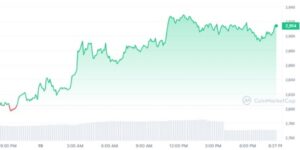

Ethereum (ETH) price crossed the $2,900 milestone on Feb. 19, but increasing trading activity across the ETH spot markets could push it even further. After gaining 15.5% last week, ETH has shown a cumulative rally of 25% over the past three weeks. It also started this week with a 3.4% increase and was hovering around $2,914 at the time of writing.

ETH Trading Volume Crosses $25B Milestone

On Monday, ETH trading volume rose to $26.7B, the highest since Jan. 11. Generally, an increase in trading volume is considered bullish for several reasons. Firstly, it indicates significant investor interest in the respective crypto. Heightened market liquidity allows investors to buy or sell at favorable prices without disrupting the upward price trend.

Bitcoin ETFs accumulated more than 17,000 BTC in the trading week from Feb. 12 to Feb. 16. If this trend persists, it could lead to a further increase in trading volume for Ethereum and other large-cap altcoins in the upcoming week.

Investors Moved Ethereum Worth $220M into Long-term Savings

The movement of Ethereum on exchanges since Feb. 16 indicates that investors are confident about another positive week ahead. The chart below shows that investors held 14,060,510 ETH on February 16th. However, they moved 80,222 ETH into long-term storage and staking contracts in the past 3 days, leaving only 13,980,288 ETH (worth 220M) in trading wallets as of Feb. 19.

A decrease in exchange reserves often affects asset prices positively, as it effectively causes a temporary reduction in market supply. The chart indicates that ETH’s price has increased since the exchange reserves began to drop rapidly in November last year. Reducing the market’s supply by such a large margin could further accelerate the rally if the market’s momentum remains strong in the week ahead.

Can Ethereum Hit $5,000?

Current technical patterns indicate the potential for Ethereum’s breakout to reach as far as the 78.6% Fibonacci level, approximately at $3,872. After crossing this mark, it could suppress the all-time high of $4,868, with a bullish target of $6,835.

If market conditions worsen, Ethereum might drop to around $2,300. However, indicators currently suggest that the bullish trend could continue throughout February.