As the cryptocurrency market undergoes a resurgence, meme coins, including Dogecoin (DOGE), are poised for a comeback in the upcoming month of February. Notably, the DOGE price trend is displaying signs of a swift reversal, catching the attention of investors and enthusiasts alike.

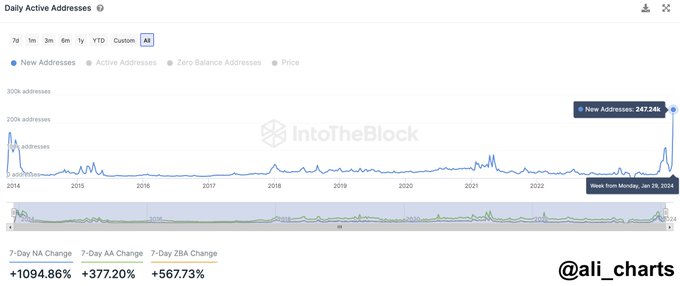

Crypto analyst Ali Martinez recently shared insights on the remarkable growth within the Dogecoin network. Over the past week, the number of new addresses has witnessed an astonishing surge, marking a staggering 1,100% increase.

According to the recent post on X, Martinez highlighted the unprecedented creation of 247,240 new DOGE addresses on January 29 alone, setting an all-time high. Additionally, if this sustained uptrend in network expansion continues, it could potentially have a positive impact on the price of Dogecoin.

Doge’s Price Swing: Hitting $0.082025 – What’s Next?

As of the latest available data, Dogecoin is currently trading at $0.081063, with a 24-hour trading volume of $1.03 billion and a market cap of $11.58 billion. Despite a slight 1.65% decrease in the last 24 hours, DOGE has managed to secure a 6% increase in the past week.

Furthermore, Changelly has released its most recent Dogecoin price forecast, suggesting a marginal 0.05% increase that could propel the value to $0.082025 by January 31, 2024. According to Changelly’s analysis of technical indicators, the prevailing market sentiment is bearish, with a Bearish score of 55% and a Fear & Greed Index registering at 55 (Greed).

However, considering the price fluctuations witnessed at the beginning of 2023, industry experts anticipate an average DOGE rate of $0.0827 in January 2024. In addition, the projected minimum and maximum prices will hover around $0.0816 and $0.0838, respectively.

Moreover, investors and enthusiasts closely monitor Dogecoin’s movements, eagerly awaiting to see if the meme coin will indeed “pop” and break through in the coming weeks. The surge in new addresses and the positive outlook from analysts indicate that Dogecoin may continue to be a focal point of interest in the cryptocurrency market.

Related Reading | Fidelity’s Spot Bitcoin ETF $208M Inflow Outpaces Grayscale Outflows