Bitcoin, the largest cryptocurrency in the world based on market capitalization, has attracted significant interest from financial institutions. These institutions are now preparing to introduce exchange-traded funds (ETFs) that track and reflect its value.

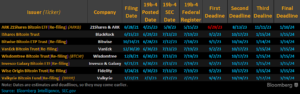

ETF analyst James Seyffart tweeted several significant dates regarding the race for approval. These include deadlines for ARK 21Shares Bitcoin ETF, BlackRock’s iShares coin Trust, Bitwise’s Bitcoin ETF, Van Eck Bitcoin Trust, Wisdomtree BitcoinTrust, and more.

By popular demand — Here's the most updated list of dates to watch for the current #bitcoin ETF Race.

(Grayscale is also sorta in this race via their lawsuit against the SEC. Judges should issue a ruling there within the next month or two) pic.twitter.com/agJj82XanO

— James Seyffart (@JSeyff) July 25, 2023

ARK 21Shares has a second deadline on Aug. 13, which could give it an edge in the race. Bitwise has its first deadline on Sept. 1. A large group of issuers, including iShares Coin Trust by BlackRock and others, share the first deadline of Sept. 2.

They may potentially face a collective judgment day by the SEC, which could have significant implications. Additionally, it is worth noting that Valkyrie Bitcoin Fund has a deadline on September 4th, slightly lagging behind its counterparts.

Bitcoin ETFs Are In High Demand

Investors have shown keen interest in an ETF linked to Bitcoin. Such investment opportunities would offer a regulated and convenient method of entering the cryptocurrency market, eliminating the need to navigate crypto wallets and exchanges.

However, there is no guarantee that any of these proposals will get approved by the SEC. The SEC holds the authority to either delay or reject any application, which has been their practice on numerous occasions.

Interestingly, BlackRock, a prominent name on the list, surprisingly filed their application last but is now expecting to receive its response alongside other applicants who submitted much earlier.

According to Seyffart, BlackRock’s timing may not be as late as it appears. Although their prospectus filing dates might be later, all other filings had already been rejected by the SEC in the 19b-4 process once or even multiple times.

Furthermore, Grayscale’s GBTC, a popular Bitcoin investment product, is emerging as another contender for ETF status. Currently involved in a lawsuit against the SEC, GBTC awaits a decision from judges in the next month or two.

Related Reading | The Resurrection of a Dormant Bitcoin Wallet: $31 Million Worth of Mystery

Some crypto supporters speculate that if GBTC triumphs over the SEC in this lawsuit, it could become the first Bitcoin ETF. However, Seyffart advises caution by pointing out that even if Grayscale emerges victorious, there may still be obstacles preventing its conversion to an ETF.