Cryptocurrency trading on decentralized finance (DeFi) platforms is where mythical unicorns and animated sushi clash for control of liquidity. Uniswap, one of the leading DeFi protocols for exchanging tokens on Ethereum, has achieved remarkable success.

A few motivated developers have released open-source software, allowing anybody to create their version. This is what SushiSwap did in particular.

SushiSwap is a new version of Uniswap, with the addition of an enticing SUSHI token. It gives holders power over the protocol and offers them part of the collected fees. Let us look at how we can invest in this promising asset!

What Is Sushi?

Sushi is a widely accepted type of cryptocurrency that operates on various blockchain networks. It is the main form of currency on SushiSwap, a decentralized exchange where people trade cryptocurrencies directly.

Holders of SUSHI have the right to participate in decision-making and receive a share of fees paid to the protocol. Simply put, the community that holds SUSHI owns the protocol.

What has caused all the excitement? The DeFi philosophy is closely tied to community governance. The rise of liquidity mining (yield farming) as a legitimate way of distributing tokens has led to many new token launches.

What Is SushiSwap?

SushiSwap is a decentralized exchange built on the Ethereum blockchain by anonymous developers known as Chef Nomi and 0xMaki. It started as a clone of the popular exchange, Uniswap.

SushiSwap is a copy of Uniswap, allowing users to exchange tokens without intermediaries. The creators of SushiSwap made it stand out by incorporating new features, such as liquidity mining and governance, through its token, SUSHI.

Holders of the SUSHI token, the main currency on the SushiSwap platform, have the right to vote on future decisions and receive a portion of the trading fees and staking rewards.

How Does SushiSwap Work?

Unlike regular exchanges that need an order book and an intermediary, SushiSwap uses an Automated market maker (AMM) that allows direct peer-to-peer trading. It is a unique way of trading which is fully decentralized.

Trades on AMM platforms, such as SushiSwap, do not require a go-between or an order book because liquidity pools are used. Users make deposits in the form of a specific token, and these funds are managed by smart contracts for trading purposes.

Since its launch in 2020, SushiSwap has greatly progressed in developing new DeFi tools. It’s no longer just a platform for traders but a one-stop shop for yield farming, staking, lending, and borrowing, all accessible through the same app.

What Can You Do On SushiSwap?

SushiSwap started as a decentralized exchange (DEX) but has since evolved into a comprehensive platform with various investment options. In addition to the DEX, SushiSwap also provides users with various tools and services through its BentoBox dapps, such as:

SushiSwap Exchange

SushiSwap is a platform allowing users to exchange any ERC20 token for another. It operates through liquidity pools supplied by Liquidity Providers, who deposit their tokens in exchange for SLP tokens.

Users who trade on the platform pay a 0.3% fee divided between the Liquidity Providers and the xSushi holders. 0.25% of the fee goes to the Liquidity Providers, increasing the value of their staked tokens.

The remaining 0.05% of the fee is collected by the SushiBar pool, which then distributes the collected funds to xSushi holders. When these users withdraw their xSushi, it will be worth more than receiving it through distribution.

SushiSwap’ Kashi and SushiBar Feature

SushiSwap has grown to cover multiple scalability networks and competing chains, including Arbitrum, Polygon, Avalanche, Gnosis, Harmony, Celo, Fantom, Moonriver, BSC, Fuse, Telos, OKExChain, Heco, and Palm.

Despite this, the majority of SushiSwap’s funds, 73%, are still held on the Ethereum network. Additionally, SushiSwap has grown beyond just being a decentralized exchange and now offers lending services through Kashi.

Kashi

Kashi is a smart lending contract, not a platform for exchanging tokens. Like other lending contracts, users can earn money by depositing their tokens into a pool, and borrowers can access these funds by putting up their tokens as collateral.

Lenders, or LPs, earn interest from loans secured by collateral. If the borrower misses a payment, the smart contract backs the collateral so the lender doesn’t lose out. This is known as the liquidation price.

For example, if someone borrows $1,000 worth of USDC using 1 ETH as collateral, the liquidation price would be 817 USDC. In this ETH/USDC liquidity pool, the loan-to-value ratio is 75%. The borrower must put up $7,500 worth of ETH as collateral for every $10,000 borrowed.

For those willing to take on more risk, there’s an option for leveraging. They can amplify their loan by up to 2x to increase their market position. For example, a 1.25x leverage would turn a $1,000 loan into $2,901.

However, this increased loan would require more collateral; if the collateral’s value (ETH) drops, the lender gets it back. This is the case with SushiSwap.

SushiBar

SushiSwap offers SushiBar as a staking liquidity reserve for added security during volatile market conditions. By staking their SUSHI tokens in SushiBar’s smart contract, users can protect their collaterals from potential liquidation during wild price swings.

SushiSwap users receive a 0.045% fee for all swaps and also get a vote on the development proposals for the protocol. Additionally, over 15,000 token pairs on SushiSwap utilize Chainlink as their oracle, bringing off-chain data to on-chain smart contracts, like asset prices.

How To Add Liquidity On SushiSwap?

Suppose You’ve decided to invest in SUSHI by staking tokens. Begin by purchasing the tokens. You can buy them from popular centralized exchanges like Binance or decentralized exchanges like Uniswap and 1inch.

We will demonstrate how to add liquidity to the BNB-ETH pair, but you can also apply the same concept to a different pair as long as the LP tokens are compatible with SushiSwap.

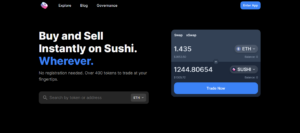

Go to Sushi and press the [Enter App] button on the top right corner to access SushiSwap.

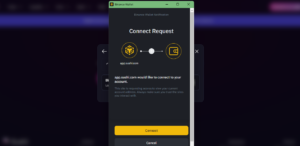

Go to the ‘Pool’ option in the top navigation bar to get started. Connect your Ethereum wallets, such as Binance Wallet, MetaMask, WalletConnect, or any other supported wallet. For this demonstration, we will be using Binance Wallet.

When you click on Binance, a pop-up will appear. Enter the password if you already created a wallet, or click ‘Create a new wallet.’ Suppose you don’t have a wallet.

Click [Connect].

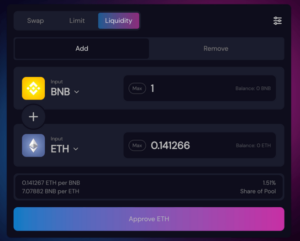

After that, you’ll be taken back to the SushiSwap Pool. To add liquidity, simply click the [New Position] button.

To add liquidity to a pair of cryptocurrencies, click on [Select a token]. Then, enter the amount of one of the tokens, such as 1 BNB. The platform will automatically calculate the required amount of the other token.

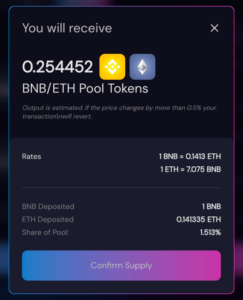

A new window will appear containing the transaction details and associated gas fee; you must decide if you would like to approve or reject it. To approve, select [Confirm] or click [Reject] to edit details. To add liquidity to the BNB-ETH pool, click “Confirm Adding Liquidity” and then “Confirm Supply.”

Verify the transaction through the pop-up in your wallet. You have successfully added liquidity to the BNB-ETH trading pair. This entitles you to a portion of the pool and rewards transaction fees when users trade between these currencies.

Is SushiSwap Safe To Use?

Investing in a smart contract risks technical issues, even for well-respected and audited projects. To stay safe, never invest more than you’re comfortable losing, and research thoroughly before making a deposit.

Due to the high cost of gas on Ethereum, with relatively small deposits, it could take an excessive effort before a person can make any financial gains.

SushiSwap Vs. Uniswap: Which Is Right For You?

Due to the ease of copying and launching similar projects with slight modifications, competition between similar products is expected. On the bright side, this competition should ultimately result in the best products for the customers.

The DeFi space has benefited greatly from the Uniswap team. However, it’s possible that both Uniswap and its forks, like SushiSwap, could succeed in the future. Uniswap might continue leading the way in innovation for AMMs, while SushiSwap could offer a different approach that prioritizes the community’s desired features.

In simpler terms, splitting liquidity between similar protocols is not the best option. The more liquidity in the pools, the better AMMs like Uniswap work. If too much of the liquidity in DeFi is divided among multiple AMM protocols, this could result in a negative experience for the user.

SushiSwap Vs. Uniswap: Comparison Table

| Feature | SushiSwap | Uniswap |

| Introduction | A decentralized cryptocurrency exchange that also functions as an automated market maker (AMM) platform. SushiSwap was originally a fork of Uniswap. | A popular decentralized cryptocurrency exchange that uses an automated market-making (AMM) mechanism to facilitate trading. |

| Launch Date | August 2020 | November 2018 |

| Tokenomics | SushiSwap has its native token called SUSHI, which provides governance rights and is used for liquidity mining rewards. | Uniswap has its native token called UNI, which provides governance rights and can be earned through liquidity provision. |

| Liquidity Mining | Offers liquidity mining rewards for users who stake their tokens in the liquidity pools. | Offers liquidity mining rewards, but these programs are subject to change or end at any time. |

| Trading Fees | 0.30% trading fee, with 0.25% going to liquidity providers and 0.05% converted to SUSHI and distributed to SUSHI stakers. | 0.30% trading fee, which goes entirely to liquidity providers. |

| Supported Assets | Supports a wide range of ERC-20 tokens. | Supports a wide range of ERC-20 tokens. |

| Slippage Protection | Offers customizable slippage protection settings. | Offers customizable slippage protection settings. |

| Liquidity Pools | SushiSwap uses smart contracts to create liquidity pools, allowing users to earn rewards through staking. | Uniswap uses smart contracts to create liquidity pools, enabling users to earn rewards through staking. |

| Cross-Chain Support | Expanding to support multiple blockchains, including Ethereum, Binance Smart Chain, and others. | Primarily focused on the Ethereum blockchain, but support for other chains may be possible. |

| Additional Features | SushiSwap offers a range of additional features, such as Kashi lending, BentoBox, and Onsen. | Uniswap is focused primarily on the exchange and liquidity provision, with no additional features beyond the core functionality. |

| Community and Ecosystem | Growing community and ecosystem, with various collaborations and integrations with other DeFi projects. | Well-established community and ecosystem, with numerous collaborations and integrations with other DeFi projects. |

Final Words

SushiSwap is an exciting new project that is shaking up the world of decentralized finance (DeFi) by taking on Uniswap, one of the most successful DeFi protocols. SushiSwap started as a fork of Uniswap, but it has since added new features, most notably community governance. In early 2023, SushiSwap will also unveil its NFT marketplace, named Shoyu.

Since its launch, SushiSwap has rapidly surpassed many other decentralized finance projects regarding the amount of value locked within it. This growth may continue, but despite its ultimate success, SushiSwap demonstrates that there is no guaranteed leader in the DeFi space.