Cryptocurrency scams are on the rise, but they’re not always obvious to people who are new to this space. Because cryptocurrency isn’t regulated by governments or banks, it can be extremely easy for criminals to take advantage of people through slickly-produced websites and fraudulent advertising campaigns.

Even experienced investors have been targeted by these types of scams, so learning how they work can help you protect yourself from falling victim to them as well. Here are five common crypto scams you need to watch out for and how to avoid them.

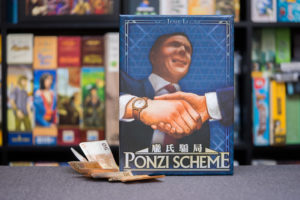

Ponzi Schemes & ICO Frauds

Ponzi schemes are a type of scam where the operator pays out older investors with newer investors’ money in order to create the illusion that they’re earning a profit. They’re named after Charles Ponzi, who made millions during the 1920s by swindling people out of their money.

The idea is to make it seem like you’re going to get rich quickly if you invest now. However, these scams always end up crashing, and no one gets anything back in the end.

In cryptocurrency, Ponzi schemes can be seen in ICOs (initial coin offerings) – companies will launch an ICO without any product or service but offer coins for sale on their website for as much as $1 billion each.

Then the company will say buy now, or you’ll miss your chance, so lots of people buy the coin from them before there’s anything to show for it. The company then claims they need more funds to develop this project which will take years, and use this opportunity to ask investors to give them more money. Once they have enough capital, they shut down the site and disappear with all of the cash.

Fake Exchanges

One of the most common scams is fake crypto exchanges. These sites typically use popular names like Coinbase, Binance, or Poloniex in their URLs and logos but are, in fact, not legitimate at all. They’ll try to trick you into thinking they’re an official site with a logo that looks similar to the real thing–and even a domain name that makes it seem like it’s one of those sites. Many people have been caught out by these types of sites and lost money as a result.

To avoid this:

- Make sure you do your research and double-check before entering any personal information on any site you’ve never heard of before.

- Keep an eye out for typos or grammatical errors in their messages to you: mistakes like You just withdrawed when the site says You just withdrew are often a sign that something fishy is going on.

- Remember, too, that cryptocurrency exchange sites will only ask for account information after making the initial deposit; scammers won’t need your account number until then, so don’t give it to them! If you notice anything suspicious, stop communicating with them immediately and report the incident.

Fake Wallet Downloads: Another scam is downloading what seems like a wallet app but really isn’t. The idea behind this type of scam is that once installed, and the malicious app has access to your phone’s data which means all your sensitive data could be compromised if downloaded from another source. If you’re looking for an app to store your crypto offline, there are plenty available–just Google it!–but be careful about where you download from.

To avoid this type of scam, always look closely at where the download link leads before clicking on anything! And if something feels off about it, cancel the download and find another way to get what you want.

Pyramid & Multi-Level Marketing Schemes

Pyramid and multi-level marketing schemes are also some of the most common crypto scams. Here’s how they work: you’re typically invited to join by someone you trust, like a friend or a family member. You make an investment, usually in cash or cryptocurrency, and then you recruit others who also invest in the program.

As more people are recruited into the scheme, those at the top of the pyramid reap all of the profits, leaving those lower down on the ladder with nothing. These schemes can be very difficult to spot because they appear legitimate. The key is to do your research – if it seems too good to be true, it probably is! Look for details about the company behind the scheme, its business model, and any online reviews.

Also, look for red flags in the language that might indicate it’s a scam. One big one is using phrases like invest now, or this offer won’t last long. If something feels off about what you’re reading, take time to investigate before making any decisions about whether or not to invest. Be especially wary if the only evidence you see to support a company is its own social media posts.

Finally, remember that just because something says it’s decentralized doesn’t mean it isn’t a scam. Scammers know that many new investors have heard about Bitcoin but don’t understand what decentralized means, so they may try to trick you into thinking these currencies are safer than traditional ones.

However, there have been cases where hackers took over decentralized exchanges and stole customer funds.

Pump And Dump Scam

Another common scam people fall for is a pump and dump. It involves buying shares in an altcoin, artificially inflating the price, then selling those coins at a higher price. The person who set up the pump will often use social media to create hype and encourage investors to buy before they sell, which results in their shares increasing dramatically in value – but only for a moment.

When the share prices begin dropping, investors panic and sell their shares at any cost, which further drives down the market. The scammers then profit by buying back their own coins at a lower price than they sold them on, while regular investors get taken advantage of. Make sure you research every coin carefully before investing, so you don’t fall prey to this scam.

Check reviews online, look up how long the company has been around, talk with others in the crypto community to get their input, and be wary if there’s no information available about where the company is located or who owns it.

In addition, remember that it’s not necessary to purchase whole coins; most cryptocurrencies are divisible into fractions, so you can spend as little or as much as you want. Lastly, never invest more money than you can afford to lose because once your funds are gone, they’re gone for good.

Be sure to read up on different types of cryptocurrencies so you can better identify scams from legitimate projects!