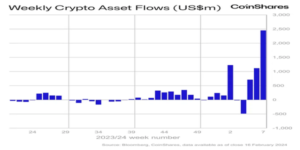

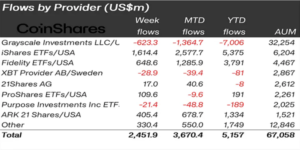

Crypto-derived exchange-traded products (ETPs) registered record inflows totaling $2.45 billion globally last week, according to CoinShares’ latest report. US-listed crypto ETPs, including the 10 approved spot Bitcoin ETFs, accounted for about 99% of the week’s inflows. This surge has propelled year-to-date inflows to digital asset investment products to a staggering $5.2 billion.

Combined with recent price increases, the assets under management (AUM) at crypto investment firms now stand at $67 billion. This marks the highest level since December 2021, CoinShares Head of Research James Butterfill wrote.

Spot Bitcoin ETFs Drive Inflows in the United States

Fidelity and BlackRock’s ETFs attracted nearly $2.3 billion of last week’s inflows. They received $648 million and $1.6 billion, respectively. Meanwhile, outflows from incumbent players have decreased significantly. Grayscale’s products, for instance, saw $623 million in weekly outflows.

The remarkable surge in net inflows, coupled with a decrease in outflows from incumbents, indicates increasing interest in the new US spot BTC ETFs, according to Butterfill. Last week, the total funds outflow from the Grayscale Bitcoin Trust (GBTC) since its conversion to a spot BTC ETF on Jan. 1 reached $7 billion.

Meanwhile, BTC gained over 4% between Monday, Feb. 12, and Friday, Feb. 16. At the end of the week, it was over $52,000, the highest since December 2021. According to the report, some investors are anticipating a price drop and added $5.8 million of inflows to short-Bitcoin products.

Besides the US $2.4 billion weekly inflows, Germany and Switzerland-based funds registered modest inflows of $13.3 million and $16.7 million, respectively. Meanwhile, Sweden experienced the largest regional outflows of $26.3 million.

Altcoins Also Gain Traction

Ether products also experienced comparatively minor inflows of $21 million and closed the week at approximately $2,800, a level not reached since May 2022. Avalanche funds saw inflows of $1 million, and Polygon and Chainlink products both added $900,000.

However, Solana investment products did not perform well, recording $1.6 million in outflows. Butterfill argued that the recent downtime of the network has dampened sentiment.