Ethereum L2s to Reach $1T Market Cap by 2030: VanEck Analysts

In an April 3 report, analysts from investment management company VanEck forecasted Ethereum‘s Layer-2 protocols will hit a market capitalization of $1 trillion by 2030. VanEck’s prediction is based on the significant growth and impact of L2 technologies on Ethereum’s performance and scalability.

The company’s senior digital assets investment analyst Patrick Bush and digital assets research head Matthew Sigel said L2 blockchains are set to confront Ethereum’s “primary challenge” of “limited capacity to process, store, and compute data.” Moreover, they estimated that Ethereum would eventually grab 60% of the market share across all public blockchains. This estimate is based on the total volume of assets within the Ethereum ecosystem.

According to the crypto analysis firm L2Beat, there are currently 46 Ethereum L2s with $39 billion in total value locked (TVL). The largest L2 network is Arbitrum, with a TVL of $18 billion. The firm identified several factors that could affect the long-term growth of L2s. These include user experience, transaction pricing, developer experience, trust assumptions, and ecosystem size.

The analysts wrote:

“Ethereum’s dominance in smart contracts faces a critical hurdle: scalability. While the network offers unparalleled security and decentralization, transaction fees and processing times soar when usage intensifies.”

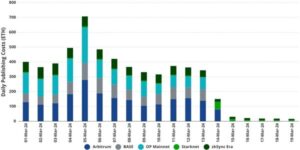

L2 technologies, like Zero-Knowledge Roll-ups and Optimistic Roll-ups, are helping address Ethereum’s scalability issues. Busha and Sigel said these roll-ups are expanding Ethereum’s capacity to process transactions without compromising on its core attributes of security and decentralization. Moreover, they highlighted the EIP-4844 upgrade, which helped to reduce L2 transaction fees through the specialized feature, “Blobs.”

Ethereum L2s to Generate More Revenue Than Base Network in Future

Bush and Siegel predicted that the L2 networks would likely generate more revenue than Ethereum’s base network due to improved “transaction throughput and user experience”. However, they express caution about the long-term value of most L2-related tokens due to intense competition. They said there is ‘cutthroat competition.’

The report states that the top seven Ethereum L2 tokens already boast a $40 billion Fully Diluted Valuation (FDV). Over the next 12-18 months, the blockchain will launch “many strong projects”, which could push the valuation to $100 billion. This influx could be challenging for the crypto market to absorb without massive discounts.