcoin’s trajectory resembles the ebb and flow of market liquidity. The liquidity around the $72,200 mark will indicate Bitcoin’s next move up in value.

However, there are also arguments to suggest that Bitcoin has not yet reached its final destination. This speaks to its resilience and indelible charm backed by solid accumulation metrics and encouraging market conditions. In wending their way through these troubled waters, investors count on the possibility of further hikes.

Related Reading | Tornado Cash Co-founder Seeks Dismissal of Money Laundering Charges