Citigroup has collaborated with Ava Labs, other traditional financial institutions, and digital asset businesses to develop a proof-of-concept for tokenizing private equity funds. Although several legal and technical issues remain, Citi is confident that blockchain may change the game for private equity.

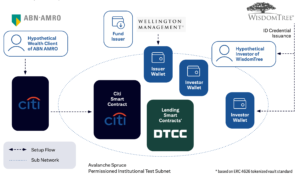

The project used simulated workflows in a private equity fund issued by Wellington Management. ABN AMRO played the role of the investor, while WisdomTree simulated the platform on the permissioned Avalanche Evergreen Spruce Subnet. The partners tested smart contracts to enforce distribution rules for a simulated fund.

It also validated identities provided by WisdomTree by its partners and worked with DTCC Digital Assets to use a private fund token as collateral in an automated lending contract. The resulting loan was then “subject to a haircut and collateralization ratio set based on the pool parameters.” The Citi report on the project stated:

“Intelligent applications supported with instant implementation can automatically allocate, fractionalize, and rebalance assets.”

Citi said tokenization unlocks value from standardization, automation, and improved operating models. However, several legal considerations remain open on the regulatory status of tokens, contractual rights, anti-money laundering, know your customer, and taxation.

Using the most” matured” identity standards will be crucial for private fund tokenization, and data flows should be secured as a fine balance between transparency and confidentiality. In addition, Citi said there was still work on technical areas such as ‘end-to-end data rails, end-to-end servicing workflow, and a tokenized cash leg to facilitate atomic settlement.’

Future Steps & Transformative Potential

Despite the work that remains to be completed, Citi concluded that blockchain technology, with its flexible on-ramp, could revolutionize private equity markets. This represents a path this bank has been down before. They have long been bullish on tokenized assets in general and private equity assets. They have previously referred to private equity assets as the “killer use case” for crypto.

Citi has worked with @Wellington_Mgmt, @WisdomTreeFunds, and @The_DTCC_DA to demonstrate how private assets could be tokenized and opened-up to new capabilities through the power of smart contracts and blockchain technology. Learn more here: https://t.co/Qr77KR1VNo pic.twitter.com/kf3G26Fjm6

— Citi (@Citi) February 14, 2024

Hedge fund Brevan Howard and alternative investment manager Hamilton Lane utilized the Libre protocol. They developed functions similar to tokenization on the Polygon network. WisdomTree and Wellington Management participated in an earlier project on Avalanche’s Spruce subnet.

The project aimed to test the use of blockchain in foreign exchange transactions. T. Rowe Price Associates and Cumberland also took part in the project. Citi Token Services blockchain launched in September. It is a solution to facilitate liquidity and automated trade finance options for its institutional customer base.

Related Reading | South Korea Ramps Up Crypto Exchange Scrutiny: Report