In recent weeks, the cryptocurrency market has witnessed a resurgence in prices, with Polkadot (DOT) experiencing an 8% increase over a three-week period.

Despite this positive movement, DOT was suffering from market volatility but still stood very strong over a weekly period, which suggests further highs.

So, by the current layout, Bitcoin’s bounce has swallowed the bounce of many of those alts, making it hard for them to fully recover. However, some analysts, including Michael van de Poppe, express confidence in the ability of alternative cryptocurrency ecosystems to grow.

Van de Poppe noted, specifically, the setup of higher lows for Polkadot on higher time frames, indicating a likely price target at $17 for DOT.

After the bounce from around the $6 level in late January, DOT has been struggling with volatility, though the buying volume has been gradually moving upwards, hinting at further bullish interest.

However, sustained growth depends on reclaiming key resistance levels, with indications pointing towards an imminent surge in volatility.

From a short-term perspective, DOT is displaying signs of forming a bullish pattern, with the potential for further upside if bullish momentum persists.

Nevertheless, caution is advised, as failure to surpass crucial resistance levels, such as the current key resistance level at $7.3, could lead to a swift downturn, potentially testing support levels at $6.6 and $6.

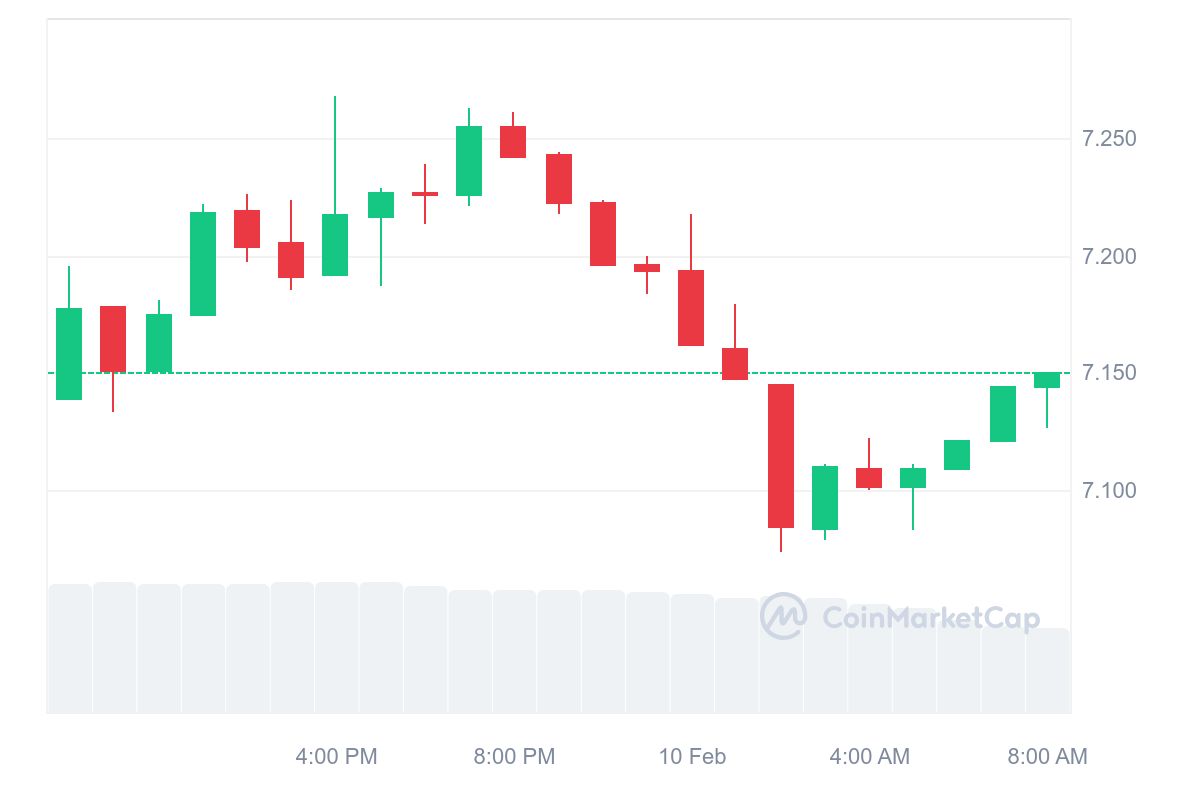

Polkadot (DOT) Short-term Price prediction

The current price of Polkadot stands at $7.16, accompanied by a 24-hour trading volume of $375.50 million. Its market capitalization sits at $7.07 billion. Over the past 24 hours, the DOT price experienced a slight decrease of -0.19%.

Recent forecasts from Changelly suggest a modest increase to $7.68 by February 11, 2024, with technical indicators reflecting a prevailing bullish sentiment. The Fear & Greed Index, with a score of 72, indicates heightened greed among investors.

As investors continue to monitor the cryptocurrency market for further developments, attention remains focused on Polkadot’s performance, with expectations of continued price movements in the days ahead.

Related Reading | Ethereum ETF’s Cash Creation Conundrum: Innovations and Concerns