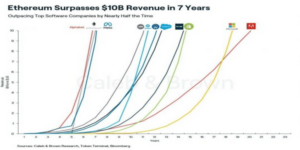

Ethereum, the leading smart contract platform, has surpassed $10 billion in revenue in just seven years, according to a new report by crypto brokerage firm Caleb & Brown. Excluding Alphabet, this rapid growth outperforms tech giants, such as Meta (formerly Facebook) and Microsoft, which took 7.5 and 19 years, respectively, to reach similar revenue levels. Alphabet took approximately six years to achieve this milestone, as per the report.

Launched in 2015, Ethereum has achieved this remarkable performance due to various sources of income and powerful network activities. These activities encompass NFT trading, decentralized finance transactions, and crypto transfers. Ethereum generates its main revenue from transaction fees, measured in gas. The network imposes varying gas fees depending on the complexity of the transaction.

However, Ethereum has experienced a revenue decline of over 77% compared to the previous year due to the broader downturn in the cryptocurrency market. According to data from Token Terminal, the decentralized network has generated $1.7 billion in revenue so far this year.

Besides finance, the broader acceptance of Ethereum in the field of gaming and art played a significant role in its latest achievement. This acceptance has empowered the implementation of more sophisticated protocols across diverse industries, distinguishing it from its counterpart, Bitcoin (BTC). According to a recent assessment by VanEck, Ethereum’s network revenue could potentially increase from $2.6 billion per year to $51 billion by 2030, assuming sustained adoption.

At the time of writing, Ethereum’s native currency, ETH, is trading at $1,615, and the network has a market cap of over $191 billion.

Ethereum’s Average Transaction Fee Plummeted

According to blockchain intelligence firm Santiment, transaction fees on the Ethereum network have dropped to $1.15 per transaction. This marks the lowest point since December of last year. Following this decline, Ethereum has become a more cost-effective option for users looking to engage with its versatile platform.

This change aligns with a reduction in on-chain activity. However, the firm stated that the decrease in activity shows a positive development for the network.

Santiment added:

“Historically, we see utility begin rising as ETH becomes more affordable to circulate. Increased utility can then lead to recovering market cap levels.”