Bitcoin surged past the $50,000 mark on Feb 12th, 2024, and this remarkable spike coincided with heightened institutional demand and potential interest rate cuts. The imminent Bitcoin halving marks a significant departure from the conditions observed two years ago.

The last time #BTC was at $50,000:

– >50% of supply held by lettuce hands

– Terra/Luna running ponzi

– FTX selling paper BTC

– GBTC premium buyers getting rekt

– Precipice of fastest rate hike in history

– Super Bowl "crypto" ads#BTC at $50,000 today:

– 70% of supply held by… pic.twitter.com/yL4ZdiFyzJ— Mitchell 🇺🇸🚀 (@MitchellHODL) February 12, 2024

In December 2021, BTC had also reached $50,000 right before the crypto market collapsed. The bear market was driven by 11 consecutive Fed interest rate hikes, leading to major crypto institutions failing. An exodus of retail investors ensued, ultimately sending BTC to $15,800.

According to eToro analyst Josh Gilbert, macro conditions are much more favourable for risky assets like BTC. “We expect 4-5 rate cuts from the Federal Reserve in 2024, the fourth Bitcoin halving will further constrain supply, and we’re seeing billions flow into new Bitcoin ETFs in just a few weeks post-launch,” Gilbert explained.

Many investors anticipate Bitcoin halving in April, which will cut mining rewards in half and catalyses long-term price appreciation.

Bitcoin ETFs Drive Institutional Adoption, Retail Interest Lags

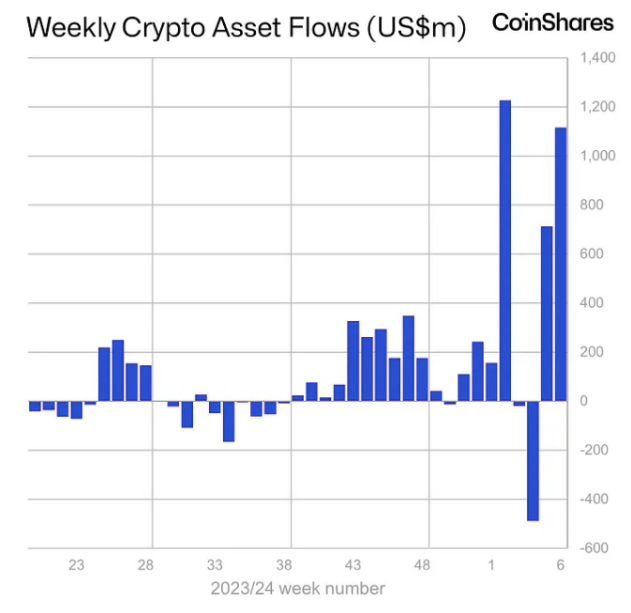

The sentiment is also improving around the launch of Bitcoin ETFs, signalling increased institutional adoption. A February 12th report from CoinShares showed BTC spot ETFs took in $1.1 billion in inflows last week – the largest 7-day haul since the funds debuted January 11th.

Meanwhile, retail interest remains muted, which analyst Will Clemente suggested could provide a more stable base for continued growth. In December 2021, a Google search for “BTC” scored 39, but current interest is just 19 – implying relatively low retail involvement.

Hovering around $50k and google search trends for "bitcoin" look like this lol pic.twitter.com/j0S4Cs1lgp

— Will (@WClementeIII) February 12, 2024

On February 11th, CryptoQuant CEO Ki Young Ju predicted BTC could reach $112,000 by 2024, partly propelled by spot ETF performance. With favourable macro winds at its back, BTC appears poised to continue its meteoric rise.

Bitcoin price today is $ 49,929 with a 24-hour trading volume of $ 66.07B and a market cap of $ 979.95B; the BTC price increased 4.18% in the last 24 hours

Related Reading | Bitcoin ETFs See Massive $403M Inflow Amid Price Surge