The U.S. Securities and Exchange Commission (SEC) is gearing up for a pivotal decision on Ark Investment’s application for a spot bitcoin (BTC) exchange-traded fund (ETF), with a deadline set for January 10, 2024. Ark Investment, a prominent Florida-based asset management firm, recently updated its S-1 filings with the SEC on December 2, 2023, as disclosed in recent records.

Ark’s Bitcoin ETF: Decision Day Approaches

Notably, Ark’s application is the second-nearest to the finish line, trailing behind Grayscale’s final deadline of January 1, 2024. The financial regulator had initially delayed the decision and sought public opinion on the vulnerabilities associated with spot BTC ETFs following the rejection of multiple applications. SEC Chair Gary Gensler and the commission moved the decision date forward by a maximum of 240 days.

However, Cathie Wood is anticipating a positive response from the SEC after the approval decision was delayed in mid-August. Bloomberg analysts estimate the odds of the SEC approving spot ETFs at over 60%.

The proposed Ark21Shares Bitcoin ETF, a collaboration between Ark Investment and 21 Shares, aims to track the performance of Bitcoin. It will utilize data from various crypto exchanges, measured by the S&P Bitcoin Index, and is slated to be listed on the Cboe BZX Exchange.

Ark’s Market Moves: Recent Sales & Bullish Sentiment

In an interview with the Wall Street Journal, Cathie Wood expressed that the SEC’s approval would provide spot bitcoin ETFs with a “seal of approval that it didn’t have before.” She also emphasized her bullish outlook on BTC.

Recent transactions reveal Ark Investment’s strategic moves in the market. On Friday, the asset management firm offloaded approximately 102,672 Grayscale Bitcoin Trust (GBTC) shares, generating around $3.6 million. Additionally, Ark sold over 200,000 COIN shares on December 5.

Despite these sales, GBTC maintains the third-largest position in ARK Next Generation Internet ETF (ARKW), constituting about 8.36% of the ETF’s total portfolio. These transactions highlight Ark’s bullish sentiment, characterized by accumulating shares during market downturns and selling during upturns. BTC’s price has reflected this positive trend, experiencing a notable upward momentum in the final quarter of 2023.

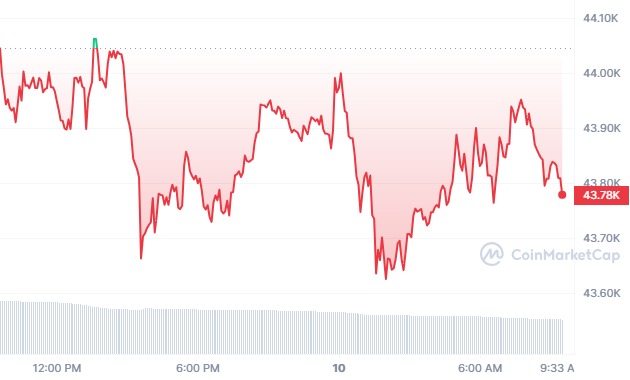

At the time of reporting, Bitcoin is trading at $43,784, marking a more than 16% increase from its value a month ago. The market awaits the SEC’s decision, which could significantly impact the trajectory of bitcoin ETFs in the U.S. market.

Related Reading | Bitcoin Soars: Record TVL and NFT Surge