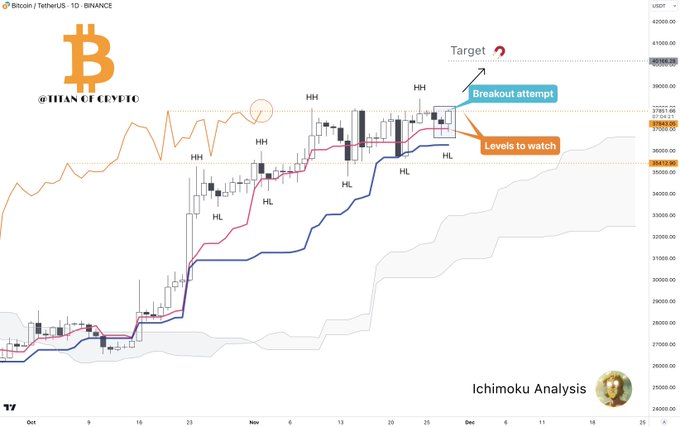

Bitcoin appears to be gearing up for a significant breakthrough, with analysts predicting a potential surge to $40,100. A recent X post by a prominent crypto analyst hinted at this bullish momentum, emphasizing the resilience of Bitcoin’s support at the $37,000 level.

#Bitcoin loading to $40,100. 🔃📈

As expected, Tenkan 🔴 at around $37k held the price. #BTC bounced from it and printed a new higher low on the daily timeframe.

Watch the $37.8k level. Bitcoin's trying to breakout from it at the moment. When it gives in Bitcoin will… pic.twitter.com/uDmrJCkPSU

— Titan of Crypto (@Washigorira) November 28, 2023

As the market witnessed the anticipated support from the Tenkan line at around $37k, Bitcoin managed to bounce back, marking a new higher low on the daily timeframe.

Therefore, analysts are now closely monitoring the $37.8k level, anticipating a breakout that could propel Bitcoin to the $40,100 mark. The analyst emphasized that the more uneventful the current market appears, the more explosive the potential upward movement could be.

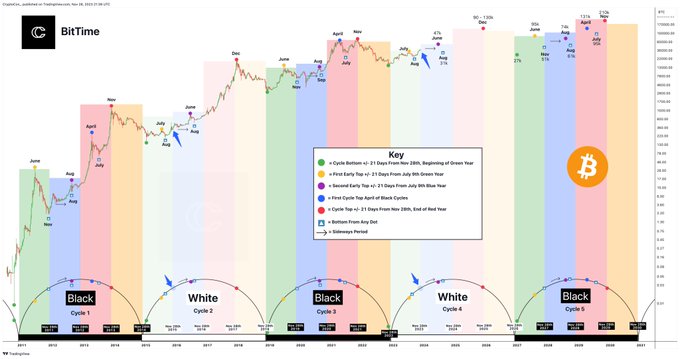

Bitcoin: BitTime Model Aligns With Cycle 2 (2015 – 2018)

Adding to the optimistic sentiment, CryptoCon, a Bitcoin Technical Analyst, shared insights from another model known as BitTime. This model suggests that Bitcoin will likely follow a cycle closely mirroring cycle 2, observed between 2015 and 2018. Notably, the model accurately predicted significant dates, demonstrating the potential cyclical nature of Bitcoin’s price movements.

Another model has also turned a new "blue" leaf, BitTime.

According to this model, #Bitcoin will follow a cycle very close to cycle 2 (2015 – 2018).

The Black Cycles (1 and 3) proved just how close this can be… with all significant dates lining up to the month.

The double… pic.twitter.com/pBAT3hhHDE

— CryptoCon (@CryptoCon_) November 28, 2023

However, the analyst cautioned against expecting an exact replication of Bitcoin’s behavior during the 2015-2018 period, emphasizing that such predictability would make the market too easy to forecast. Drawing parallels, the tweet highlighted that in 2015, BTC experienced a rise leading into December, prompting speculation about a potential repeat performance this year.

Even in the event of a correction from the current point, analysts remain optimistic about the broader trajectory of BTC’s value in the coming months. In addition, a sideways period is expected after the completion of the recent rise, aligning with the typical pattern observed in each cycle.

Moreover, the analyst provided a forward-looking perspective, suggesting that a potential early top could manifest in June, reaching an estimated $47,000.

Further predictions indicate a bottom from this rise in August, based on insights from the previous white cycle. If this cycle’s performance remains consistent, the analyst envisions a singular top in December 2025, projecting a price range of $90,000 to $130,000, with a preference toward the higher end.

Currently, BTC is trading at $37,946.80, boasting a 24-hour trading volume of $19 billion, indicating a notable 13.15% increase. Additionally, over the past 24 hours, the price has surged by 2.71%, contributing to an almost 5% gain in the weekly chart.